The progress of the Australian medical cannabis industry since its legalisation indicates that the country is following the footsteps of Canada, attracting established international players. The market experts believe that the Australian cannabis industry has the potential to become a multi-billion dollar industry in the coming years.

In Australia, access to medicinal cannabis products can be obtained through TGA (Therapeutic Goods Administration) through a specific access scheme. The medicinal cannabis products are not subsidised by the Australian government under its PBS (Pharmaceutical Benefits Scheme). However, few states in Australia like New South Wales and Victoria, are taking steps to expand the use of medicinal cannabis products.

Australian Governmentâs View on Medical Cannabis Products

According to the Australian government, there is hardly any quality evidence available to justify the decision of doctors to prescribe medicinal cannabis. Also, there is not much information available to know about the adequate doses of individual cannabis products. This is the reason that none of the medicinal cannabis products is accessible as registered prescription medicines in Australia except Nabiximols. Although there are special pathways for the unapproved medicines, that can also be used to import these products from Canada or Europe.

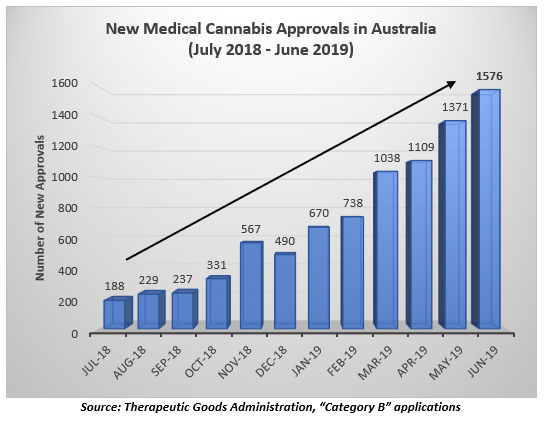

By 30th June 2019, the Therapeutic Goods Administration has approved more than 9300 Special Access Scheme (SAS) Category B applications for unauthorised medicinal cannabis products. Let us have a look at the number of new approvals for medical cannabis in Australia held in the last one year:

There are several companies listed on the Australian stock exchange that are associated with the cannabis industry. As the industry has gained momentum in the previous few years, investors might be interested in monitoring the performance of the cannabis stocks. Let us have a look at two of these ASX-listed cannabis stocks below:

Cann Group Limited

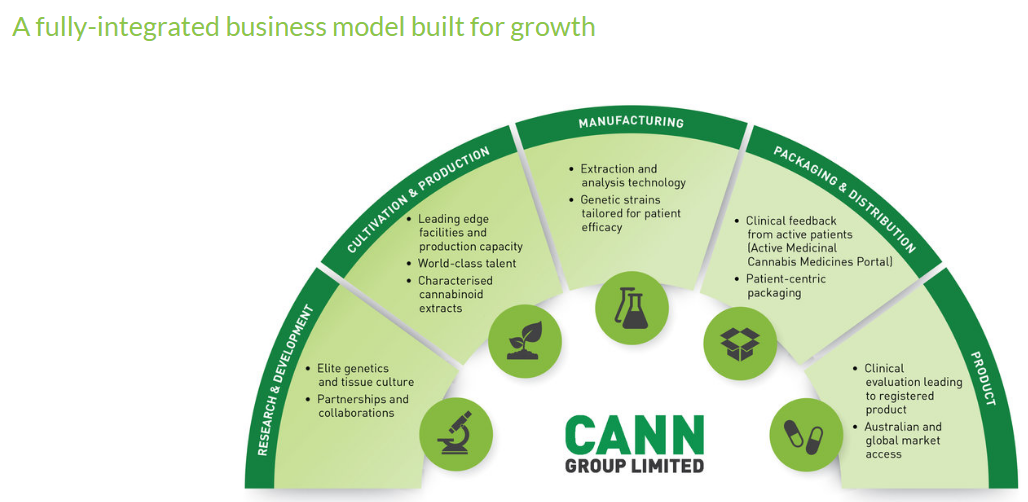

Cann Group Limited (ASX: CAN) is the first company in Australia that received the permit and licence from the Federal Government for the cultivation of medicinal cannabis in the country. The purpose of the company is to offer access to various medicinal cannabis products to patients across the world and Australia. The company is creating a top-notch business, focussing on cultivation, manufacturing and breeding of medicinal cannabis for use and sale within Australia.

Source: Company Website

Operational Performance

Today, Cann Group has released its quarterly activities and cashflow report for the quarter ending 30th June 2019. The company highlighted the following activities that were undertaken during the quarter:

- Under the supply agreement with the Victorian Government, the company delivered its first commercially grown and Australian sourced medicinal cannabis resin to the Government for use by Australian patients.

- Cann Group possessed Mildura site during the quarter as part of its third planned facility, for large scale production and cultivation of medicinal cannabis. The groundworks and the remodelling of the current manufacturing area have already been commenced at the site.

- In late June, Health Canada provided an import permit to Aurora Cannabis for the cannabis cultivated by the company.

