An Overview of Lithium Stocks and Lithium Market

Lithium stocks on ASX have witnessed a dramatic rise and fall in the lithium prices, making lithium companies sit on the lower side of their respective 52 weeks low. As of 19 February 2020, a number ASX lithium stocks traded lower than their 52 weeks high by a significant margin. For example, Pilbara Minerals Limited (ASX:PLS) closed at A$0.33, lower by ~64%, Galaxy Resources Limited (ASX:GXY) settled at A$1.05, a drop of ~54%, Core Lithium Limited (ASX:CXO) traded at A$0.038, lower by ~36%, to mention a few.

However, there were a few ASX-listed lithium stocks that showed trading values at their 52 weeks high. For example, Orocobre Limited (ASX:ORE) traded at A$3.29, lower by only ~19% and Mineral Resources Limited (ASX:MIN) closed at A$19.32, lower by a mere 1%. The ASX-listed lithium companies producing other commodities other than lithium, such as gold or iron ore, depicted stronger performance than its peer with majorly lithium output.

Why Has there been a Dramatic Fall in Lithium Prices?

It all started with the anticipated boom in electric vehicles (EV), moving car manufacturers to secure supply. This led to an increase in lithium carbonate spot prices to a maximum of ~US$ 22890/tonne (monthly average) in February 2018. The surge in prices aided the commissioning of further projects with a ramp-up of producing mines in Australia and Brazil outpacing the Chinese conversion capacity. This resulted in the tumbling the price to ~US$9560/tonne monthly average in June 2019 and consequently, a plunge in lithium companies shares.

The lithium carbonate (min 99.5%) battery grade prices further stumbled to US$9250/tonne as of 12 December 2019 due to the increasing supply and lacklustre demand. The falling price resulted in a curtailment in production by the producers to reap the benefits in future at a higher price. Come 2020, the battery-grade remains at a lower value and consistently hovering around ~ US$6968/tonne (converting CNY 49000/tonne assuming an average exchange rate of 0.14220) between January to 19 February 2020.

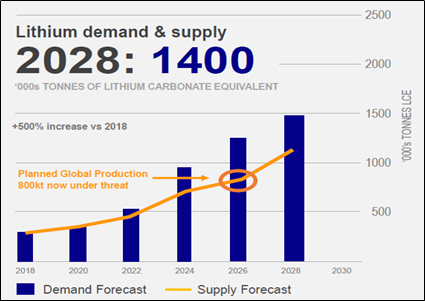

The lithium market is anticipated to help ASX-listed lithium companies through 2023 to 2025 when lithium oversupply market is likely to change to an undersupply market due to the EVs expansion and thus the battery manufacturers expansion as shown below:

Must Read: Weekly recap on Copper and Nickel vis-à-vis Australian Market

Source: Lake Resources Presentation

The expected surge in lithium price may create positivity among the investors to invest in lithium shares. In the milieu of which it is quintessential to analyze how the lithium companies or lithium stocks are performing in Australia vis-à-vis its product.

Comparative Analysis of ASX Lithium Companies

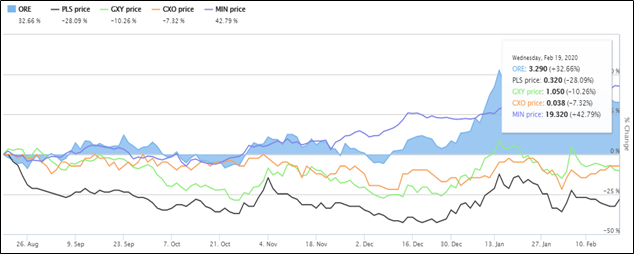

For the purpose of conducting an analysis, let us take the above-debated stocks. The six months return of lithium stocks on the ASX was negative except for the diversified portfolio of the company. The return from lithium companies such as PLS (-28.09%), GXY (-10.26%) and CXO (-7.32%) have been negative while ORE (+32.66%) and MIN (+42.79%) generated positive returns.

Source: Australian Stock Exchange

Though the share prices have dipped for some of the lithium companies, the scenario for the future post-2025 is expected to respond better considering the economic rationale of supply and demand dynamics.

- Pilbara Minerals is a lithium-tantalum producer through its Pilgangoora project. The project has 23 years of mine life and a milling capacity of 5mtpa. Also, it is worth mentioning that PLS has reliable offtake partners, namely, CATL, General Lithium, Ganfeng Lithium, Great Wall Motors and POSCO. No dividend has been paid, nor the directors recommended it in FY19. The company’s 52 weeks high and 52 weeks low stand at A$0.885 and A$0.250, respectively, and the stock has negative EPS of A$0.016.

- Galaxy Resources is a lithium mining company having a production facility, brine assets and hard rock mines. GXY was debt-free as of 31 December 2019 and had financial assets of worth US$143.2 million in hand. FY19 report is yet to be published, and the company had no dividend recorded in the prior year. Its 52 weeks high and 52 weeks low stand at A$2.3 and A$0.825, respectively, and the stock has a negative EPS of A$0.139.

- Core Lithium is targeting the advancement of its highly crucial prospective asset Finniss Lithium Project. The cash and cash equivalent at the end of December 2019 quarter was A$4 million. Also, there is no dividend paid in FY19. Its 52 weeks high and 52 weeks low stand at A$0.059 and A$0.031, respectively, and the stock has a negative EPS of A$0.004.

Interesting Read: Core Lithium completed strategic acquisition of new NT Lithium Project

- Orocobre Limited is a brine-based global lithium carbonate supplier with high quality, low-cost and long-life resources. ORE is set to build Naraha Lithium Hydroxide plant in Japan, which is likely to benefit from lithium price fluctuations between China and South Korea. No dividend has been paid since the start of FY19. Its 52 weeks high and 52 weeks low stand at A$4.04 and A$2.18, respectively. The company has a P/E ratio of 11.04x with an EPS of A$0.298.

- Mineral Resources is a mining services company having a mining portfolio across multiple commodities in Western Australia and the Northern Territory. The company has a collaboration with Jiangxi Ganfeng Lithium Co., Ltd - one of the world's largest lithium producers owning 50% of the Mt Marion asset. The presence of another commodity, iron ore, has boosted the performance of the company in terms of revenues and EBITDA. During 1H20, the company declared an interim dividend of 23 cents per share. Its 52 weeks high and 52 weeks low stand at A$19.68 and A$12.44, respectively. The company has a P/E ratio of 3.51x and an EPS of A$5.5 with 2.8 annual dividend yield.

Interesting Read: ASX Lithium Stocks Blazing High; Stable Subsidy, Cost-Cutting, Tesla Push- Positive Tailwind

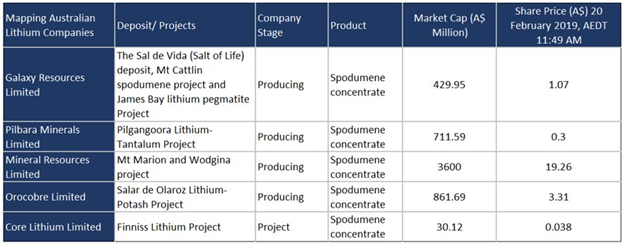

The performance of ASX-listed Lithium Stocks is likely to improve in the future due to the advent of EVs. The following table provides a parametric analysis of lithium companies mentioned in this article.

Source: Company’s website and Annual Report