Generally, stocks are bifurcated into four categories based on their market cap: Large cap, Mid cap, Small cap and Penny Stocks. Large and Mid-cap stocks offer low risk and low return, but on the other hand, if we look at the small cap and penny stocks, these are considered risky but if invested properly offers great return.

Small cap stocks are generally under-priced as they are under-researched. These stocks are generally considered value investment because of their low valuations and potential to grow to become mid or large cap stocks.

Now let’s look at some of the small cap stocks that ended 2019 with a good note.

Resources and Energy Group Limited (ASX:REZ)

Resources and Energy Group Limited is an independent mineral resources company with projects located in key mining areas in Western Australia and Queensland. The company’s aim is to discover important gold deposits under explored or overlooked by using modern exploration methods. It is currently focussed on the flagship Menzies Project located 130 km north of Kalgoorlie in WA.

Update on the East Menzies Gold Project

Recently, the company provided an update on recent exploration results and upcoming drilling and potential third-party mining activities for its 100 per cent-owned East Menzies Gold Project (EMGP) in WA.

Key highlight of the update:

- 26 RC holes for 3,788 metres completed across three zones;

- 106 bottom of hole geochemical samples submitted for analysis;

- Studying third-party offers to campaign-mine existing deposits, which could generate cashflow for the Company to invest in wider exploration at East Menzies.

Stock Performance

The stock of REZ closed the day’s trading at $0.015 on 3 January 2020, down by 6.25% from its previous closing price. The company has a market cap of $6.2 million. Its 52-week low and high is $0.013 and $0.065, respectively.

Southern Gold Limited (ASX: SAU)

Southern Gold Limited is a successful gold explorer, which owns 100% of a significant portfolio of high-grade gold projects in South Korea. These projects are situated in the south-west of the country largely aiming greenfield epithermal gold-silver target.

Permit to Develop Kochang Gold Mine approved by the South Gyeonsang Provincial Government

The company has been advised by Bluebird Merchant Ventures Ltd, its joint venture partner, the Permit to Develop for the Kochang Gold Mine has been approved by the South Gyeonsang Provincial Government.

- The approval is subject to several conditions largely in relation to physical development requirements regarding safety and environmental management;

- Bluebird and Southern Gold each hold a 50% equity interest in Singaporean company Kochang Project JV Co Ltd which in turn holds 100% of South Korean company Geochang Project Co Ltd which holds the Kochang gold development project;

- Joint Venture costs are currently shared 50/50 while Bluebird is responsible for day to day operations.

Stock Performance

The stock of SAU closed the day’s trading at $0.165 per share on 3 January 2020, down by 21.429% from its previous closing price. SAU stock’s market capitalisation stood at $18.55 million. Its 52-week low and high is $0.104 and $0.280, respectively.

Imagion Biosystems Limited (ASX: IBX)

Imagion Biosystems Limited is engaged in creating a new safe and non radioactive diagnostic imaging technology, with an aim to identify cancer and other ailments earlier and with a detail narrowness that is currently not possible by combing biotechnology and nanotechnology.

The Company Receives $300K Order for Supply of Nanoparticles

The company has received an order totalling approximately $300K for the supply of Imagion’s proprietary nanoparticles for 2020, which will be used in the product from NewPhase Ltd, an Israeli biotechnology company developing cancer treatments.

- NewPhase is developing a proprietary cancer therapy based on hyperthermia; the principle of killing cancer cells by heating them;

- The overall cancer therapy market is forecast to grow at CAGR 8.37% through 2024.

Stock Performance

The stock of IBX closed the day’s trading at $0.025 per share on 3 January 2020, down by 7.407% from its previous closing price. IBX stock’s market capitalisation stood at $13.8 million. Its 52-week low and high is $0.016 and $0.075, respectively.

Lithium Consolidated Ltd (ASX: LI3)

Lithium Consolidated Ltd is engaged in the exploration of lithium. 2019 has been a very challenging year for Lithium players. To overcome this, LI3, focussed mainly on Western Australian, Zimbabwe, and Mozambique.

The Company Has Appointed Company Secretary

The company has Mr Paul Jurman as Company Secretary. He is a CPA with more than 15 years' experience. He has been involved with a different range of Australian public listed companies in company secretarial and financial roles. Currently, he is company secretary of Platina Resources Limited and Carnavale Resources Limited.

LI3 Successfully Acquires Warrigal Mining Pty Ltd

The company has successfully acquired 100% of a Western Australian based exploration company, Warrigal Mining Pty Ltd. Transaction cost will be paid in three tranches.

Stock Performance

The stock of LI3 closed the day’s trading at $0.025 per share on 3 January 2020. LI3 stock’s market capitalisation stood at $3.68 million. Its 52-week low and high is $0.019 and $0.119, respectively.

Globe Metals & Mining Limited (ASX:GBE)

Globe Metals & Mining Limited is a Perth based company, which is engaged in the development of speciality metals and minerals. It’s an African-focused resources company having Kanyika niobium project in Malawi.

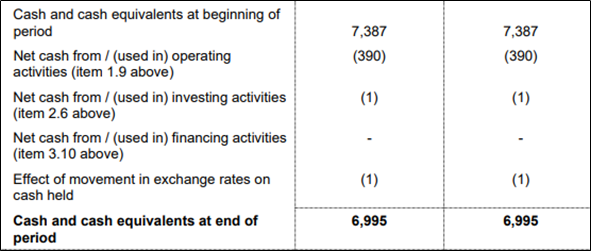

Cash position of the company in the Quarter ended on 30 September 2019.

Net Increase/(Decrease) in Cash Flow (Source: Company’s Report)

Stock Performance

The stock of GBE closed the day’s trading at $0.017 per share on 3 January 2020. GBE stock’s market capitalisation stood at $7.92 million. Its 52-week low and high is $0.014 and $0.024, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.