Dominoâs Pizza Enterprises Limited (ASX: DMP)

Based in Australia, DMP is the largest franchisee of the global pizza heavyweight - Dominoâs Pizza, Inc. (NYSE:DPZ). It is the leading international franchise of the parent company, which is based in the USA.

Bad news travels much faster than good news â this saying completely fits the context, letâs discuss both:

On Tuesday, in the US, the franchise company held the third quarter (ended 8 September 2019) earnings conference call. Accordingly, the pizza giant reduced its forward guidance timeframe for the upcoming period. Earlier, it used to provide guidance for the next three-to-five years, which has now been shortened to two-to-three years, as the current trading conditions are making the view of DPZ less significant.

Earlier, DPZ was anticipating global sales growth between 8 percent to 12 percent, over the span of three-to-five- year timeframe. Further, it anticipated achieving growth in the range of 3% to 6% for the US same-store sales. International same-store sales were expected to grow in the range of 3% to 6% as well.

According to the latest communication, the pizza giant is expecting global retail sales growth in the range of 7% to 10% in the next two-to-three years. The US same-store sales are expected to achieve sales growth of 2% to 5%, and international same-store sales growth is anticipated in the range of 1% to 4%.

Amid these headwinds, DPZ closed the market session on 9 October 2019 lower by 2.23% or USD 5.65 from its prior close at USD 248.19. The pizza giant announced a USD 1 billion share repurchase program, and the earnings growth is still there. The diluted EPS (as adjusted) was up by 5.1% to USD 2.05 vs previous corresponding period (Q3 2018). For nine-months to Q3 2019, the diluted EPS (as adjusted) increased to USD 6.44 compared to USD 5.8 vs previous corresponding period (Q3 2018).

On changing the guidance pattern, Mr Richard E. Allison â CEO of DPZ, has said that the escalating uncertainties have suppressed the relevance of three-to-five years outlook. In addition, the quick-service restaurant segment has been casting threat to the pizza giant, leveraging deep discounts and lower prices in a bid to achieve market share.

How is Aussie pizza giant holding up?

On 10 October 2019, DMP stock was trading at $47.56 (at AEST 1:06 PM), down by 0.937%. DMP, the Australian franchise is not just Australian! The gigantic franchise operates in the amply developed economies with relatively higher per capita income against the emerging markets.

The Aussie Pizza giant operates in the substantial part of Europe that includes Belgium, Germany, Luxembourg, Denmark, France, and the Netherlands. In addition, DMP has a presence in New Zealand & Japan.

In the report for the year-ended 30 June 2019, the pizza franchise had recorded revenue growth of 24.4% to $1.43 billion compared to $1.15 billion in the previous year. The company opened 179 new Dominoâs stores and converted the remaining Hallo Pizza stores in Europe to the Dominoâs brand. In Germany, the conversion of Hallo Pizza had resulted in a one-off cost of $47.4 million.

In ANZ, the company witnessed record usage of its digital platform, selling pizzas and sides in excess of two million in one week. New product items were launched in the market. Further, the company is collaborating with franchise operators to drive efficiency gains and cost savings. In addition, the company opened the 700th store in Australia. However, underlying EBITDA was down by 4% to $127.9 million, and same-store sale growth was positive at 2.4%.

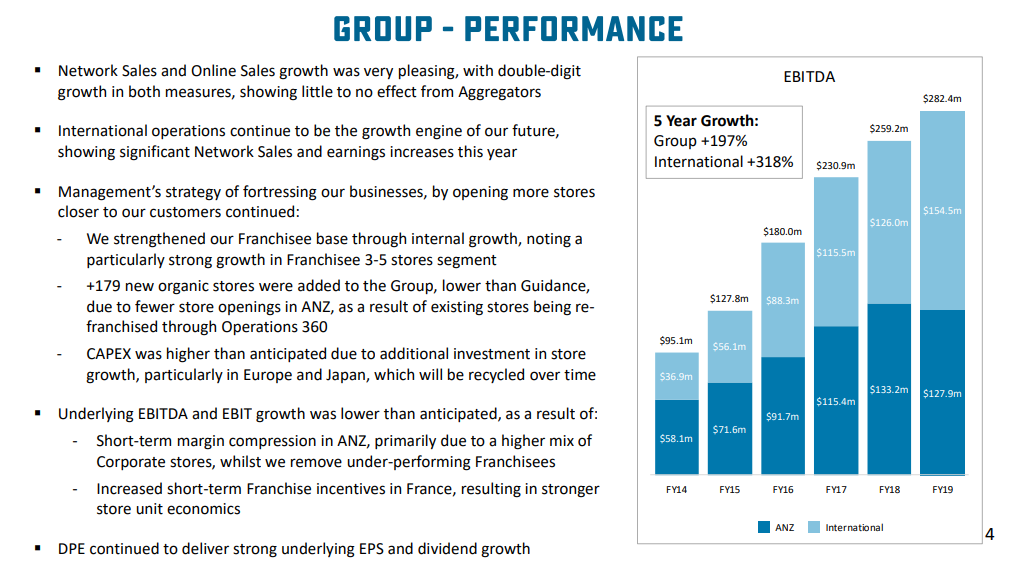

Group Performance (Source: DMPâs FY19 Full-year Market Presentation)

Group Performance (Source: DMPâs FY19 Full-year Market Presentation)

In Japan, the operation of the company performed very well in the country, delivering strong growth through new value offerings that balanced the existing premium ranges. The company achieved an increase in same-store sales of 8.4%.

The operations in Japan were benefitted by the new leadership, and its digital menu, operational initiatives resulted in a positive impact. As a result, the company is expecting to open 1000 stores in Japan, having opened 81 stores at the year-end, passing the 550 and 600-store milestones.

In Europe, the company completed acquisitions in Denmark & Luxembourg, and these opportunities had provided strong geographic and cultural alignment. The Netherlands & Belgium business continued to perform strongly, and the rest of the business had been benefitted by the lessons learnt in the growth markets.

Further, the companyâs expectations were above the results in France. However, the performance in France had depicted green shoots in the second half of the period. The company had scaled up operations in Germany with store count reaching 327 stores from less than 15 stores four years ago. The company passed the milestone of 1000 stores in Europe, and it achieved same-store sales growth of 3.1%.

FY 20 Trading and Outlook

According to the full-year results, it was said that the same-store sales growth at the group level has been depicting positive movement, and growth in the second half period was better than the first half by 60bps.

The momentum achieved in the last quarter of the FY2019 had continued in the initial trading days of the financial year 2020, and the same store sales were lifting up. By 21 August 2019, the company had constructed, and opened nine new stores.

Reportedly, the company provided the long-term outlook (3-5 years) on sales & store count growth. It expects the same-store sales growth in a range of 3% to 6% annually at a group level, and store count growth of 7% to 9% annually at a group level as well.

Further, the company has been focused on expanding its footprint in Japan, particularly the corporate stores. It is also focused on empowering young managers, franchisees via short-term loan on commercial terms to scale up the businesses.

It anticipates incurring net capex in the range of $60 million to $100 million annually for the next three-to-five years, majorly through the capex recycling when franchisees pay down the loans, and new corporate stores are franchised.

On a YTD basis, DMP has delivered a return of +17.96%. In the past three-month, the return of the stock is up by 19.07%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.