Crude oil is witnessing a bumpy ride across the international market with prices of Brent crude oil futures first plunging USD 71.75 (intraday high on 8 January 2020) a barrel to the present low of USD 53.69 (intraday low on 4 February 2020), which marked a price fall of ~33.63 per cent.

Post an intense fall, oil prices are now showing slight recovery with prices recovering till USD 56.45 (intraday high on 5 February 2020), and are currently trading at USD 56.18 a barrel (as on 6 February 2020 2:54 PM AEDT).

Oil Supply Glut and The Fearmongering around Coronavirus

The spread of the coronavirus in China, which has claimed 492 lives across 25 countries, has impacted the demand for oil deeply. China is among the topmost oil consumer, and there have been 24,363 confirmed cases of the coronavirus in China, which has hampered the demand for oil, especially when the global market is already shifting towards renewable energy sources and when there is plenty of oil supply.

The black gold, which was once entirely controlled by the OPEC members, is now seeing a supply glut, especially after the production from non-OPEC nations coming in along with the OPEC supply. OPEC is putting in efforts to support the oil prices through production cut; however, finding it difficult to curb it further and tag along with OPEC+ members such as Russia, which is worried of losing its market share.

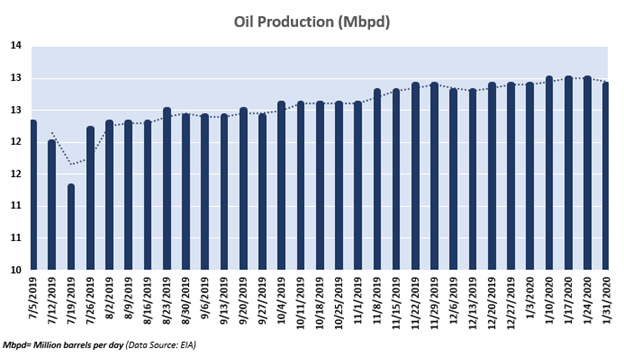

The United States is one of the major contributors in the non-OPEC supply, with its domestic oil production rising to record highs of 13 million barrels per day.

To Know More, Do Read: U.S. Contours All-Time High Oil Production; Libya Supply Constraints Subdued

While the supply of oil across the global front is far exceeding the global demand, the demand dynamics are shifting further over the worries concerning the spread of the coronavirus. The oil Kingpin-Saudi Arabia had urged caution and is assessing the impact on the demand due to coronavirus and had indicated a further production cut if required to support the oil market.

However, nothing seems to have played-out for oil supplying nations, and the market has briefly discounted the market value of crude, which fell by ~19.57 per cent in January 2020, right after the outbreak of the coronavirus on 31 December 2019.

To Know More, Do Read: Market Pessimism Grows Stronger Over Coronavirus; Risky Assets Under Pressure, Gold Near Record Peak

Oil Production Capacity Not Stalling Across the United States

The United States President- Donald Trump had time and again reminded the market concerning overvalued oil prices, which had impacted many businesses across the United States and other geographical regions, in terms of high business cost. However, the OPEC countries did not bother amid dominance over the oil supply chain.

In the wake, the oil exploration and production activities across the United States, which holds a significant amount of oil reserves, propelled the nation to stand as the largest oil supplier and producer outside OPEC boundaries.

The domestic oil production capacity across the United States is currently hovering around 13 million barrels per day; however, there has been a little see-saw in production capacity, but it is expected by many independent forecasters such as the Energy Information Administration (or EIA), that the production capacity would rise further across the United States.

Also Read: EIA Modelled Reference Case Forecast; Non-OECD Nations To Witness Higher Energy Consumption

- Oil Production Across the U.S.

The domestic oil production across the United States is on a surge with average production now reaching to 13.0 million barrels a day; however, a see-saw could be seen in production with domestic production declining to 12.9 million barrels per day for the week ended 31 January 2020.

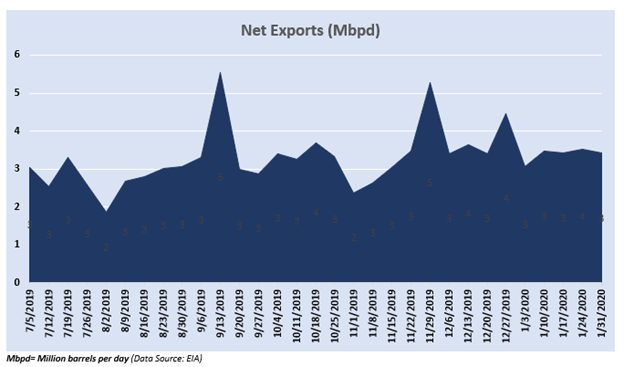

- The U.S. Oil Marking Its Way To Global Supply Chain

The higher production from the United States is marking on its way to the global oil market with exports averaging around 3.2 million barrels a day from May 2019 to January 2020. However, at present, the average exports from the United States are lower against its peak but are expected to surge ahead with a further increase in oil production capacity.

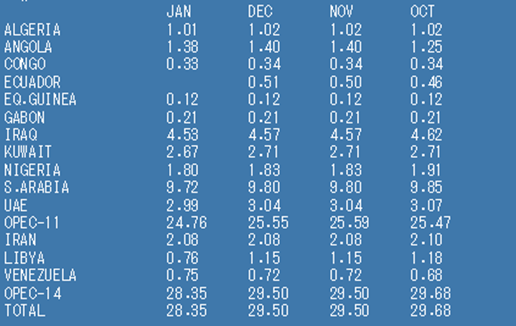

OPEC Maintaining the Production Cut

While the production from the United States is surging and the oil from the nation is flowing to the international supply chain, OPEC is sticking to its action of gradually decreasing the production, with average production from OPEC-14 standing 28.35 million barrels per day, down by ~ 4.50 per cent as against the average supply of 29.68 million barrels a day in October 2019.

OPEC-14 Oil Survey (Source: Thomson Reuters)

There has been a subtle decline across the OPEC production; however, the recent tensions in Libya have reduced the Libyan oil supply substantially, which should have created a slight cushion for oil prices, but as usual, the United States came to the picture and demonstrated high production, which kept the pressure on the oil.

Market Not Concerned Over Supply

Crude oil prices are predicted by the EIA to be driven by demand and related factors, as supply is of least concern for oil market participants amid towering production capacity across non-OPEC nations.

To reckon the mood of market related to supply worries, investors can track the movement of COBE oil volatility index with prices. Typically both the aspects move in the opposite direction; however, whenever, there is a supply concern, both the volatility index and prices move in the same direction.

The relation could be confirmed from the chart below, where both CBOE and prices moved opposite until the Aramco Incident-when drones attacked the oil facilities of Aramco in Saudi Arabia. The event created the supply panic; thus, both the price and CBOE converged to move in the same direction. However, since then, the negative correlation between the two could be evident from the chart below.

CBOE (.OVX) and Crude Oil (LCOc1) Daily Chart (Source: Thomson Reuters)

Recent News Impact on Oil Prices

There have been rumours around an unconfirmed report, which suggests possible medical assistance to combat and contain the coronavirus threat; however, there has been no official statement out from the World Health Organization (or WHO) over the possible medical treatment. Albeit, the WHO and local government of China have taken certain measure to control the risk of spreading.

The slight positive news coupled with lower prices might have instigated some speculative buy, but fundamentals do not thoroughly support the gain in oil prices, and it would be interesting to look ahead, if this slight ray of hope in oil could ignite a fire in terms of both prices and demand, respectively.