On 22 October 2019, a major catastrophe occurred at the Fletcher Building Limited construction site of the New Zealand International Convention Centre (NZICC), though all the Fletcher Construction Company staff and subcontractors on the site were evacuated safely.

Details of the Fire at New Zealand International Convention Centre

SkyCity Entertainment Group Limited (ASX: SKC) confirmed that just after 1:00PM on 22 October 2019, a fire broke out at the NZICC in Auckland. The emergency team responded quickly and worked continuously to contain the fire to a satisfactory level. The NZICC was evacuated immediately and for precautionary reasons, the wider SkyCity Auckland precinct was also evacuated and will remain closed until the further notice. All the guests were accommodated in other hotels around Auckland.

After understanding the magnitude of the damage to the NZICC and Horizon Hotel, the company, in conversation with Fletcher Construction Company Limited, will determine the effect of the project delivery timeline. At this stage more delays were expected in the conclusion dates for the Horizon Hotel and NZICC projects.

The company confirmed that the third-party liability insurance and the contract works are in place for Horizon Hotel Projects and NZICC.

Updates on Fire at New Zealand International Convention Centre

SkyCity further confirmed on 24 October 2019 that the fire at NZICC in Auckland was under control and emergency services teams remained on suite until it extinguished fully, post which, it was to be handed back to the main contractor for the Horizon Hotel and NZICC (Fletcher Construction Company Limited).

- SkyCity stated that it will reopen a few parts of the SkyCity Auckland precinct and will continue regular business operations in a phased approach;

- Once the scope of the damage to the NZICC and Horizon Hotel is known, SkyCity will, in discussion with Fletcher Construction Company Limited, be able to determine the impact on the project delivery timeline;

- Both SkyCity and Fletcher Construction Company Limited remain dedicated to finishing the NZICC to the standard decided with the New Zealand Government.

NZICC Site Handed Back to Fletcher Construction

On 6 November 2019, Fletcher Buildings Limited provided further updates on the NZICC project catastrophe:

- In the past two weeks, Fletcher Construction staff worked closely with fire and emergency services teams, local authorities, and SkyCity to manage the impact of the fire;

- The NZICC site was finally handed back to Fletcher Construction, though access remained restricted as safety and structural assessments and investigations into the cause of the fire are completed;

- Fletcher Building is working closely with the insurer for the Contract Works and Third-Party Liability insurances which are in place on the project;

- Fletcher Building notes and agrees with the comments by the company confirming the credibility of the insurer and their ability to meet their obligations.

The Fire Is Expected to Impact 2021 Conferences

As per the company, the delay in its NZICC project due to the massive fire can affect its ability to host conferences in 2021. The company has time until January 2023 to complete the project and currently, Fletcher Building is building the convention centre.

Let us now have a look at SkyCity Entertainment Group Limited and its updates

About the Company

SkyCity Entertainment Group Limited is New Zealandâs largest leisure, tourism and entertainment company with an iconic status. The company manages integrated entertainment complexes in Adelaide, Australia and in New Zealand (Hamilton, Queenstown and Auckland).

Apart from offering casino gaming facilities, it also offers bars, conference facilities and premium restaurants which are an eye candy for both international and domestic visitors.

FY19 Results Highlights

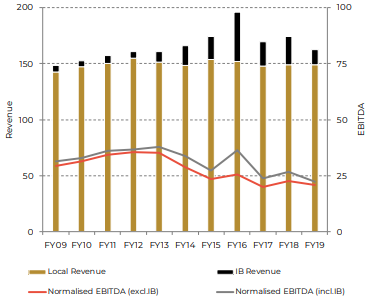

The company reported a revenue of $822.3 million, up by 0.8% from previous year. However, EBITDA decreased by 3.9% YoY to $297.8 million. The company reported normalised NPAT up by 7.5% on like-for-like basis.

