Retail & Consumer Sentiment

The National Retail Association (NRA) has unveiled that the spending levels in Australia could hit $14 billion in the last week to Christmas. It was reported that the retailers across the country are preparing for the rush season.

Following a successful Black Friday that saw sales clocking $5 billion in the four days to Cyber Monday, the retailersâ body is forecasting a spend of $50.1 billion for the period from mid-November to year-end or Christmas trade period.

Meanwhile, the Australian Retailers Association is indicating that Australians are more than ready to accept the taste of Autonomous retailing. Amazon Go has established such stores in the US, which allows the consumers to shop with no checkout required.

NAB Cashless Retail Sales Index â November

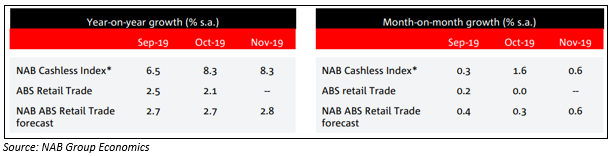

NAB Group Economics has released Cashless Retail Sales Index for November. The group is expecting that ABS retail trade numbers for November are likely to report a rise of 0.6 per cent on a m-o-m basis.

Earlier, ABS had reported flat numbers in the October issue, which was below the NABâs initial forecast of 0.4 per cent. Rising retail prices and extended Black Friday sales are suggesting an uptick in the November data, says NAB.

Alan Oster, Chief Economist, noted â if the forecasts were to materialise, it means the strongest result since February this year. However, this does not represent a revival in the sector. Meanwhile, the business survey has depicted signs of increasing prices, which might be an effort to capture margins amid higher input costs.

NAB is of view that retail sector fundamentals are highly unlikely to depict optimism, attributed to higher unemployment, subdued wage growth and escalated debt levels. These factors are likely to hurt spending with interest rate cuts. Eventually, additional stimulus would be required to change this equation.

Black Friday Sales

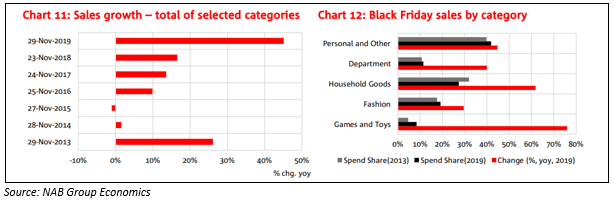

The data collected by the group, which does not include food, grocery and liquor, and motor vehicle retailing, indicated that some retailers had started the sales early and continued till the weekend, and even into December.

NAB emphasised only on the Friday sales, which depict that the event has been getting traction over the past decade, with sales up around 45% from the same event last year. The sales of games and toys had recorded the largest growth, and sales of personal and other goods and fashion also depicted growth.

The group believes that there has been a change in spending habits of consumers within months and across months. And, this is resulting in challenges in the seasonal adjustment process, and in turn, leading to swings in the monthly retail sales data.

Westpac-Melbourne Institute Index of Consumer Sentiment

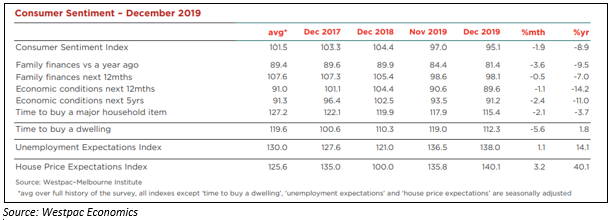

Earlier this month, Westpac Economics (WE) revealed that consumer sentiment index declined 1.9 per cent to 95.1 in December from 97 in November. The index continued its falling trajectory since the initial rate cut in June this year, reported Westpac Economics.

The subdued performance of the index is in line with the deterioration in consumer spending levels that were indicated in the GDP numbers for the September quarter, and some early evidence of weaker December quarter.

It was mentioned that the impact of rate cuts in the consumer sentiment had weighed in drastically. And, the consumers are much more sensitive to interest rate cuts than they were earlier in this decade.

In December, all major components of the index had recorded declines. Among some components, the unemployment expectations continued the rising trajectory, and the component was up 14.1 per cent on a y-o-y basis.

The unemployment expectations are consistent with data, including sluggish job growth, increases in unemployment and underemployment. However, WE expects the unemployment rate to come down in the first half of 2020.

The interest rate cuts have impacted the consumer expectations for finances, and major item household component also fell, indicating a reluctance in discretionary spending.

Further, the time to buy a dwelling component is now down by 11.5 per cent from its peak in August. And, the House Price Expectations Index rose 3.2 per cent in December. The RBA Board would be meeting again in February to decide on a monetary policy decision, and WE expects a 0.25 per cent rate cut.

WE anticipates that the RBA might be impressed by the escalating asset prices and downward pressure on the exchange rate. Meanwhile, the Governor had stated that rate cuts might not have impacted the spending habits, while the consumers might be repairing their balance sheet in a bid to spend at a later date.

Westpacâ Melbourne Institute Leading Index

WE noted that the six-month annualised growth of the index fell from -0.78 per cent in October to -0.81 per cent in November. Moreover, the growth rate of the index has been below trend for the past twelve months now.

This is indicating that weak economic conditions are likely to continue through to 2020. And, the index behaviour is in line with WEâs growth forecast of 2.1 per cent. The growth rate of the index decreased to -0.81 per cent in November from -0.17 per cent in June.

The factors that are driving the downward trends include;

- A sell-off in commodity prices.

- A mixed performance of the Australian stock market.

- A subdued picture in dwelling approvals.

- Falling Westpac-MI Consumer Sentiment Index.

This downward pressure is offset partially by;

- Wider yield spreads due to low rates, and in turn, lower short-term rates.

- Less downside pressure from the US industrial production.

Moreover, WE is expecting a rate cut in February, and the incoming economic data would hold the keys as well, including retail data, labour market, and confidence.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.