While the raw material diplomacy has already begun, rare earths (RE) have been tagged as the clean energy future finding demand in aerospace, healthcare, electronics, chemicals and transportation industries, to name a few. This demand is set to surge extensively owing to advances in technology and the critical role of RE.

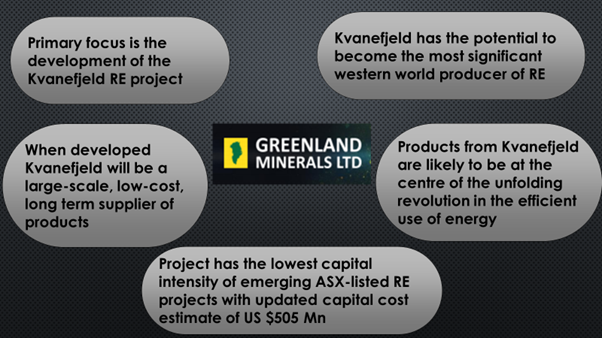

Thriving to leverage from this opportunity is Australia based Greenland Minerals Limited (ASX:GGG), which has been operational in the mineral-rich province of Greenland since 2007. GGG is currently developing what is positioned to be a future cornerstone to global RE supply, the Kvanefjeld RE project in SW Greenland.

In 2019, at the back of developments at the project, GGG hit international headlines with RE in spotlight. The outstanding optimisation outcomes emphasise Kvanefjeld’s global significance.

Besides, considerable progress was made in terms of permitting procedures, with acceptance of social impact assessment for public consultation and the advancement of environmental studies. Additionally, strengthened community ties has fostered local participation in the project.

To read about the GGG’s 2019 progress at Kvanefjeld, PLEASE READ- Greenland Minerals Accomplishes Significant Milestones Across 2019, 2020 Focused on Progressing Kvanefjeld

Moving on to more recent times, it is undeniable that the novel coronavirus- COVID 19, deemed as a pandemic has been influencing businesses across the world.

Let’s understand GGG’s take on the unprecedented economic and health crisis-

GGG’s Stance Amid Pandemic

Post the progress made in FY 2019, there have been considerable economic disruptions arising from the outbreak of COVID-19 virus, which is a non-adjusting post balance sheet event for GGG.

In a recent address to shareholders, GGG’s non-executive Chairman Anthony Ho acknowledged the fact that COVID 19 might unquestionably influence global logistics across the year, though there is inherent unpredictability associated with the outbreak.

As on 30 March 2020, GGG was unable to determine the financial effects that the outbreak of the virus could have in the business in the coming financial period.

However, GGG has already implemented several actions, with a range of expenditure containment measures devised to deal with the prolonged economic and logistical impacts of the virus outbreak. Further contingency measures have been considered by the company and will be implemented as and when required.

GGG believes that the actual financial impact of the COVID19 outbreak, if any, on the Group’s 2020 financial statements will depend on how the situation evolves.

GGG’s Outlook for 2020

The outlook for the RE sector continues to strengthen, while GGG remains at the forefront of a strategic evolution in RE supply. In the Annual Report released on 30 March 2020, GGG intimated that it aims to build on the strong outcomes achieved across key areas in 2019 and position the project for the development pipeline.

GGG’s near term action plan includes:

- To have addition EIA related studies, and the updated EIA document finalised in Q1 2020;

- Additional studies and environmental document to be further lodged with the Greenland Government before charting out a time and plans for public consultation and a schedule for follow-up steps;

- Main planned technical work programs include pilot plant operations of the optimised flow sheet, with a flotation pilot plant to be undertaken first. These will be conducted in Perth with input from Shenghe and BTMR Laboratories;

- To continue to work closely with Shenghe, GGG’s biggest shareholder and the world’s second largest producer of RE, to progress the development strategy;

- Areas of focus include downstream processing, marketing and off-take, and project finance;

GGG aims to establish greater ties to European industry, driven by soaring demand for RE that will come with the rapid expansion of EV manufacturing

ALSO READ- Greenland Minerals Advancing Well Amid Pandemic- EIA Ramps Up, Productive Meetings Continue

GGG acknowledges the fact that field work and some operations in Greenland may be impacted logistically by the impacts of the COVID-19 virus. Amidstthis uncertainty, the Company has a positive outlook regarding its ability to successfully develop the project, as a multi element RE and uranium project.

To give shape to this aim, GGG has been working with the Greenland Government and other stakeholders to progress the mining license application to move to development in accordance with both Greenland Government and local community expectations.

GOOD READ- Globally Significant Greenland Minerals Fostering Rare Earths Realm

GGG stock last traded at $0.105 on 16 April 2020.