Sovereign island country and a developed nation, New Zealand is one of the last lands to be settled by humans. Though its capital is Wellington, the major chunk of population resides in Auckland. In this article, we would browse through its economyâs landscape, and acquaint ourselves with the recent on this front. Let us dig right in!

New Zealand Economy

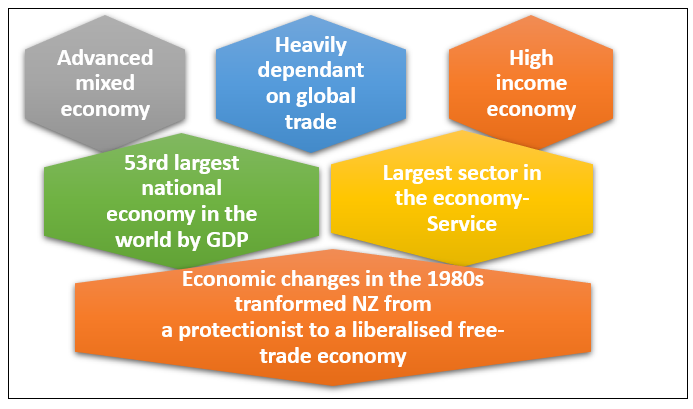

New Zealand has an advanced mixed economy which operates on the principles of free market. It comprises of a sizeable secondary and tertiary (manufacturing and service) sector along with a highly effective primary (agricultural) sector. The exports of goods and services account for approximately one third of the real expenditure GDP of the country. New Zealand is heavily dependent on international trade, specifically the agricultural products, as a result of which it is vulnerable to global commodity price fluctuations and economic slowdowns.

The below image highlights the unique attributes of the New Zealand economy:

Economic Transformation of New Zealand

With its history largely defined by agriculture, for decades the economic growth in New Zealand was pretty much restricted due to its remote geographic location and dependency on the British market.

However, the silver lining appeared approximately 30 years back, when rapid transformations took over, and the government transformed the country from an agrarian economy, dependent on concessionary British market access to an industrialized free market economy, competent on an international scale.

Moreover, the country is tagged as a lucrative tourism spot, which accounts to be the single-biggest generator of foreign exchange since 2008.

The transformation led to an influx of expats and foreign investors and catalysed the economy to become tech-savvy and uplifted the output of primary production goods, which are the most profitable exports, across Southeast Asia.

The countryâs trade partners include Australia, the U.S., China, the EU, Japan, and South Korea.

Economic Scenario in 2019

December 2018 Quarter

- The December 2018 quarter real production GDP growth of 0.6% was marginally weaker than the forecast of 0.7%, though it was in line with broader market expectations.

- At the end of 2018, the unemployment rate rose to 4.3% and there was a pick-up in inflation to 1.9%, largely driven by the higher petrol prices in Q318.

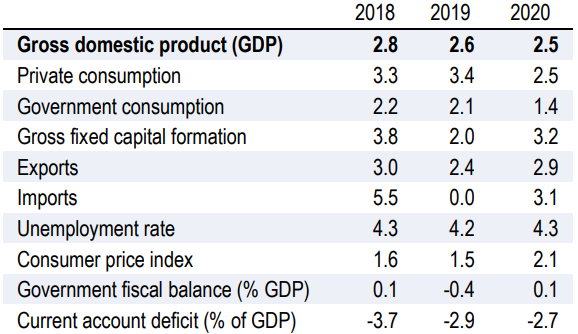

- The average GDP growth in NZ is noticeably easing since 2017, recorded at 2.8% in the December quarter.

March 2019 Quarter

- In March 2019, the GDP was up by 0.6% and grew 2.7% over the year ended March 2019.

- The goods-producing industries showcased the strongest growth and were up by 2%, driven by increased activity (+3.7%) in the construction industry, the largest since September 2017.

- However, the growth in the service industries eased by 0.2% (against 0.9% in December 2018 quarter). This was the slowest growth rate since the September 2012 quarter. Service industries grew 3.1 percent in the year ended March 2019.

- The primary industries slumped by 0.7%, continuing to fall, majorly due to the unfavourable weather conditions.

June 2019 Quarter

- The NZ economy grew by approximately 0.5% in the June 2019 quarter, slightly over the market forecasts, though the pace of growth has slowed substantially over the last year (2.1%- slowest since end of 2013), hinting continued weak productivity.

- The Service industries, which were up by 0.7% on the back of a subdued March 2019 result, were the main contributor to GDP growth. The GDP-per capita grew by 0.2% for the quarter.

- The challenging areas of the quarter included construction, particularly non-residential, and manufacturing, with less meat and dairy production.

What do the experts say?

It is evident that New Zealand's economy has been sluggish in 2019, given that the business confidence has been at record lows and continuous headwinds from global trade tensions persist, coupled up with slowing Chinese economy and Brexit.

It should be noted here that China is New Zealandâs biggest export partner and the on-going US-China trade conflict has been curtailing the business sentiment in the country.

In order to jolt the economy from the possibility of a sharp slump, the Reserve Bank of New Zealand shocked the nation (and beyond) with a steep 50 basis point interest rate cut in August, with an easing expected in November 2019.

Market experts believe that the lack of confidence from firms and households and heightened uncertainty offshore curb the possibility of strengthening the growth soon. The need of the hour is strong, wise, and expansive fiscal policy, as the global headwinds do not seem to be going away. Moreover, the main domestic risk in the country is a housing market correction.

However, Even when the NZ economy has been running out of steam, there is certain optimism in the industry experts who believe that the country is well positioned to deal with micro and macro-economic adversities, even though the effects would be felt.

New Zealand Economyâs Outlook

The prolonged trade war, which has shaken the global economic sentiment, is expected to impact both private sector and exports, that recorded a dip in July 2019.

Though, a ray of hope does lie with the Central Bankâs expansionary monetary stunt (lower interest rates and healthy investment activity) which is likely to support the NZ economy.

The policy interest rate is at a record low of 1.5% and is not expected to increase before end-2020. The overall growth is expected to soften in 2019, considering a weaker domestic demand and is estimated to remain stable in 2020, as a reinforcing domestic economy compensates for a weaker external sector.

The New Zealand economy is forecasted to expand by almost 2.5% in both 2019 and 2020.

NZ Economic Outlook (Source: OECD)

The OECD believes that New Zealand is a robust, green and inclusive economy that underpins well-being. On a good note, there are certain activities (as mentioned below) that would contribute to bettering the economyâs situation in the long run, according to the OECD

- Labour market reforms have been initiated- Fair Pay Agreements.

- The government has completed the first phase review of the Reserve Bank Act, clarifying the role of the Bank to promote the prosperity and well-being of New Zealanders.

- Reserve Bank has proposed large hikes in bank capital requirements.

- The government is drafting a Zero Carbon Bill that will set an emissions reduction target for 2050.

- The government is also considering options for embedding a well-being approach in legislation.

- Immigration policy has been changed to target immigrants with better labour market prospects.

Moving onto the currency, when the USD strengthens, the NZD is prone to be relatively weaker (and vice versa). On 19 September 2019, the NZD slipped 0.3 percent versus the US dollar. On 20 September 2019, the NZD was trading at 62.95 US cents (5pm in Wellington).

Amid the domestic and global concerns, and New Zealandâs much believed potential to combat any adversities, it would be interesting to witness the unfolding of the economic events in the country.

We are committed to providing our readers with economic and share market insights and encourage you to watch out this space for more.

Meanwhile, to get an overview of NZâs neighbour Australia, and its evolution in the trade world in the past century, READ HERE.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_02_05_2025_05_53_40_418159.jpg)