Introduction:

Mining sector is one of the major contributors to the economy of Australia. The sector has contributed more than 148 billion to the countryâs economic growth during financial year 2018. Mining sector reported about 6.4% of the gross value added (GVA) in Australia. The sector generated more than 1,32,000 employment in the country in the FY18 period. In this article, we will be discussing about Macmahon Holdings Limited, which offers mining and consulting related services to mining entities across the Australian region.

Letâs discuss the recent updates along with operational highlight of Macmahon Holdings Limited.

Macmahon Holdings Limited (ASX: MAH)

Macmahon Holdings Limited provides extended services to the metals and mining companies based across Australia and Southeast Asia. MAH also offers consulting services to the mining companies.

The business is working on several projects like Mount Wright Gold Mine, Ballarat Gold Mine, Cadia-Ridgeway Gold Mine, Nifty Copper Mine, Pajingo Gold Mine, Granny Smith Gold Mine, Fosterville Gold Mine, Tujuh Bukit Copper/Gold Mine, Boston Shaker Gold Mine etc.

MAH struck a deal with NCM:

On 4 November 2019, MAH has confirmed on the deal struck with Newcrest Mining Limited (ASX: NCM) on higher rates for MAHâs carried out work at the Telfer gold project. The company expects a positive cash flow from the Telfer contract for the remaining period. Earlier MAH reported that it entered into a contract with Newcrest for its Telfer project in Western Australia, which is expected to be completed by January 2023.

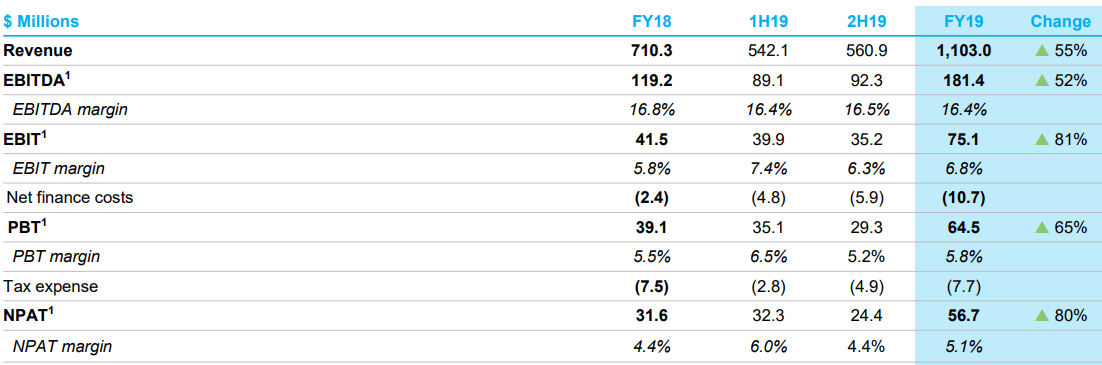

Revenue grew by 55% in FY19: MAH reported its FY19 financial results closed 30 June 2019 wherein, the company reported revenue of $1,103 million, which grew 55% from previous financial year of $710.3 million primarily due to the ramp up of several large contracts that commenced during FY18. Net profit after tax (NPAT) came in at $56.7 million as compared to $31.6 million in FY18. The company reported EBIT margin of 6.8% as compared to 5.8% in previous year. The company reported EBIT at $75.1 million as compared to $41.5 million in previous year. While, during FY19 the company posted NPAT margin of 5.1% as compared to 4.4% on FY18. During FY19, the company reported property, plant and equipment of $399.6 million, total assets of $824.9 million, cash balance of $113.2 million as on 30 June 2019. Net Assets of the company stood at $447.6 million followed by borrowings of $29.55 million during FY19.

The business reported cash from operating activities at $92.5 million and $54.24 million as net cash used in investing activities. MAH reported cash used in financing activities at $35.6 million during FY19.

FY19 Financial Highlights (Source: Companyâs Report)

FY19 Financial Highlights (Source: Companyâs Report)

The company expects solid medium-term business outlook with largely long-term alliance style contracts. The order book of the business is primarily exposed to Copper/Gold and Gold. During the year, the company acquired GBF Group. During FY19, the company commenced a new project at Macmahon, Boston Shaker and Langkawi.

During the year, the company reported a total capital expenditure of $124.5 million, which comprises of $67.8 million of finance leases and $56.7 million of cash funding and excludes the lease receivable of $16.1 million.

Key Business Highlights: The major highlights for the FY19 are summed up as follows:

- During June 2019, MAH entered into facilitated negotiations with NCM to enhance contract rates at Telfer gold project. It is anticipated that the contract would prove to be cash flow positive.

- During the period, MAH Secured Tropicana Boston Shaker contract for 5-year, worth $170 million.

- The company acquired GBF Group on August 2019 (specialist underground contract) for $14.9 million cash, $5.9 million non-assumed debt was repaid, and $4 million cash was retained in escrow.

- The business was marked by strong earnings driven by successful ramp up of several large contracts, started during FY18 period.

- During FY19, MAH achieved record monthly volumes for major contracts - Batu Hijau, Tropicana, Byerwen, Telfer & Mt Morgans.

- The business successfully secured a 7-year quarry contract at Langkawi worth $40 million during the financial year FY19.

Dividend Update:

MAH declared a final dividend of 0.5 cps for FY19, which was 30% franked. It had an ex-date of 11 October 2019 and was paid by 29 October 2019. The stock has generated a dividend yield of 2.38% on an annualised basis.

Segment Update: The business delivered a revenue of $700.2 million from Australia as compared to $545.4 million in previous year. The Indonesia business reported a revenue of $388.9 million as compared to $160.2 million while, MAH derived a revenue of $13.9 million from other international geographies. The work in hand consists of 54% from gold exploration, while copper and gold comprised of nearly 37% of the total WIP. Coking coal and other was reported at 6% and 3% respectively.

Outlook: As per the FY20 guidance, MAH expects its revenue within $1.2 billion to $1.3 billion, followed by an EBIT $80 million to $90 million. MAH reported robust order book of ~$4.7 billion while work in hand for FY20 stood at $1.2 billion. The management of the company has guided towards a positive outlook on account of strong order book, significant $7 billion plus tender pipeline and higher scale and diversity from its recent GBF acquisition.

Stock Update: The stock of MAH last quoted at $0.220, moving up by 4.762% as on 05 November 2019. The stock has a market capitalisation of $452.55 million and is available at a price to earnings (P/E) multiple of 9.590x. The stock has given healthy returns of 23.53% and 5% during the last three-months and six-months, respectively. The stock has done well in the recent trading sessions generating 2.44% and 10.53% during the last five days and one month, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.