Summary

- COVID-19 pandemic has created havoc across the world, causing a global health crisis and forcing economies to slow down.

- Throughout the unprecedented time, investors are facing cash-flow crunch putting pressure on the property prices.

- This pandemic has created a bust in the property market in Australia, and an increase in unemployment could be one of the topmost threats to housing price growth.

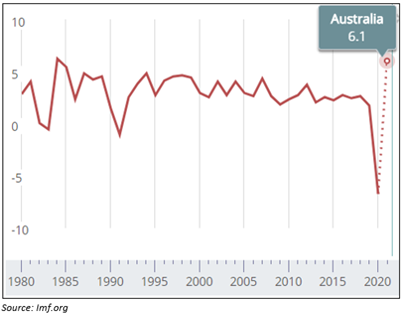

- Despite the current economic crisis amid COVID-19, the IMF is predicting Australian economy to grow by 6.1% in 2021.

Empty streets, empty offices, empty malls, but full homes have become a way of life over the last few months since the fight with COVID-19 started. COVID-19 pandemic hit nation’s economy is fast-tracking certain ongoing trends in diverse property markets across Australia.

At present, there is an immense uncertainty, comprehending what is going on in the property market is imperative. Also, housing sector is the largest source of capital for majority of houses in Australia.

Amid uncertainty, investors are facing a possible cash-flow crunch looming ahead to burden real estate prices. Currently, the construction, as well as property markets, are under enormous tension.

COVID-19 has Set up Residential Property Market Bust

After surging up for the last five years, the Australian property market is now falling down, amid the pandemic. The market has been stung by the lockdown and social restrictions induced by COVID-19 that have stopped buyers from inspecting properties or to participate in the auctions.

Moreover, high unemployment rates, credit shrinking and rise in the lending risk are all together standing as barricades to the path of recovery. The market might also be harmed because of the ongoing travel restrictions, as well as possible restrictions on immigration.

While talking about the construction of new properties, in the short term, it will confront delays in accomplishing projects as supply chains might take time to recoup. The situation could worsen if the ongoing trade war between the United States and China persists.

It is worth mentioning that Australia will give eligible residents AUD 25,000 grants to build or significantly renovate their homes as Canberra moves to revive a construction sector that is badly affected by the COVID-19 pandemic.

DID YOU READ: Bubble versus an Affordable Dream Property: The Real ‘Real Estate’ Bargains in Australia

An approaching housing market bust, prompted by the COVID-19 pandemic and the resulting spike in unemployment, will not reinstate greater equality. On the reverse side, recent history demonstrates that housing busts can exacerbate income inequality.

Some experts also believe that upsurge in unemployment as the main threat to house price growth, and this risk became a reality with the COVID-19 turmoil.

Outlook for Australia’s Economy and Property Market

As it is known to all that the world economy is moving towards recession, but how long it will take to recover and how bad it will be is the main question.

According to the International Monetary Fund (IMF), worldwide economy is anticipated to plunge by 3% in 2020, which compares to a drop of 0.1% in 2009 at the peak of the global financial crisis.

IMF projects that economic growth in Australia to fall by 6.7% this year as the world deals with the economic consequence from the COVID-19. However, the IMF is predicting Australia to grow by 6.1% in 2021, sooner than the economies of the US, Japan, the United Kingdom, Canada, France and Germany.

However, varied property asset groups will face different recovery paths. The retail and office markets will likely see recovery with a long flat bottom. It can be stated that once household wages and employments begin recovering, the property market will also start growing. Moreover, the eventual lifting of travel restrictions will further boost the market out of this ongoing gloom.

According to Dr James Brugler and Dr Jonathan Dark, University of Melbourne, it is being predicted that residential property costs across all capital cities would tumble by nearly 4.4% over the June-2020 quarter and in the September-2020 quarter it would show another drop of 2.3%.

DO READ: How REITs Are Reacting to COVID-19 Uncertainty: Lens on VCX, ARF, GPT

GPT Group Disclosed Decline in Book Value

Recently, one of Australia’s real estate investment trust GPT Group (ASX:GPT) stated that it independently revalued its retail portfolio, as noted on 31 May 2020. Moreover, all assets in the GPT Wholesale Office Fund and the GPT Wholesale Shopping Centre Fund have been independently revalued, as on 31 May 2020.

GPT Wholesale Office Fund (GWOF) reported a negative revaluation of nearly AUD 34 million, that represents a 0.4% drop in book value against the book value of 31 March 2020. GPT Wholesale Shopping Centre Fund (GWSCF) recorded a 3.5% decline in book value against the 31 March 2020 book value with a negative revaluation of nearly AUD 137.6 million.

On 11 June 2020, GPT quoted AUD 4.280, declining by 4.251% from its last close, with a market cap of AUD 8.71 billion.

Overall, the COVID-19 turmoil will have economic effects across the housing and property market, but with good fortune, as restrictions have eased now, certainly there is light at the end of the tunnel to be reflected soon through improvements.

In forthcoming months, strategies for strengthening the property markets, such as dwindling interest rates, mortgage assistance, as well as support for first home purchasers. All these factors together could play an essential part in alleviating the adverse impacts on the wealth of Australian landowners.

HAVE YOU READ: Property market’s struggle expected to persist while Australians focus on stocking food