Short Selling

According to ASICâs short positions report dated 16 September 2019, the below companies are among the most shorted ones.

| Product | Product Code | Reported Short Positions | Total Product in Issue | % of Total Product in Issue Reported as Short Positions |

| Nufarm Limited | NUF | 65848027 | 379639334 | 17.34 |

| Orocobre Limited | ORE | 42252602 | 261678074 | 16.15 |

| Syrah Resources | SYR | 66097385 | 413374399 | 15.99 |

| Galaxy Resources | GXY | 63754199 | 409479338 | 15.57 |

| Inghams Group | ING | 55134423 | 371679601 | 14.83 |

| NEXTDC Limited | NXT | 50078613 | 343655108 | 14.57 |

| JB Hi-Fi Limited | JBH | 15510350 | 114883372 | 13.50 |

| GWA Group | GWA | 31368201 | 263947630 | 11.88 |

| HUB24 Limited | HUB | 7078564 | 62589415 | 11.31 |

| Dominoâs Pizza | DMP | 8714385 | 85788290 | 10.16 |

Source: ASIC Report â 16 September 2019

Short selling refers to selling the securities at prevailing prices in anticipation that the price of the security would fall in the near future. Shorting is facilitated by the borrowing of the securities, that are intended to be sold at the prevailing prices.

Letâs have a look at such shorted stocks now.

Nufarm Limited (ASX: NUF)

The pessimism looming over the agricultural stocks continued, backed by drought headwinds in Australia. Besides in June, the company provided an update on its use of glyphosate, following the increasing scrutiny of glyphosate in the courts, accusing glyphosate of adverse impacts to human health.

Consequently, the company had taken pre-emptive measures, and the verdicts were reviewed by the company. It was noted that numerous regulatory agencies around the world had deemed glyphosate safe to use but only as per the labelâs directions.

Second Half Update (Source: NUFâs Macquarie Australia Conference 2019)

Further, Nufarm does not manufacture glyphosate, but it buys the material and uses it in its production. It would be closely following the developments, and the market would be updated subsequently.

Recently, the company had undertaken preference placement to raise $97.5 million from the existing investors, and strategic partner â Sumitomo Chemical Company Limited.

On 23 September 2019, NUFâs stock last traded at $4.61, down by 1.285% from the last close.

Orocobre Limited (ASX: ORE)

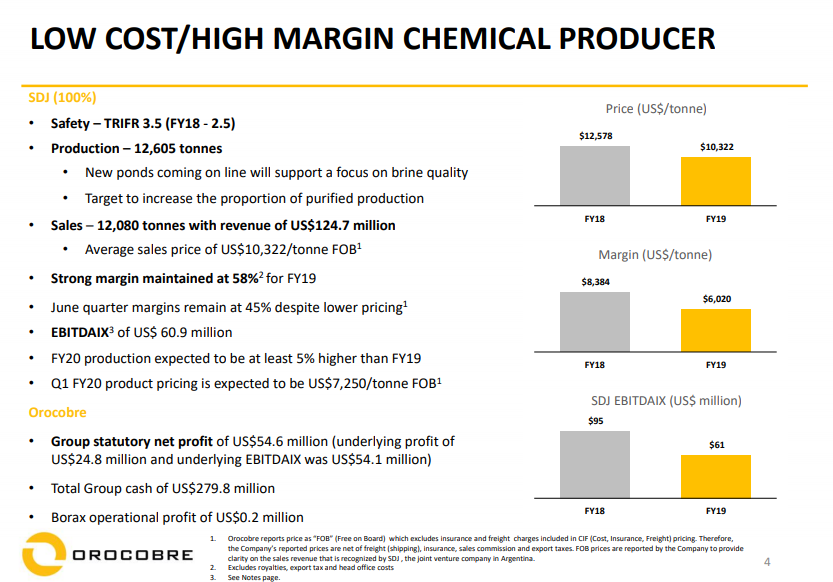

Lithium player, Orocobre generated a decent full-year result, and it reported a net profit after tax of US$54.6 million in FY 2019 compared to US$1.9 million in FY2018. The company was adversely impacted by the falling price of lithium chemicals, and introduction of new temporary export duties.