- Reported earnings were down vs prior period due to one-off items and low International Business win rate;

- The company recorded strong electronic gaming machine performance in Auckland and Softer performance in domestic tables;

- After the restructure, the company improved its performance in Adelaide on like-for-like basis;

- The company has declared a final dividend of 20 cents per share, which accounts for 5% of the cash yield and is consistent with the existing policy.

Outlook for FY20

The comparability of FY20 earnings with the earnings of FY19 has been impacted by structural changes like asset sales and closure of Auckland Convention Centre.

- The company has reduced FY19 normalised EBITDA to $303 million and NPAT to $151 million;

- It expects to achieve some growth in FY20 Group normalised EBITDA vs pcp on like-for-like basis;

- FY20 Group normalised NPAT likely to be flat vs prior period on like-for-like basis;

- The operating environment will continue to be challenging with cost pressures.

Companyâs Focus for FY20

The companyâs primary focus will be to improve operating performance, thus delivering on earnings guidance. It is planning to deliver major products like Horizon Hotel, Adelaide and NZICC, including preparing for new business operations. The company will continue to develop and deliver sustainability and wellbeing initiatives.

Key Thesis Behind Adelaide Expansion

The company is planning to transform Adelaide casino into a world-class casino and entertainment complex, which will create significant opportunity to grow market share and turnaround an underperforming casino.

- Key value driver of the project is the significant expected increase in gaming activity (combination of local, interstate and IB);

- New hotel, F&B, car park and broader precinct to be significant demand drivers and complement core activities;

- Riverbank precinct to be the centre of entertainment for Adelaide;

- This project is expected to deliver significant incremental earnings and required returns.

Adelaide Casinoâs Normalised Revenue and EBITDA (Source: Company Reports)

Companyâs New Opportunities in the International Business Segment

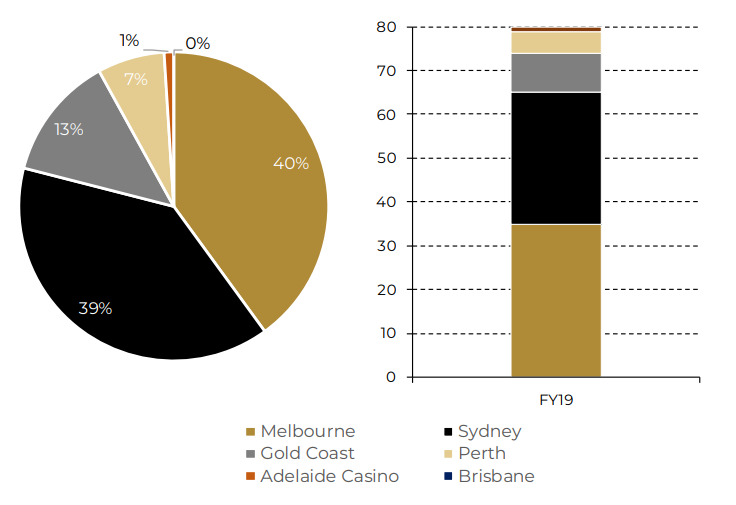

International business has remained historically challenging for Adelaide due to lack of accommodation and limited gaming facilities. The Company thrives for the below:

- New IB facilities to be best in Group and comparable to peers;

- Adelaide is an attractive location for VIPs â improving connectivity, unique experiences and safe/clean/green;

- Opportunity to cross-sell Adelaide to existing IB customers and originate new customers via Asian sales team;

- Proximity to significant casino resorts in Australia, particularly Sydney and Melbourne.

Total Australian IB Market (Source: Company Reports)

Stock Performance

SKC closed the dayâs trading at $3.61 per share on 8 November 2019, up by 1.6% from its previous closing price. The company has a market cap of $2.3 billion and the total outstanding shares were 670.19 million. The stockâs 52-week low and high is $3.210 and $3.900, respectively, and it has delivered total negative returns of 5.08% and 1.66% in 3 and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.