- The Office of Drug Control granted a manufacturing licence to IDT Australia during the period, following which IDT has installed Cann Groupâs supercritical carbon dioxide extraction equipment needed for the processing of medicinal cannabis.

- Developing its abilities as a cultivator of commercial medicinal cannabis, Cann Group finalised the first harvest of globally sourced genetics in the quarter.

- The company completed a strategic investment of NZ$6 million in Pure Cann NZ Limited in April, securing a 20 per cent ownership in New Zealand-based medicinal cannabis company. A Technical Services Agreement was also signed by the two companies with an intention to fast-track Pure Cannâs growth plans to the market.

- An updated investor presentation was also released in April by Cann Group that covered its recent achievements, major expansion plans and upcoming milestones.

Financial Performance

In its recently released quarterly update, the company notified that it has secured sales amounting to $2.3 million during the quarter, that led to a 413 per cent increase in its revenue, relative to the previous financial year. The company spent ~AUD 2.08 million on the operating activities during the quarter that included an expenditure of AUD 27k on research and development. Cann Group has estimated a total cash outflow of ~AUD 13.76 million for the next quarter. The cash balance of the company at the end of the June quarter stood at ~AUD 46.4 million.

Future Outlook

The company expects the following developments in the future:

- Progress on construction and development of Mildura facility.

- Confirmation of debt funding arrangements required for the Mildura facility.

- Consistent Supply to the Victorian Department of Health and Human Services in the present quarter.

- Action its first exports to Canada under its agreement with Aurora Cannabis.

- Aims to bring its manufacturing capability with IDT Australia online.

- Continuation of refinement in its commercial strategy.

Stock Performance

The companyâs stock closed the trading session higher on the ASX at AUD 2.180, up by 1.4 per cent in comparison to the previous closed price. The market cap of the stock was recorded at AUD 304.88 million at the time of writing the report. CAN has delivered a return of 7.50 per cent on a YTD basis.

Elixinol Global Limited

An international leader in the cannabis industry, Elixinol Global Limited (ASX: EXL) cultivates and manufactures medicinal cannabis products. The company also sells hemp food and wellness products, and hemp derived Cannabidiol (CBD) dietary supplements. The companyâs businesses include Nunyara Pharma Pty Ltd, Hemp Foods Australia Pty Ltd and Elixinol LLC.

Operational Performance

Elixinol Global Limited has also released its quarterly activities and cashflow report for the quarter ending 30th June 2019. The company outlined the following activities that were undertaken during the quarter:

- The company made changes to its board and the executive management groups during the period that included appointment of Stratos Karousos as the Chief Executive Officer, Paul Benhaim as the Chief Innovation Officer, Mr Gabriel Ettenson as Global Chief Technology Officer, Mr Leif Harrison as CEO Americas, Mr Greg Smith as Global Chief Information Officer and Mr Ali Atcha as CEO Europe & UK.

- In June 2019, a certificate of occupancy was received by the company from the City of Louisville for its new production facility. The company informed that its Colorado production facility is now operational and more than doubleâs the Elixinol Globalâs production capacity.

- RFITD Holdings, LLC and the company entered into a strategic partnership via Infusion Strategies during the period.

- Elixinol acquired a 25 per cent interest in Altmed Pets LLC, which is a leading brand in the rapidly expanding CBD pet products market.

- A CBD Authorization was granted to the company by the New York State Dept. of Agriculture and Markets in May 2019.

- The company raised AUD 50 million through a successful institutional placement to accelerate its expansion initiatives in the US.

Financial Performance

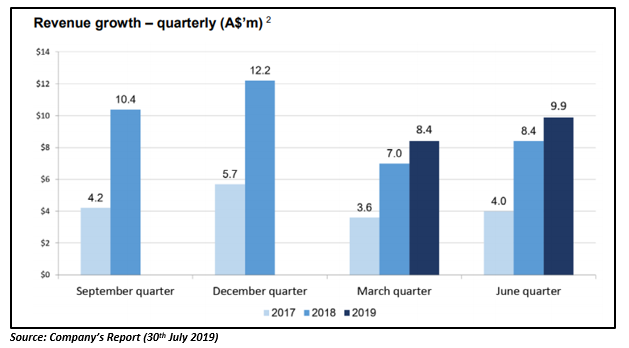

In its June 2019 quarterly report, the company reported a rise of 19 per cent in its unaudited group revenue to $9.9 million on pcp (Q2 FY2018). According to the company, its normalised revenue growth for Q2 FY2019, excluding its private label business, would have been 38 per cent on PCP. The company spent ~AUD 19.3 million on the operating activities during the quarter and has estimated a total cash outflow of ~AUD 25.56 million for the next quarter. The cash balance of the company at the end of the June quarter stood at ~AUD 48.1 million.

Stock Performance

The companyâs stock ended the trading session higher on ASX today at AUD 3.480 with a rise of 0.87 per cent relative to previous closed price. With ~137.89million outstanding of shares, the market cap of the company stood at AUD 475.73 million. EXL has generated a return of 28.25 per cent on a YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.