Introduction:

One of the primary constituents of the stock market is the investorâs expectation from a stock. If the company does not fulfil investorsâ expectations, the stock price is bound to fall and vice versa. On the other hand, a stock price also tends to decline despite impressive results because of profit booking action from the investors.

During bear market phase, the general portfolio of an investor tends to provide negative return and thus, investors want for profit booking and consequently, the fall in price of the stock happens despite good financial results.

We will be discussing four stocks in this article, which have been trading near the 52-week high, wherein based on the market sentiments there might be a healthy correction.

Credit Corp Group Limited (ASX: CCP)

Credit Corp Group Limited is a debt collection company also, engaged in the consumer lending business across Australia and New Zealand. Recently, CCP informed the market that Robert Fitz-Gerald Shaw ceased to be the director of the company with effect from 04 November 2019.

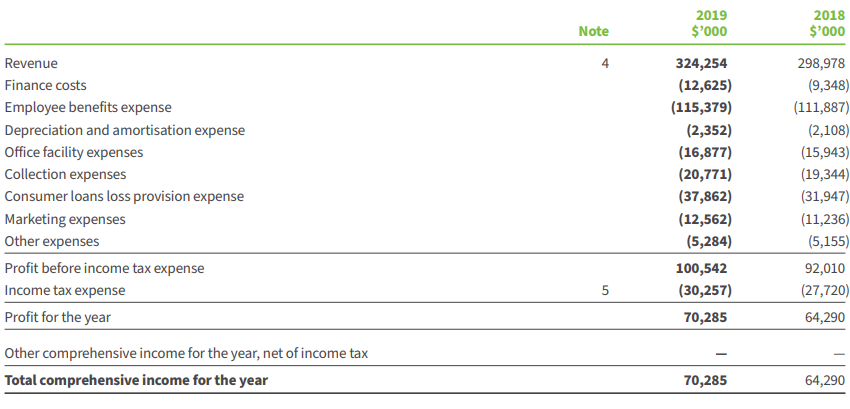

Key Highlights for FY19 results: CCP announced its FY19 financial results wherein the company for the period ending 30 June 2019, reported total revenue of $324.25 million as compared to $298.97 million in FY18. NPAT during FY19 stood at $70.28 million as compared to $64.29 million in the previous financial year. During the year, consumer loan book, gross of provisions, grew by 16% on y-o-y basis to $212 million, aided by 18% higher new customer settlements, followed by above expectation maturity of the book.

FY19 Income Statement Highlights (Source: Companyâs Report)

FY19 Income Statement Highlights (Source: Companyâs Report)

Outlook: As per the revised FY20 guidance (announced in August 2019), the management expects PDL acquisitions to remain within $300 million to $320 million, while net lending is expected around $60 million to $65 million. NPAT of the company is expected between $81 million to $83 million followed by basic EPS at around 149 cents to 151 cents.

Dividend Update: The Board of directors paid a fully franked dividend of AUD 0.36000 to each shareholder of the company on 30 August 2019.

Stock Update: The stock of CCP last quoted at $31.5, down 0.063%, as on 06 November 2019. The stock has a market capitalisation of $1.73 billion and is available at a price to earnings (P/E) multiples of 22.21x on trailing twelve months (TTM) basis. The stock has given stellar returns of 27.46% and 32.66% during the last three-months and six-months, respectively. The stock last traded close to its 52-weeks high of $33.110. The annualised dividend yield of the stock was recorded at ~2.28%.

Ale Property Group (ASX: LEP)

Ale Property Group is a property management company which specialises in owning, leasing and renting of properties. Recently, LEP announced UBS Group AG and its related bodies corporate as an initial substantial holder with 5.51% voting rights.

