Australia has managed to flatten the coronavirus curve more effectively and early than some other developed nations. The country is already looking forward to reopening its economy in parts. On 1 May, the country reported just 16 new cases, which is a sharp decline from the peak of 480 cases recorded on 28 March. As the country recovers from the virus, 3 things it has been pushing ahead are-

Easing of restrictions

PM Scott Morrison has declared easing of lockdown restrictions next week offering Australian an “early mark”. He also cautioned that the return to normality would be contingent on the acceptance of CovidSafe contact tracing app. The critical part of relaxing restrictions will depend on how many Australians download the COVID-19 tracing application citing traces of coronavirus are still in the economy.

Some restrictions were relaxed this week for New South Wales and Australian capital territory, Canberra allowing visits to friends and family. However, Morrison asserted that Australians need to be careful as the country does not want to go into a reverse process of coronavirus in future.

Health Minister, Greg Hunt suggested a target of 40% implying the need for 10 million people to download the application. However, the health department stated that even 20% would give a good result.

Easing of restrictions will be decided by leaders next week on 8 May after cabinet meetings on how restrictions can be eased, and decisions will be brought forward from the week beginning 11 May.

Property Market on spiral

The property market of Australia has been hit hard with plummeting sales volumes and rentals due to coronavirus lockdown. Sales have been dropping, and tenants are breaking leases as they are not in a position to pay rent.

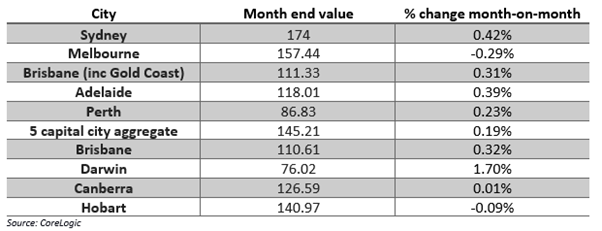

According to CoreLogic’s monthly house price index, Melbourne and Hobart have registered a price drop of 0.3% and 0.09% respectively in April, while Sydney house values have risen but lost vapour by rising just 0.4%. Further, the combined capital city index increased by 0.2 percent for the month of April, this year.

Moreover, national house prices were down from 0.7 percent recorded in March to 0.3 percent noted in April, almost half, which is also the smallest movement (month-on-month) since the month of June. The number of home listings was noted at 35% percent lesser at the close of April comparative to the same time a year before.

ALSO READ: Property market’s struggle expected to persist while Australians focus on stocking food

Tim Lawless, CoreLogic head of Research, predicts that house prices to fall about 10% from peak to trough with the rental suffering more significant decline of 15% or more.

However, despite a drop in the market activity and consumer confidence, home prices rose across most capital cities, driving prices up at 0.3% in April.

Tim Lawless has stated that the housing market is still quite resilient considering weak economic and market conditions due to coronavirus pandemic. Nonetheless, there will be downward pressures on the housing values in the coming months contingent majorly on the length and duration of social distancing policies being lifted.

He expects economic conditions to improve once the virus is contained within 3-6 months which could drive the housing market activity. However, if the virus takes longer, there can be downward pressure on house prices.

Income Tax reform on the agenda

Big businesses are pushing for company tax cuts due to record low revenue and sales growth with some even shutting down due to coronavirus pandemic as federal government is in the process to make a comprehensive economic reform agenda post coronavirus crisis.

The Morrison government, along with his finance team, have declared that a fresh perspective is needed to survive the inbound coronavirus storm.

However, Labor’s Kristina Keneally has cautioned the government against bringing up ideological, economic reforms amid COVID-19 economic disruptions. She stated that there was no legit proof that a softer tax rate on big businesses would result in the growth of the economy. Although it is reasonable to see that tax cuts will see the benefits abroad of share buybacks, increased dividends and salaries. But there are other better ways to support growth like investment allowance and urged the government to consider it.

ALSO READ: Storm Clouds on the Australian Economy

The PM Scott Morrison may also have to reveal that working families might have to face bigger tax burdens than the Gillard government if he considers personal income tax cuts to charge the economy. He has promised to declare some “pro-growth” policies to grow the economy in order to reduce the enormous government debt that had to be incurred due to relieve the economic fallouts of coronavirus pandemic on the economy.

A recent survey by an Australian institute has shown that Australians believe that the company tax rate must stay the same. The poll questioned about 1000 people across Australia and found that a company’s tax rate must remain at the current level of 30%. The Director of the institute also asserted that lowering the tax rate will not result in a broad economic benefit as businesses prefer to put their savings in dividends rather than using it to increase its workforce.

Hence, ideological policies are not expected to work in an economy where workers are going jobless, and the country is witnessing worst economic contraction.

As Australia looks to reopen its economy, the situation remains uncertain, and a lot will depend on whether the country witnesses the second wave of infections, which can cause further shutdowns and hence, weakening of the economy.