Healthcare is a lucrative and dynamic sector for investors, and amid ambiguity and fluctuating stock market environment, Australia’s healthcare system stands out as one of the top sectors for investment purpose. Investment in healthcare stocks brings great excitement and diversification support to market fans. In lure of earning huge money, investors often flock to the healthcare market.

In this article, we are discussing two ASX-listed healthcare penny stocks- ImpediMed Limited (ASX: IPD) and Antisense Therapeutics Limited (ASX:ANP). Before diving deep, let’s first understand what penny stocks are.

Penny stocks refer to the stocks with a very low trading price, more or less equal to a penny; hence, called ‘penny stock’. Such smaller stocks grow at a much faster rate than large-cap stocks and can often see a surge of 2-3 times in a very short span of time; however, the higher reward is associated with very high risk and low liquidity. These stocks are also referred to as ‘micro-cap’ or ‘nano-cap’ and are usually cherry-picked by high-risk appetite investors seeking high rewards.

Pros & Cons of Penny Stocks

Here are some of the advantages of investing in penny space-

- Incredibly low price

- Higher return on investment

- Fewer investors

- Short period liquidity

While there are many advantages of investing in penny stocks, there are few disadvantages also such as-

- High volatility

- Prone to risk of manipulation

- Illiquidity

- Access to limited information

Let’s now discuss some of the recent advancements made by the above-mentioned healthcare stocks in the penny space.

ImpediMed Limited (ASX: IPD)

Founded and headquartered in Brisbane, Australia with operations in the United States and Europe, ImpediMed Limited (ASX: IPD) is a medical software technology company that uses innovative bioimpedance spectroscopy (BIS) to non-invasively measure, monitor as well as manage fluid status and tissue composition.

The Company manufactures a family of medical devices that are approved by the US Food and Drug Administration and CE Mark certified, including SOZO® for various indications.

ImpediMed embraces NCCN’s updated breast cancer guidelines to offer early lymphoedema screening

ImpediMed recently welcomed the updated new recommendations from the National Comprehensive Care Network Clinical Practice Guidelines for Breast Cancer (NCCN Guidelines®) for early detection and diagnosis of lymphoedema, aiming to attain optimal management.

This update comes after an appeal made by Vanderbilt University School of Nursing, Lymphedema Education and Research Network (LE&RN), and the American Society of Breast Surgeons Foundation to the NCCN.

LE&RN and the foundation had asked to add language recommending establishing an early surveillance program with the Company’s BIS test, enabling detection of subclinical BCRL (breast cancer-related lymphoedema) and initiating a premature intrusion with a target to lessen the requirement for complete decongestive physiotherapy.

In addition, a suggestion for pre-treatment baseline measurements to expedite the earliest identification of subclinical lymphoedema was also requested.

- NCCN® has documented suggestions for diagnostic, treatment, and supportive services provided to cancer patients.

- Providers and payors refer to these NCCN Guidelines® while making decisions about care and coverage of oncology patient services.

- These guidelines are consistent with the Test, Trigger, Treat™ protocol delineated in ImpediMed’s Lymphoedema Prevention Program (LPP), backed by the PREVENT Trial

Moreover, the updated clinical practice guidelines now encourage healthcare providers to consider pre-treatment baseline measurements for patients with lymphoedema risk factors.

Highlights from Quarterly Cash Flow report for the period ended 31 December 2019

- The Company is on track to accomplish the FY2020 low to midrange guidance of $7.0 million - $8.5 million in revenue.

- Q2 FY2020 total revenue up 63% year-on-year amounting to $1.5 million. The revenue was up 7% on a quarter-on-quarter (q-o-q) basis.

- SOZO® SaaS Revenue for Q2 FY2020 increased by 216% year-on-year and 14% q-o-q to $0.8 million.

- As at 31 December 2019, cash on hand stood at around $13.0 million.

On the stock front, IPD closed the day’s trading at $0.105 on 13 February 2020, down 8.696% from the previous close. The market capitalisation of the stock stood at $58.77 million with approximately 511.05 million outstanding shares. The stock has generated a negative return of 20.69% in the past six months.

Antisense Therapeutics Limited (ASX: ANP)

Melbourne-based biopharmaceutical company, Antisense Therapeutics Limited (ASX: ANP) is engaged in the development and commercialisation of antisense pharmaceuticals for large unmet markets. The Company has an advanced stage product pipeline with positive Phase II clinical results delivered from 2 of its compounds, ATL1102 and ATL1103.

Positive results in Duchenne Muscular Dystrophy (DMD) unravel ATL1102’s broader value creation potential

Antisense Therapeutics has conducted Phase II clinical trial of ATL1102 in Duchenne Muscular Dystrophy (DMD). Nine patients completed 24 weeks of dosing in the Phase II clinical trial, with data from all these 9 participants confirming the drug’s excellent safety profile and positive immunomodulatory activity on CD49d T cells in the blood with clinical benefits on muscle strength and function, thereby, unlocking the broader value creation potential of the drug.

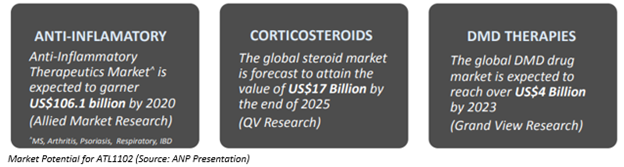

Following these positive results, in parallel with its plans to proceed ATL1102 into a potentially pivotal Phase IIb clinical trial, Antisense Therapeutics is now keen to explore clinical development opportunities in several clinical indications with inflammation playing an important role in progression of disease.

Previously, in a Phase IIa clinical trial in patients with Relapsing Remitting -MS, ATL1102 was found highly effective in diminishing MS inflammatory brain lesions.

Further, the Company received clearance for its Investigational New Drug application with the US Food and Drug Administration for ATL1102 to use in a Phase IIb clinical trial in MS patients at the same dose (25mg/week) that has demonstrated activity in the given trial.

In the year 2018, MS drug sales were US$23 billion and are expected to reach US$39 billion by 2026.

December Quarter Highlights

Antisense Therapeutics has recently provided quarterly update for the period ended 31 December 2019, outlining the updates on clinical trials as well as financials.

During the given quarter, the Company received $5.5 million by means of exercise of ANPOB listed options and underwriting of outstanding options as at expiry date of 19 December 2019.

Of the total amount, $3.75 million was received during the quarter ended 31 December 2019 and $1.75 million was received in January 2020 subsequent to the settlement of underwriting shortfall to appear in the quarterly report for the period ending March 2020.

Additionally, ANP received research & development tax incentive rebate of $559,000 in December 2019. At the end of the quarter, the Company had cash of $5.12 million.

On the stock front, ANP settled at $0.064, climbing up 6.667%, on 13 February 2020. The market capitalisation of the stock stood at $29.33 million with approximately 488.79 million outstanding shares. The stock has generated a return of 3.45% in the past six months.