Leading online integrated screening and verification company, CV Check Limited (ASX: CV1) has delivered another impressive third quarter FY20 (Q3FY20) of revenue growth as announced on 6 April 2020. The company has also provided information on measures being taken to address the effects of the COVID-19 pandemic such as cutting non-essential expenditures along with a reduction in the Board members to three.

B2B Segment records Continued Growth – Q3 FY20

CVCheck’s revenue streams have been expanding through the provision of a comprehensive range of checks across the globe via its proprietary online platform to employers, industry associations and individuals for more than 10 years.

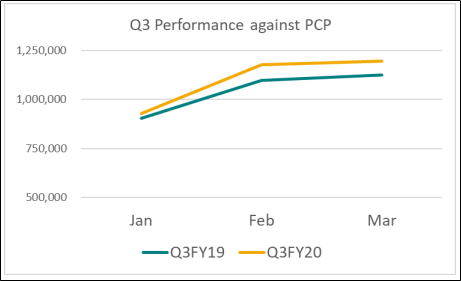

For the month of January 2020, the orders were seasonally slow as they tend to be due to holiday effects, particularly in New Zealand, with acceleration observed into February 2020. Before the pressures were observed from COVID-19 pandemic that affected order flow during the final two weeks of March in both Australia and New Zealand. The Australian operating climate had already been facing the impact of turbulent conditions caused by bushfires and floods during the quarter.

Source: Company’s Q3FY20 Update

Amidst the global economic turbulence, the Company recorded revenue of $ 3.3 million, demonstrating growth compared to the prior corresponding period (PCP), with 11% growth in the B2B sales which contributed 69% to the total revenue. A high number of 427 new B2B customers across a range of industry sectors were onboarded and they placed first orders during Q3FY20 including Northern Star Resources and the AICD. Although, the new customer wins are yet to book revenue included LMS Thinking, The Law Society of Australia and two tender wins with labour hire providers to the disability services sector and call centres for Australia’s largest telecommunications companies.

First revenues were also booked through the Xref phase one integration launched in late February 2020 with the two teams, CVCheck and Xref, regularly exchanging leads by operating to a weekly meeting cadence while new clients continue to sign up.

Some new business wins were also reported in the final two weeks of March 2020 despite the pandemic havoc and the Company will update in due course.

Impact on Cash flow due to COVID-19, $ 560K of Carried Over Creditors

The cash burn (operating, investing and lease outflows) for Q3 amounted to $ 0.9 million despite revenue growth, improvements in margin and ongoing excellence in cost control. The carried over creditors from Q2 of $ 560k paid later than normal owing to the impact of shutdowns across Australia and New Zealand due to COVID-19 late in Q3FY20. The Company had $ 4.9 million as cash at bank with no debt at quarter end.

COVID-19 Impact, Adopted measures buffer revenue by 25%

Revenue: The Company’s revenue flow had followed the same pattern as PCP, apart from some change to client mix as the initial effect of COVID-19 played out across Australia and New Zealand, and remained at record levels until 22 March 2020, when the lockdown was imposed.

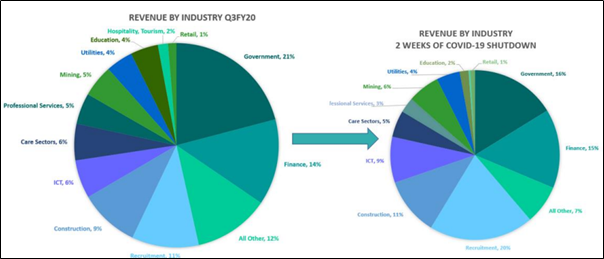

Source: Company’s Q3FY20 Update

Australia saw closure of non-essential services inlcuding tourism, hospitality, gaming and retail while New Zealand has had a more comprehensive shutdown leading to differing effects on Company’s total revenue.

Cost and cash saving measures are already being executed to provide a buffer to the potential of continued reduced order flow and hiring trends which have also been identified by CVCheck’s new integration partner LinkedIn.

CV1’s adopted measures buffer revenue by 25%: CVCheck has been keeping an eye on the ball amidst COVID-19 situation as:

- Second week of March 2020: All plane travel ceased on company business for all of its teams.

- Third week of March 2020: Staff migrated to working remotely until Friday 20 March 2020.

- Fourth week of March 2020: Staff related cost reductions initiated.

These measures were all enacted and completed before data was available from the effects of the shutdowns and, collectively, they buffer the company against a potential 10% permanent fall in revenues.

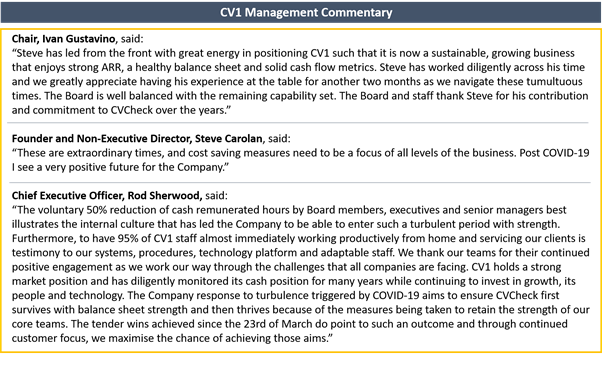

During the week of the 30th of March, the Board, Executive and Senior Managers realised the need for continued decisive action in order to further buffer the Company and some of them voluntarily reduced their cash remunerated hours to collectively achieve a 50% cash reduction. This measure would be applicable for 12 consecutive weeks commencing 6 April 2020.

This Board move and the combined sum of cash conservation measures taken will buffer the company to a potential 25% fall in revenues across the coming quarter Q4FY20.

Director Resignation To Further Aid Permanent Cost Saving Measures

The CVCheck Board has decided to reduce its size to the minimum statutory compliance of three members whereby Founder and Non-Executive Director, Steve Carolan, will step down effective 31 May 2020. Additionally, the director’s fees have been slashed by 50%.

CV1 holds a strong market position and has diligently monitored its cash position for many years while continuing to invest in growth, its people and technology. The Company response to turbulence triggered by COVID-19 aims to ensure CVCheck first survives with balance sheet strength and then thrives because of the measures being taken to retain the strength of our core teams.

Stock Performance: CVCheck has a market capitalisation of around AUD 22.79 million with ~ 292.2 million shares outstanding. On 6 April 2020, the CV1 stock settled the day’s trade at AUD 0.070, down 10.25% with ~ 213,906 shares traded.