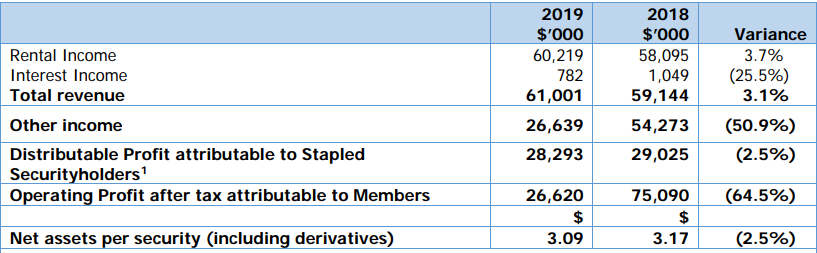

FY19 reportâs Highlights: LEP announced its FY19 full year results for the period ending 30 June 2019, wherein the company reported total revenue of $61 million, up 3.1% on y-o-y basis. Operating profit after tax came in at $26.62 million as compared to $75.09 million in previous financial year as the business observed lower fair value increments to properties and higher fair value decrements to derivatives. Rent received from properties during FY19 increased by 3.7% on y-o-y basis aided by 10% higher rent received on 36 properties from November 2018. LEP reported that another 43 properties remain subject to determination and it is expected that the determinations will be completed by November 2019. The business reported lower Interest income due to lower funds on deposit and lower deposit rates. During FY19, the costs related to management increased due to costs associated with the rent determinations on 43 properties.

FY19 Financial Highlights (Source: Companyâs Report)

FY19 Financial Highlights (Source: Companyâs Report)

Stock Update: The stock of LEP last quoted at $5.410, declining by 0.734% as on 06 November 2019. The stock has a market capitalisation of $1.07 billion and is available at a price to earnings (P/E) multiples of 40.070x on TTM basis. The stock has given decent returns of 4.81% and 15.47% in the last three-months and six-months, respectively. The current stock price quoted is near to its 52-weeks high of $5.480.

CSR limited (ASX: CSR)

CSR Limited is engaged in the manufacture and supply of building products in Australia and New Zealand. Recently, CSR informed the sale of the second tranche of surplus land at Horsley Park, NSW for a price consideration of approximately $140 million.

H1FY20 resultsâ Highlights: CSR limited announced its half-yearly financial reports for FY20 for the period ending 30 September 2019, wherein the company reported 4% y-o-y lower revenue at $1,150.1 million, on account of slowdown in residential construction. The company posted statutory NPAT of $68.8 million, declined by 19% on y-o-y basis during the first half of FY20.

EBIT of CSR came in at $113 million, with decrease of 16% on pcp terms, primarily due to weak results from building products and timing of property transactions. CSR reported net cash balance of $142 million during the first half of FY19. Currently, the ongoing projects of the company are Schofields, NSW, Warner, QLD, Brendale, QLD and Chirnside Park, VIC.

CSR declared a 50% franked dividend of AUD 0.14 payable on 10 December 2019. The annualised dividend yield ratio of the stock was recorded at 4.95%.

CSR earlier announced a share buyback program worth $100 million, wherein the company has purchased $47 million till date.

Outlook: As per the management guidance, the company has forecasted to deliver a net profit after tax of $107 million to $133 million for FY20. For the second half of FY20, CSR expects lower volumes across its building products segment. The company further expects demand for CSRâs building products will continue to be supported by housing activity driven by population growth, high employment and low interest rates on a medium to longer term perspective. Within the property segment, the proceeds of the sale of 20 hectares of land at Horsley Park are expected to be recorded in FY21 and FY23.

Stock Update: The stock of CSR last traded at $4.66, up by 0.215% as on 06 November 2019. The stock was quoted near the upper band of its 52-week trading range of $2.620 to $4.79. The stock has a dividend yield of 4.95% on an annualised basis. Currently, the stock is available at a P/E multiple of 19.380x.

Village Roadshow Limited (ASX: VRL)

Village Roadshow Limited is an entertainment entity, which has businesses in theme parks, cinema exhibition, distribution of film etc.

FY19 resultsâ Highlights: VRL announced its FY19 financial results for the period ending 30 June 2019, wherein the company reported EBITDA at $124.9 million as compared to $90.9 million in previous financial year. The company reported NPAT at $20.6 million as compared to a loss of $7.3 million in FY18. During the year, the revenue drivers of theme parks were dinner & show, special events, accommodation, film studio hire etc. The theme park business witnessed 25% higher ticket yields during FY19, aided by migration to annual and multi-day passes followed by higher sales through VRTP channels.

Outlook: The company is looking forward to increasing its customer base through a focus on relationships with blue-chip clients and exploring to new opportunities across US and South Africa. VRL also expects an improvement in FY20, with a stronger pipeline of confirmed promotions for FY20 in UK, US and Europe.

Stock Update: The stock of VRL last traded at $3.05, down 1.613% as on 06 November 2019. The stock last quoted near the upper band of its 52-week trading range of $2.130 to $3.900. The stock has a dividend yield of 1.61% on an annualised basis. Currently, the stock has a market capitalisation of $604.98 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.