Company profile

Zimplats Holding Limited (ASX:ZIM) is into the business of producing platinum group and its associated metals from the Great Dyke in Zimbabwe. It is situated in Guernsey, Channel Island and listed on ASX.

Long term income stocks: To ensure maximum returns from the dynamic equity market, investors adopt different strategies based on their risk profile and return expectation. One such popular strategy is investing in income stocks i.e. stocks offering regular income and steady returns in form of dividends. These stocks pay higher dividends as compared to normal growth stocks. Income stocks usually have high dividend yield and have lower level of volatility than the stock market, i.e. these are generally defensive stocks.

Growth stocks vs Value Stocks vs Income Stocks: Growth stocks belong to those companies which are growing at a rapid pace and generally do not give dividends or give very low dividends. They generally prefer utilizing their earnings for expansion and growth purposes or paying off the debt.

Value stocks are generally undervalued stocks which have a low P/E multiple. These stocks have a good growth potential because they have been undervalued by the market due to reasons like external factors, economic factors.

Income stocks are generally stable stocks but offer high dividend yield to market players. These stocks are kept in the portfolio to ensure regular income from the stocks and are generally less risky as compared to value and growth stocks.

Features of Income stocks: Income stocks normally have low beta i.e. they are less sensitive as compared to the market. The dividend yield should be higher than 10-year bond yield and good revenue and profit growth.

Benefits of Income stocks: Income stocks are less volatile as compared to other stocks because of low beta. With the investment in these defensive stocks, investors generally do not lose money when there is tension in the markets. Companies which have segments like food, beverage and utility are considered to offer defensive stocks as market their products will be in demand even in the economic slowdown.

Drawbacks of income stocks: However, as per certain market analysts, Income stocks are not completely defensive and can also go down; thus, the investors may lose their capital. Well generally, income stocks do not fall as much as any other stocks as dividends act as a support to the stock price.

The income stocks are sensitive to the interest rates as when interest rates go up, other fixed income securities become more attractive.

Inflation plays an important role in choosing income stocks. If the rate at which dividends are increasing is slow as compared to the inflation, then investors may apply caution in investing in dividend yield stocks.

Here are few examples of long-term income stocks trading on ASX

Wesfarmers Limited

About the company: Wesfarmers Limited (ASX: WES) is into the extensive area of business operations which has many segments like home upgrading, outdoor living, clothing, general merchandise, office supplies and also an Industrial division. The market capitalization of the company stands at A$44.67 billion as on 16th September 2019.

Latest announcements: On 13 September 2019, the company has updated that the Scheme of Arrangement ,as per which Wesfarmers (via its wholly owned subsidiary, Wesfarmers Lithium Pty Ltd) will buy 100% of the issued ordinary shares in Kidman Resources Limited (ASX: KDR), has been lodged with the ASIC. Accordingly, KDR shares have been suspended from ASX.

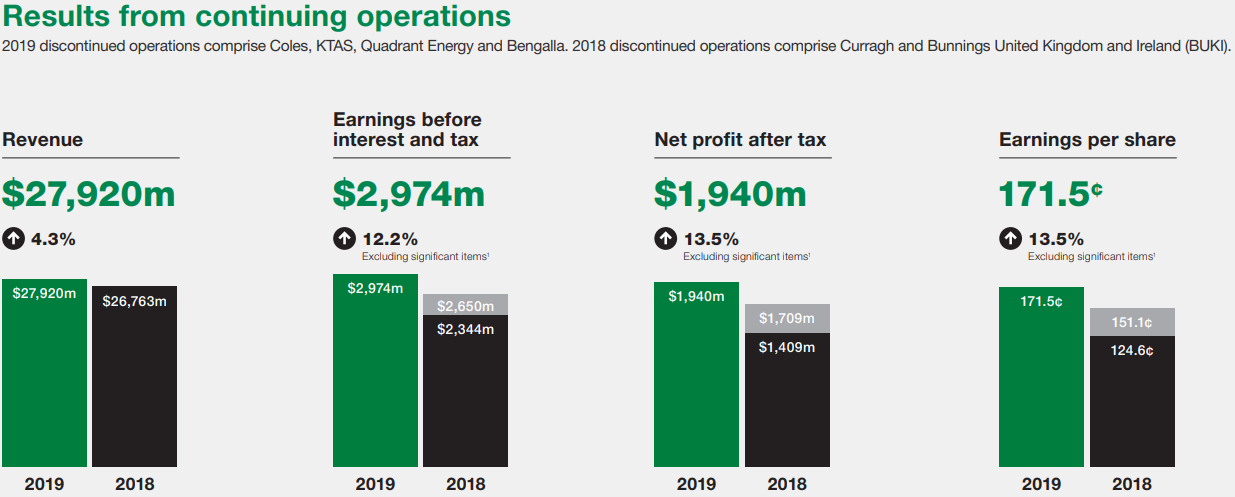

Financial Performance: The company declared reported NPAT of $5,510 million for FY19. NPAT from continuing operations saw an increase of 13.5 percent to $1,940 million.