FY2019 Review (Source: ORE Full Year Presentation)

Downward pressure on the prices of lithium chemicals was attributed to the ongoing US-China trade dispute, changes in Chinaâs New Electric Vehicles (NEV) Policy, and growing emergence of Chinese lithium players in the seaborne market.

The company was well capitalised with US$279.8 million in cash at the year-end in its balance sheet.

On 23 September 2019, OREâs stock closed at $2.78, up by 6.513% relative to the previous close.

Syrah Resources Limited (ASX: SYR)

In its interim disclosure 2019 for the period ended 30 June 2019, the company had recorded revenue of US$46.9 million from the sales of 101kt of natural graphite. It suffered a net loss after tax of US$81.4 million, largely attributing to a non-cash impairment of US$65.9 million, and inventory write-down of US$4.8 million.

Recently, the company had provided an update on the Natural Graphite market. Accordingly, it was said that due to depreciation in Chinese Yuan and concerns on Chinese inventory levels had dragged the spot price of the Natural Graphite to lower levels.

Consequently, the company had decided to reduce the production volumes in the Q4 2019, undertaking a review to reduce costs, and conduct an operational & strategic review for 2020 period.

On 23 September 2019, SYRâs stock ended the market session at $0.50, up by 0.99% relative to the previous closing price.

Galaxy Resources Limited (ASX: GXY)

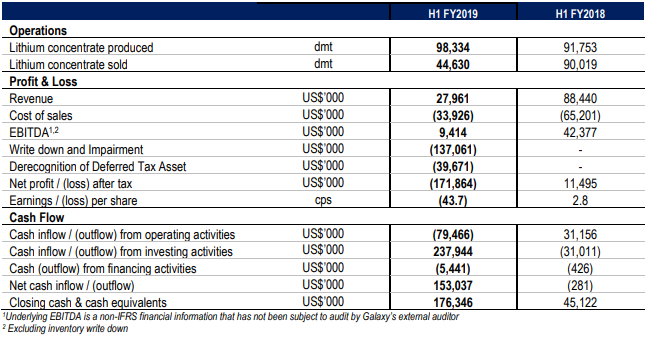

In its interim disclosure for the period ended 30 June 2019, the company had produced 98,334 dry metric tonnes of total lithium concentrate and sold 44,630 dmt during the period. It was produced at an average unit operating cost of US$387/dmt.

Revenue for the period stood at US$28 million, down from US$88.4 million in the previous corresponding period. Lower revenue was attributed to lower realised selling price, and lower sales volume.

Financials (Source: GXY Half Year Announcement)

Further, the average realised selling price for the lithium concentrate was down by 38% in year-over-year terms. Following the lower prices, the company undertook balance sheet, resulting in non-cash write-downs and impairment of US$176.8 million.

The US$176.8 million included the write-down of inventory at Mt Cattlin of US$13.6 million, impairment of Property Plant and Equipment at Mt Cattlin for US$123.5 million, and derecognition of deferred tax assets of US$39.7 million.

Subsequently, the company recorded a statutory net loss after tax standing at US$171.9 million against a profit which stood at US$11.5 million a year ago.

On 23 September 2019, GXYâs stock last traded at $1.135, shifting downwards by 0.439 percent relative to the previous close.

Inghams Group Limited (ASX: ING)

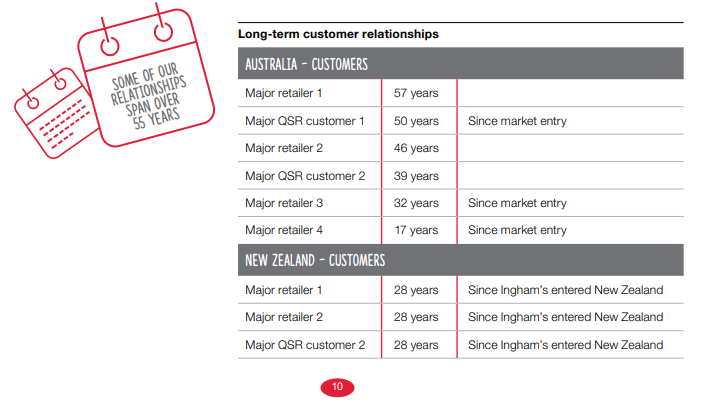

Inghams Group had delivered a $126.2 million net profit after tax in FY 2019. Strong demand in Australia and revival sign in NZ had resulted in core poultry volume growth of 4.3%

