The real estate industry comprises groups that hold, develop, and operate commercial, residential and industrial real estate. Australian property stocks are facing the worst housing slump in a generation, rallying to the maximum in roughly three years. The housing prices in Australia started soaring after the Reserve Bank of Australia (RBA) announced a cut in the borrowing costs to record lows in 2016 (last when real estate shares were trading higher), increasing the need for the property.

Australian real estate market is made up of two industries- Equity Real Estate Investment Trusts (REITs) industry, the industry include the trusts who are into the ownership, acquisition, development, leasing, operation and management of the property and Real Estate Management & Development industry, includes the companies who are engaged in management, development & sales activities, or provide real estate services.

In Australia, Real Estate Investment Trusts (A-REITs), is a method to obtain exposure to property investments wherein it’s not needed by the investor to buy or manage the physical property. Australian Real Estate Investment Trusts are companies that hold and operate the property on behalf of shareholders. They might hold assets such as shopping malls, industrial properties and warehouses, and commercial buildings. The most critical reasons investors keep REITs are- diversification, professional management, dividend income, and capital gains of the underlying property portfolio.

In this article, we are discussing what’s recent for the three ASX listed real estate stocks- MGR, VCX, GOZ

A leading, diversified Australian property group Mirvac Group (ASX:MGR) is engaged in asset management capability and integrated development. The group has an experience of more than 45 years in the real estate industry and holds a unique reputation for providing superior services and products across its businesses. The group is located in four key cities in Australia- Brisbane, Sydney, Perth and Melbourne. It has more than AUD 18 billion of assets which are under management, and it manages and owns assets across the industrial & retail sector and offices.

New development opportunity in Melbourne-

Mirvac Group unveiled that the company has exchanged contracts to buy 7-23 Spencer Street in Melbourne, Victoria for a complete consideration of approximately AUD 200 million, to be paid in instalments.

Concerning planning approvals, Mirvac’s vision is to change the site into a vibrant mixed-use metropolitan community, including an office tower of nearly 40,000 square metres and a build-to-rent (BTR) apartment tower of around 430 apartments as well as additional commercial space. Both towers would be accompanied with superior quality service and retail space.

The acquisition is in track with Mirvac’s advancement return barriers, and settlement is projected to take place between March 2020 and August 2021.

Tenderer for waterloo metro quarter-

Mirvac Group reveals that its association with John Holland has been selected to provide development of Sydney metro’s integrated station at Waterloo, which is in partnership with New South Wales (NSW) Government. The anticipated end value of this collaboration is approximately AUD 800 million, and it is planned that all elements of the plan would be achieved over the next 5-6 years.

In this project, John Holland would provide the Waterloo metro station, and the component of integrated station would be delivered by the Consortium. The concept of Waterloo consists of five building envelopes including two mid-rise buildings and three towers, above and close to the station.

Pipeline of additional opportunities obtained in the fiscal year 2019-

Stock performance-

MGR’s market capitalisation stands at around AUD 12.86 billion, with nearly 3.93 billion shares outstanding. On 30 December 2019, the MGR stock is trading at AUD 3.245 (AEDT: 03:32 pm), down by 0.765%. MGR has generated positive returns of 48.64 per cent on year to date basis. The MGR’s stock has 52 weeks high and low price at AUD 3.440 and AUD 2.190, respectively. The P/E ratio of the stock stands at 11.850x, with an annual dividend yield of nearly 3.79%.

Vicinity Centres (ASX:VCX)

An ASX listed Real estate investment trust company Vicinity Centres (ASX:VCX) one of Australia’s leading retail property groups having a completely integrated asset management platform and approximately AUD 26 billion in retail assets under management across 63 shopping centres. Vicinity manages 31 resources on behalf of Strategic Collaborators, 27 of which are combinedly owned by the group, the company has more than 23,000 security holders.

