On 20 September 2019, the S&P/ASX 200 Financials (Sector) inched upward by 0.28% to 6,495.6, while Magellan Financial Group Limited closed the dayâs trading at $ 52.500, up 2.619% from its previous close. The company has a market cap of $ 9.32 billion and approx. 182.16 million outstanding shares. In the last three months, the stock has delivered a return of 39.93%, while its year-to-date return stands at 118.91%.

Let us delve into the financial sector player, along with its recent market updates.

About Magellan Financial Group Limited

Magellan Financial Group Limited (ASX: MFG) got listed on the Australian Stock Exchange in the year 2004. The core business of the company is funds management. The main component of MFGâs revenues is management fees that it earns on the investment strategies the company manages for its clients. The management fee revenue would be driven by the Groupâs funds under management (FUM).

The companyâs objective is to offer international investment funds to high net worth and retail investors in ANZ as well as to global institutional investors. As at 30 August 2019, total funds under management with MFG stood at $ 92,092 million as compared to $ 89,730 million as at 31 July 2019. Of the total FUM, global equities, infrastructure equities and Australian equities accounted for $ 68,291 million, $ 16,154 million and $ 7,647 million. In the month of August 2019, the company had net inflows of $ 315 million.

Issue of Shares

- In a market update on 18 September 2019, Magellan Financial Group Limited announced that it had issued 87,167 fully paid ordinary shares at a consideration of $51.06 per share. It added that the shares were issued under the companyâs Employee Share Purchase Plan.

Institutional Placement Completion

MFG, through a release dated 14 August 2019, unveiled the successful wrap up of its fully underwritten institutional placement, which was announced on 13 August 2019.

- MFG raised an amount of $ 275 million from the placement.

- The company issued 4,981,885 fully paid new ordinary shares at the consideration of $55.20 per new share, which represented a discount of 6.0% to the dividend- adjusted last traded share price of $ 58.72 on 12 August 2019.

- As well as a discount of 4.5% to the dividend-adjusted 5-day volume-weighted average price of $ 57.78 on 12 August 2019.

- The funds raised under the fully underwritten placement would be utilised to address the anticipated cost of supporting and seeding new fund launches as well as products under development and to provide strength to its balance sheet.

- On 19 August 2019, the company updated the market regarding the issue of these fully paid new ordinary shares. The shares would rank equally in all respects with the existing shares of MFG on issue.

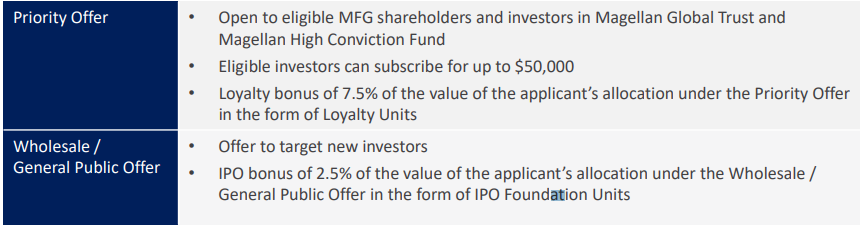

IPO of Magellan High Conviction Trust

- On 13 August 2019, MFG announced that Magellan Asset Management Limited, the main operating subsidiary of the company, is planning to undertake an initial public offering (IPO) for ordinary units in a new ASX-listed investment trust, named as the Magellan High Conviction Trust.

- It was mentioned in the release that the Magellan High Conviction Trust would inject funds in a focused portfolio of international companies (high-quality), with a weightage towards the best ideas of Magellan Asset Management Limited. Moreover, it would target to provide an annual cash distribution of 3% to investors.

- The company further stated that the Magellan High Conviction Trustâs investment strategy would be a replica of the unlisted Magellan High Conviction Fundâs investment strategy. The fund has provided a return of 16.6% p.a. net of fees since inception on 1 July 2013 to 31 July 2019.

- Magellan Asset Management Limited would be the investment manager as well as a responsible entity.

Source: Companyâs Report

Financial Performance

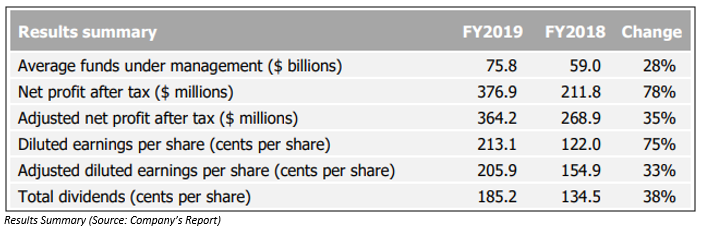

Magellan Financial Group Limited on 13 August 2019 updated the market with its performance during the financial year 2019. Key highlights from the results are as follows:

- For the period ended 30 June 2019, the company witnessed a rise of 35% in adjusted after-tax net profit, and the figure stood at $364.2 million.

- The company reported a substantial growth in average funds under management, which stood at $75.8 billion with a rise of 28% year-on-year.

- Management and service fees revenue increased by 22% and the figure reached $472.5 million.

- Net Profit after tax grew by 78% to $376.9 million.

- Strong performance of global equity and infrastructure strategies in challenging market conditions.

- For the 12 months ended to 30 June 2019, the effective tax rate was 23.6%.

Dividend

- For the 6 months ended 30 June 2019, the Board of the company unveiled a 75% franked dividend amounting to 111.4 cps, which comprises a final dividend of 78.0 cps and a performance fee dividend totalling to 33.4 cps.

- The interim and final dividends of the company are based on 90%-95% of profit of Funds Management segment ex- crystallised performance fees.

Change in Directorsâ Interest

Recently, the company made a series of announcements, which are related to the change in holdings of its directors:

- John Eales made a change to his holdings in the company via acquiring 4,837 units in Magellan Global Trust at a consideration of $1.7628 per unit. It was also mentioned in the release that the total securities held with John Eales stood at 77,616 ordinary shares in MFG and 289,136 units in Magellan Global Trust before the change.

- Karen Phin also acquired 1,444 units in Magellan Global Trust at a consideration of $1.7628 per unit. After change, the director holds 89,312 ordinary shares in MFG, 86,277 units in Magellan Global Trust and 19,049.0704 units in Airlie Australian Share Fund.

- Hamish McLennan made a change to holdings in the company on 29 July 2019, wherein, the director acquired 1,441 units in Magellan Global Trust. Post-change, the total securities with Hamish McLennan stood at 100,248 ordinary shares in MFG and 86,088 units in Magellan Global Trust.

- Paul Lewis acquired 1,277 units in Magellan Global Trust at a price of $1.7628 per unit in MGG on 29 July 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.