These results were achieved despite the pressure & impact of drought on feed and selling prices. Besides, the rising feed costs continue to pose a challenge to the business. However, Inghamsâ market position, along with contractual arrangements had delivered intended outcomes for the company.

Customers (Source: ING Annual Report to Shareholders)

Inghams intends to tackle inflation on its cost base through strategic initiatives and sustainable improvement.

On 23 September 2019, INGâs stock also traded at $3.18, up by 2.913% relative to the previous close.

NEXTDC Limited (ASX: NXT)

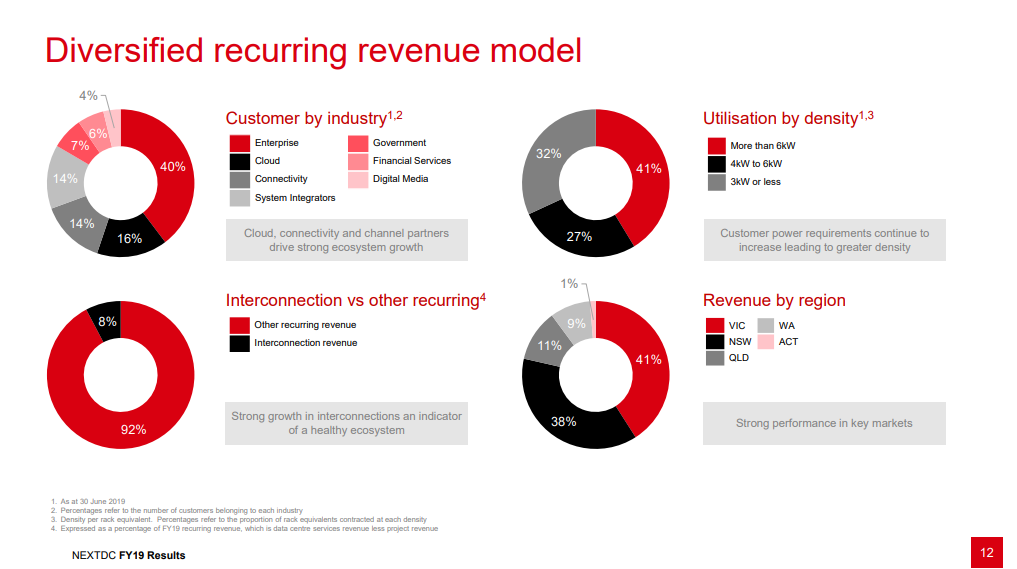

In its full year disclosure for the period ended 30 June 2019, the company had reported revenue growth of 11% to clock $179.26 million compared to $161.6 million in FY2018. Statutory net loss after tax for the period was $9.8 million compared to a profit of $6.6 million in FY18.

Revenue Model (Source: NXT FY19 Results Presentation)

During FY 2019, the company raised $500 million of senior unsecured debt and refinanced its $300 million syndicated senior secured debt facility. Besides, it completed acquisitions of land & buildings, resulting in rental savings for ~$15 million per annum.

On 23 September 2019, NXTâs stock last traded at $6.28, up by 0.965% relative to the prior close.

JB Hi-Fi Limited (ASX: JBH)

According to the Annual Report 2019, FY 2019 period ending on 30 June this year had been a strong year for the company. JBH witnessed record sales, profits, and dividends, which increased in comparison to the preceding year.

In FY 2019, the company achieved sales of $7.1 billion, up 3.5% over the prior year. Besides, EBIT increased by 6.4% to $372.8 million in FY 2019, and NPAT increased by 7.1% to $249.8 million in FY 2019.

