NAB Australian Economics has released November 2019 business survey report. The headline view suggests a stabilisation in business conditions at low levels, and construction and manufacturing sectors have also stabilised after suffering large falls.

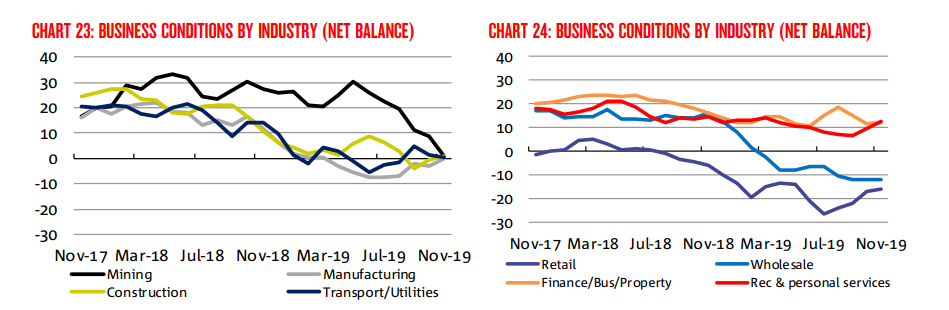

The business conditions in mining have also witnessed pull-back due to lower commodity prices, and goods related industries were weakest and services-related industries were strongest. New South Wales and Tasmania showed the best conditions with Queensland on the weakest side.

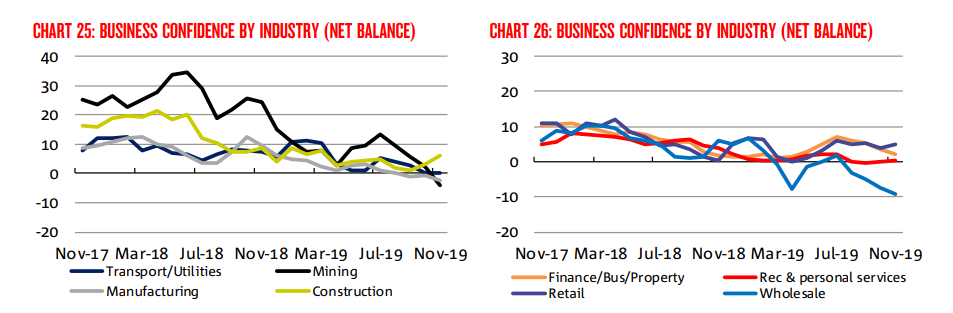

The business confidence fell 2 points to 0 index points erasing gains from the previous month with forward orders reversing last monthâs gains. The survey price measures indicated that inflationary pressure remains weak with a rise in recent months, including retail due to higher input costs.

Further, the businesses continue to face margin pressure with input cost growth outstripping the growth of final product prices. Moreover, NAB Economics has a view that the survey is consistent with weakness in economic activity (GDP growth). And, it perceives the risk of slower employment growth with weak investment despite spill-over demand from public-sector spending and mining stabilisation.

Weak Household Consumption; September GDP Data

In the September quarter, the household consumption growth recorded its weakest growth since the global financial crises, increasing at 1.2 per cent in y-o-y terms. The growth in spending on discretionary goods fell sharply while spending on essentials (staples) remained steady, yet slowed. Moreover, household spending on goods was weak.

Source: NAB Group Economics

Consequently, the weaker data on consumer spending/household spending has impacted the business survey, including a decline in retail and wholesale business conditions. The business conditions have improved in finance, business services, property, recreation and personal services.

Moreover, the business confidence remains subdued in the goods-based industries (retail & wholesale) while the opposite is noticeable in the other industries.

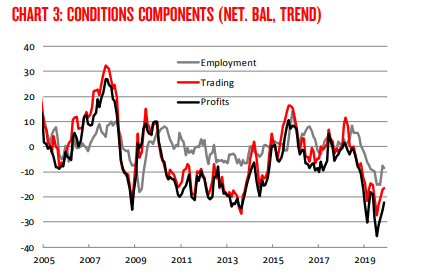

Business Conditionsâ Components Below Zero

All three components of business conditions are tracking below zero levels, and the profitability is the weakest. Meanwhile, the three components have posted decent gains in recent months.

Source: NAB Group Economics

Confidence building up in Retail & Construction

The survey suggests that business confidence is improving in construction and retail. There are sharp downward pressure noticeable in wholesale and mining. Meanwhile, confidence has also gradually stabilised in transport/utilities, manufacturing.

Source: NAB Group Economics

Retailers might be looking for some favourable seasonal activity amid a festive season, and sale periods. Meanwhile, the commodity prices are taking a toll on the confidence of miners. The conditions are not appearing favourable for electricity producers with many plants not in production, and increasing supply from renewables.

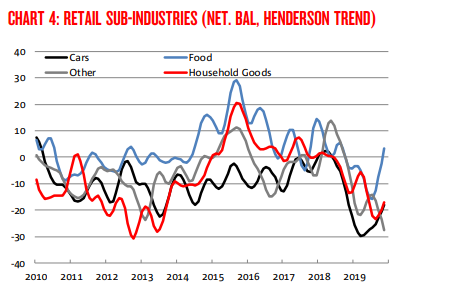

Conditions in Car, Food & Household Goods Picking up

The survey also suggests at sub-industry level there has been an improvement in business conditions in food retailing in the recent months. Food Retailing has picked up to a positive level now.

Source: NAB Group Economics

Meanwhile, there has been a material improvement in the car retailing after falling to record low-levels this year. And, the conditions in household goods has depicted some gains with other retailing conditions falling to lower levels.

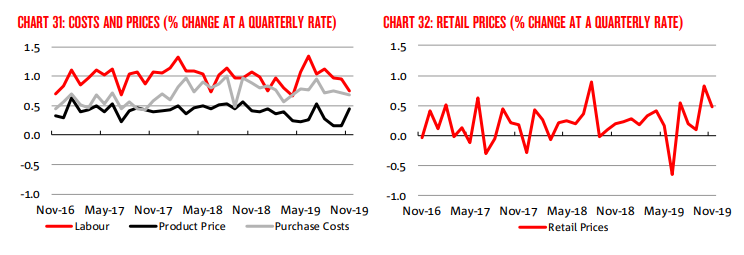

Retail Margin Pressure, Rise in Input Costs

Despite a pick-up in retail prices, the survey found that other indicators of the retail industry continue to point out to ongoing stress. Moreover, the input cost has increased sharply in recent years, suppressing margins.

Source: NAB Group Economics

Further, the challenges in the retail sector include competition and weaker consumer demand that has held price growth while the costs have remained higher concurrently. NAB believes that the major headwinds for the retail sector continue to be low-wage growth and a higher level of household debt.

It was also said that the tax cuts passed by the government looks to be flown into savings, and the impact of rate cuts is likely to take some time. Also, the policymakers would need to adopt a more accommodative stance for the households to support the retail sector.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_06_10_2025_01_00_15_274451.jpg)