People want to make investments or purchase gold in order to protect themselves from volatility and uncertainty, highlighting that gold is the safest investment at any given time.

In FY18/19, Australia ranked the second-largest gold producer in the world with Hong Kong, China and the United Kingdom (UK) being its key export market destinations. Gold production in Australia increased by more than 6.4% to 322 tonnes in FY19 in comparison to FY18. The average annual production percentage is anticipated to surge further to 4.9% in FY20, followed by 2.7% in FY21 from the respective previous year. Interestingly, the increase in production is not as intended to be due to the lower output in some of the large mines because of falling grades such as Cadia Valley and Tefler mines to mention few.

In the milieu of which, it is pertinent to note that the Yandal West gold project of Great Western Exploration Limited (ASX: GTE) has confirmed rich gold grade in the range of 3.89g/t to 7.75g/t along with newly identified high-grade target with rock chip sampling return of 23.5 g/t gold. The range of grade reported from recent drilling samples for the project has significant potential to be on the lower quartile of cash cost, depending on the reserves and resources estimation, and mining type and processing. It is worth mentioning that the grade is comparable to one of the low expenses producing mines, i.e. Fosterville Mine and higher than Newmont Mining Corporation’s average gold reserve grade of ~1.19 g/t.

Please read to know more about the projects: Assessing Great Western Exploration’s Projects vis-à-vis Market Opportunities

Let us now unearth the global gold supply and demand to demystify the future proposition of the project.

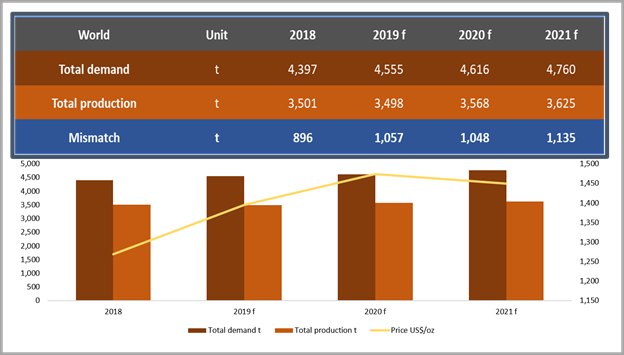

World gold production is expected to grow at a CAGR of ~1.17% from 2018 to 2021, whereas consumption is likely to rise by ~2.68% CAGR, as per the Australian Department of Industry, Innovation and Science. This mismatch is expected to contribute toward commodity prices even after the easement of global uncertainty, subject to demand met by the recycled metal.

In line with the supply-demand mismatch and global uncertainty, gold price is expected to rise by a CAGR of ~4.54% to reach 1,450 US$/oz in 2021 from 1,269 US$/oz in 2018.

World Production and Consumption

Source: Department of Industry, Innovation and Science

Meanwhile, the share of Australian gold supply from mine in total world production is expected to increase from ~8.64%1 in 2018 to ~9.58%1 in 2020 due to the supply coming from the commercialisation of projects.

1 Kalkine estimate (post adjustment)

Good Read: Gold outlook and Investment Scenario in 2020

Gold Export Market

The major gold consumer in the world is China, followed by India. Approximately 51% of gold consumption is in the form of jewellery, followed by 25% in gold coins and bars, 15% in Central Bank Reserves, 7% in electronics and industrials use, and lastly, 1% in each global-backed exchange traded funds (ETFs) and medical or dental applications.

In the quarter ended September 2019, the Australian gold export market witnessed a 48% increase from the previous year to $7.3 billion due to rise in gold prices and boosted export volumes. However, to the major export destinations of Australia, i.e. Hong Kong and China, export value decreased by 66% and 45% year on year, respectively, as the decline in the paying capacity of the local currency may have negatively impacted gold import. Whereas, the UK export surged dramatically by 1384% to $5.3 billion, owing to inflow in exchange-traded funds and strong safe-haven bullion demand.

Gold Backed Exchange Traded Funds (ETFs)

Global gold-backed ETFs have seen a tremendous net inflow of US$19.2 billion in 2019, reaching an all-time high in the fourth quarter of the calendar year to ~2,900t. Where European fund experienced an inflow of US$8.8 billion, mainly contributed by the UK worth US$4.1 billion, i.e. 91t, whereas Australia inflow in 2019 was around US$ 283.58 million.

The gold outlook is inevitably positive in the future and is most likely to outperform various other commodities. The price increase would provide an optimistic stance for gold companies to bring exploration projects to production and to leverage the benefit of commodity price.

Interesting Read: Gold Price: Unappreciated or Appreciated

Great Western Exploration, being a gold explorer with high-grade mineralisation, is likely to have an encouraging scenario in future, courtesy to increasing gold prices that may benefit in terms of better margin, and demand-supply mismatch with a high rate of production growth in comparison to supply.

Stock Price Information – The stock of Great Western Exploration was trading upward by more than 33% to $0.004 on 16th January 2020 (AEDT 01:43 PM), with a market cap of $3.76 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.