Sales & EBIT (Source: JBHâs Annual Report 2019)

Further, the EPS for the period was 217.4 cents per share, up 7.1% over the previous year, and the total dividend for FY 2019 were up by 10 cents per share to 142 cents per share. The company expects the total sales to be around $7.25 billion in FY20.

On 23 September 2019, JBHâs stock ended at $34.160, down by 2.008% relative to the previous close.

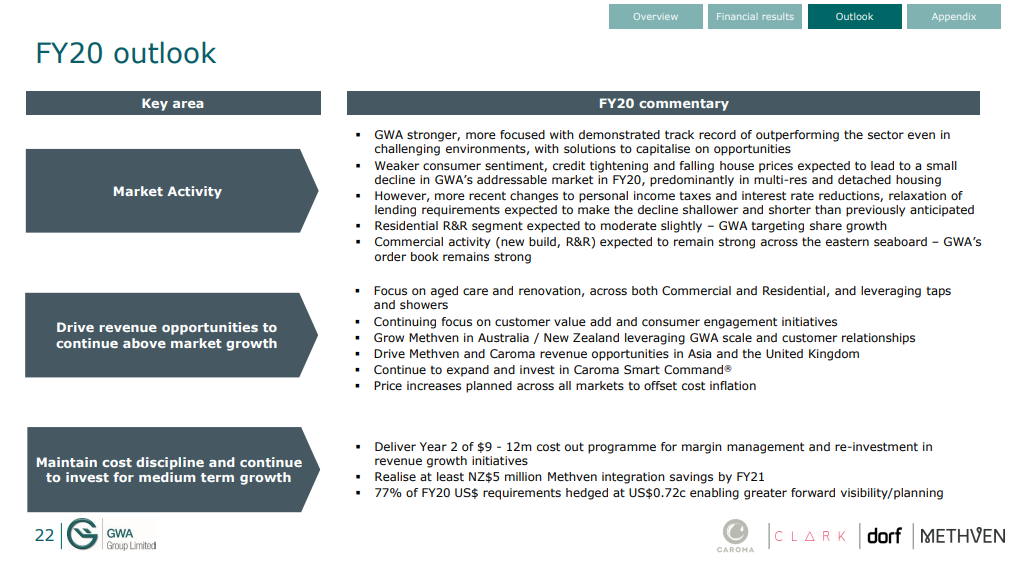

GWA Group Limited (ASX: GWA)

In FY 2019, the group had completed the acquisition of Methven Ltd and divested Door & Access Systemsâ business. Thetotal revenue of the group increased by 6.4% to $381.7 million in FY2019.

Further, the company had reported a net profit after tax of $95 million, which included $50.8 after-tax profit from the Door & Access Systemsâ business, and $7.6 million in significant items from the integration costs of Methven Ltd.

FY20 Outlook (Source: GWAâs FY19 Results Presentation)

Reported earnings per share for the period were 36 cents against 20.6 cents in the previous year. During FY 2019, the company had declared total dividend worth 18.5 cents per share compared to 18 cents per share in the previous year. The dividend declared for the period closed 30 June this year was 9.5 cents, fully franked and was paid on 4 September this year.

On 23 September 2019, GWAâs stock last traded at $3.42, up by 0.588% relative to the previous close.