Acquisition of 50% interest in Uni Hill Factory Outlets-

On 23 December 2019, Vicinity Centres unveiled that the company has consented for the acquisition of 50% interest in Uni Hill Factory Outlets in Victoria from MAB Corporation for approximately AUD 67.8 million. In this acquisition, MAB Corporation would hold a 50 per cent interest in the asset.

The acquisition is subject to Australian Competition and Consumer Commission (ACCC) approval, with completion projected in the second quarter of 2020 and the price of the proposed Uni Hill acquisition indicates a capitalisation rate of 6.5%.

Addition to this, Vicinity centres mentioned that its interim results for financial year 2020 would be revealed on Wednesday 19 February 2020.

Stock performance-

VCX’s market capitalisation stands at around AUD 9.82 billion, with nearly 3.76 billion shares outstanding. On 30 December 2019, the VCX stock is trading at AUD 2.525 (AEDT: 03:40 pm), down by 3.257%. VCX has generated positive returns of 3.57 per cent on year to date basis. The stock has 52 weeks high and low price at AUD 2.720 and AUD 2.415, respectively. The P/E ratio of the stock stands at 28.870x, with an annual dividend yield of nearly 6%.

Growthpoint Properties Australia (ASX:GOZ)

An ASX listed publicly-traded company Growthpoint Properties Australia (ASX:GOZ) focuses on the management and ownership of quality investment property. The company intends to strengthen its portfolio with the time and diversify its property investment by geography, asset class and exposure of tenant via individual property acquisitions, portfolio transactions, and corporate activity as opportunities evolve. Growthpoint possesses interests in a diversified portfolio of 58 office and industrial properties throughout Australia valued at nearly AUD 4.0 billion and has an investment mandate to invest in office, industrial and retail property sectors.

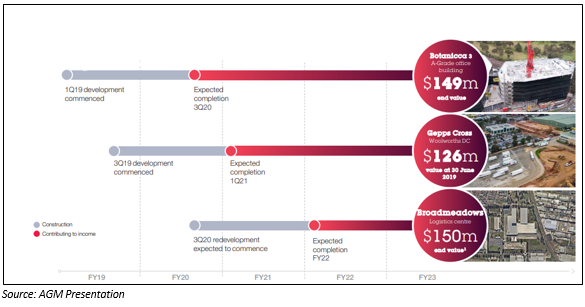

The company has a well-planned project pipeline for the upcoming years-

New lease with the New South Wales (NSWPF) Police Force-

On 23 December 2019, Growthpoint unveiled that the company has entered into a new twenty-five-year contract with the NSW Police Force beginning 1 January 2020. New South Wales Police Force occupies 32,356 square metres of A-grade office space and 444 car spaces at the Curtis Cheng Centre, Charles Street, Parramatta, NSWPF headquarters. The current lease would be replaced by the new lease with the NSW Police Force, which was due to expire in May 2024.

The company has entered a Refurbishment Works Deed with NSW Police Force, as part of the new lease plans. Growthpoint anticipates providing a fund of approximately AUD 44 million to modify the New South Wales (NSWPF) Police Force headquarters, which the NSW Police Force plan to commence over the next few years.

Due to the lease with NSWPF, the value of the property is projected to rise to AUD 420 million, 19 per cent higher than the book value of June 2019 and 74 per cent higher than its June 2014 buying value of AUD 241 million. The positive pro-forma impact on net tangible assets is 8.7 cents per security.

Stock performance-

GOZ’s market capitalisation stands at around AUD 3.33 billion, with nearly 771.78 million shares outstanding. On 30 December 2019, the GOZ stock is trading at AUD 4.225 (AEDT: 03:40pm). GOZ has generated positive returns of 16.44 per cent on year to date basis. The stock has 52 weeks high and low price at AUD 4.520 and AUD 3.630, respectively. The P/E ratio of the stock stands at 8.170x, with an annual dividend yield of nearly 5.42%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.