Cash position of company: The company reported an Operating cash flow of $2,718 million, by 33.4% from the previous year because of demerger.

Dividends: The company has declared a final dividend of 78 cents per share. Thus, making the full year ordinary dividend to $1.78 per share and the total dividend to $2.78 for the current year ($1.00 being the special dividend).

Stock Performance: On 16th September 2019, WES stock is trading at A$39.080, down by 0.812 percent (as at 12:44 PM AEST). The stock is trading near its 52-week high of A$40.430, offering a YTD return of 28.53%. Currently, the stock is trading at a PE multiple of 8.090x as per ASX.

AGL Energy Limited

About the company: AGL Energy Limited (ASX: AGL) is operating Australiaâs largest retail energy and dual fuel customer base and is involved in major portfolio of wholesale energy contracts and assets, to support its retail customer base. The market capitalization of the company stands at A$12.55 billion as on 16th September 2019.

Buy-back of shares: The company has announced a buyback of up to 5% of the issued ordinary shares whose value will stand approximately $650 million. Plenty headroom is remaining to care of investments back into business and fund growth. The total amount of shares that company will acquire would be 655,825,043.

As per ASX update, the company has repurchased 24,07,993 shares as on 10 September 2019.

Dividends: The company announced final dividend of 64cps for FY19 which will be 80 percent franked with a DRP price of A$18.88. This makes the total dividends to 119 cents per share, up by 2 percent from previous year.

Perth Energy acquisition: As per latest ASX update, AGL has successfully acquired Perth Energy from Infratil Limited (ASX:IFT) . The Perth Energy acquisition is a strong strategic fit with the companyâs WA expansion. The Enterprise Value of Perth Energy is $93 million. It is the 3rd largest electricity retailer to business customers with around 1,400 GWh of electricity sales. It also provides 1.1 Pj of gas to its business customers.

Resignation of EGM: Richard Wrightson, the Executive General Manager, Wholesale Markets, of the company has resigned from the role but will continue to work closely with the CEO and AGLâs Wholesale Markets team to maintain a smooth and orderly transition of the role.

Financial performance: The company reported statutory profit after tax of $905 million, down by 43% due to negative fair value movement because of higher forward electricity prices. Companyâs underlying EBITDA increased by 2% YoY from strong earnings due to electricity portfolio.

Guidance for FY20: The company expects the underlying profit will be in the range of $780 million to $860 million in FY20. One of the key reasons for reduction in Underlying PAT is the outage until December 2019 of Unit 2 at AGL Loy Yang. The impact of this outage would be between $80 million and $100 million.

Stock Performance: On 16th September 2019, AGL stock is trading at A$18.865, down by 1.39 percent from the prior close (as at 1:08 PM AEST). The stock is near its all-time low of A$17.440, with a negative YTD return of 5.76%. Currently, the stock is trading at a PE multiple of 13.860x as per ASX.

Zimplats Holdings Limited

About the company: Zimplats Holding Limited (ASX:ZIM) is into the business of producing platinum group and its associated metals from the Great Dyke in Zimbabwe. It is situated in Guernsey, Channel Island and listed on ASX. The market capitalization of the company stands at A$1.1 billion as on 16th September 2019.

Financial performance: The company reported strong numbers for FY19 with revenues up by 8% to US $631 million as compared to US$582.5 million in FY18. The revenues were mainly impacted by the prices of rhodium, ruthenium, palladium and iridium.

The COS (cost of sales) inclined by 4% to US$447.7 million mainly because of increase in insurance premiums and royalty expenses.

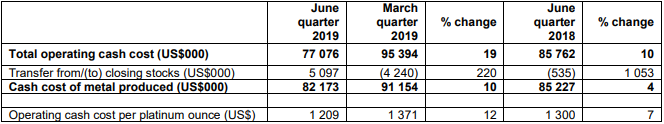

Gross profit increased by 300 basis points to 29% due to increase in average metal prices. Operating cash cost per platinum ounce improved slightly to US$1,292 in FY19 from US$1,290 in FY18.

Financial position of the company: The company generated US$189.4 million from operating activities as compared to US$195 million in FY18. Total dividends paid during the year amounts to US$85 million and repaid borrowings of US$42.5 million in FY19. At the end of the year, the company had a total borrowing of US$42.5 million and a cash balance of US$67 million.

Decrease in cash cost per platinum ounce Source: Companyâs Report

Decrease in cash cost per platinum ounce Source: Companyâs Report

Dividends: The company has declared a final dividend of US$0.42 per share amounting to US$45 million to shareholders on record date as at 12th September 2019. The current dividend yield of the company is 8.57% as per ASX.

Stock Performance: On 16th September 2019, ZIM stock is trading at A$9.980, down by 2.6 percent from the prior close (as at 1:10 PM AEST). The stock has offered a YTD return of 65.32%. Currently, the stock is trading at a PE multiple of 5.320x as per ASX.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.