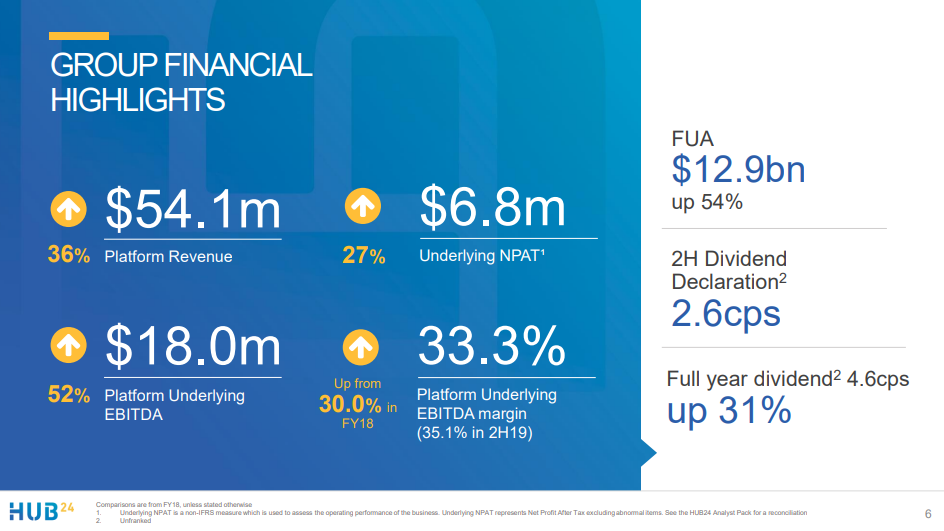

HUB24 Limited (ASX: HUB)

In FY 2019 period, the company had recorded statutory NPAT of $7.2 million compared to $7.4 million in FY2018, which included a material non-cash fair value gain.

During FY 2019, the company continued to maintain its position as the fastest growing platform provider in percentage terms. Growth in Funds Under Administration (FUA) continues to be driven by organic opportunities arising out of existing, new, and transitioned clients.

FY 2019 Highlights (Source: HUB24 FY19 Results Presentation)

The company is targeting FUA in the range of $22 to $26 billion by the end of FY2021, which is a $3 billion increase from the previous FY21âs target.

On 23 September 2019, HUBâs stock last traded at $12.84, down by 0.465% relative to the previous close.

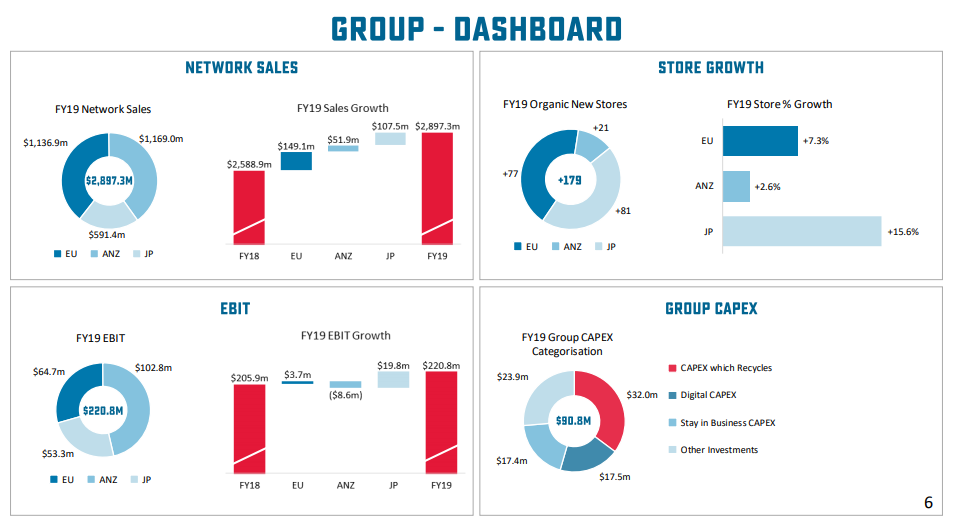

Dominoâs Pizza Enterprises Limited (ASX: DMP)

In FY 2019 report, the network sales of DMP were up 11.9% or $308.4 million to $2.9 billion over the prior year. During FY 2019, the company continued to grow market share in all the regions, particularly online sales.

Full Year Presentation (Source: DMPâs FY2019 Results Presentation)

Its online platform processed more than 66 million orders this year, equating to two orders every second. The companyâs Japan operations scaled up substantially during the period, which contributed to more earnings than Australia & New Zealand operations.

At the year-end, the company had 2,531 stores in eight countries on the three continents.

On 23 September 2019, DMPâs stock last traded at $47.55, down by 0.21% relative to the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.