According to the Communications report by Australian Communications and Media Authority, the change in the Australian communications and media landscape has been at a striking rate.

The Australian media and advertising industries have evolved significantly over the years with the disruptive technologies coming into play. The adoption of technology like IoT has propelled the growth of these industries in Australia by offering innovative experiences to consumers and businesses while generating profitable growth.

Media Companies Partner to Develop Joint Platform

According to recent media news, few media companies operating in Australia have come together to develop a new joint platform, which shall enable media agencies to buy advertising across commercial television in one place. If the source is to be believed, Nine Entertainment Co. Holdings Limited, Seven West Media Limited, Network Ten, Foxtel and SBS Media have put together their common interest to develop the platform.

In addition to this, the ever-increasing appetite for content and services has driven extraordinary progress over the past few years. The growing media industry carries numerous prospects for the companies as well as the investors.

In light of the anticipated potential of the media and advertising industry of Australia, let us look at a few ASX-listed stocks from the industry that are currently in the news.

Seven West Media Limited (ASX: SWM)

As an integrated media company, Seven West Media Limited (ASX: SWM) is currently focusing on increasing its presence felt in the further delivery of its both video and publishing content apart from its digital broadcast channels and throughout a range of platforms.

According to SWMâs reports, Seven is growing its presence in global content production with the establishment of new worldwide production entities while generating additional content than at any time in its history.

The company recently made two major strategic announcements that include:

- Proposal by Southern Cross Austereo to acquire the Seven West Media Group Limitedâs Redwave Media;

- Merging SWM with Prime Media Group Limited (Prime) through a 100% scrip-based Prime scheme of arrangement;

We would discuss Redwave Mediaâs proposed acquisition later in the article. Letâs learn more about the merger of SWM with Prime Media Group Limited now.

~90% Potential Reach to Australiaâs Population for SWM

Under the binding Scheme Implementation Deed between Seven West Media Limited and Prime Media Group Limited, it is proposed that SWM shall acquire all the shares issued by way of a scheme of arrangement of Prime Media.

As a proposed transaction, shareholders of Prime shall be entitled to 0.4582 SWM shares for each Prime share held by them. Subsequent to the accomplishment of the proposed transaction, existing shareholders of SWM shall own 90% of the combined entity, with the residual 10% being owned by Prime shareholders.

Figure 1 SWM Merger with Prime (Source: Company's Report)

The expected benefits of the merger for SWM are as follows:

- Potential reach to over 90% of Australiaâs population each month;

- Single platform to seamlessly access metro and regional markets;

- Enhances audience proposition through content and digital delivery;

- Expected cost synergies of $11 million on an annualised basis â expected to be fully realised within 12-18 months from completion;

- Unlocks revenue potential of regional audiences;

- Expected to be EPS accretive on a pro forma basis following realisation of expected cost synergies;

On 21 October 2019, SWM stock was trading at a price of $0.425, surging up by 10.39% (at AEST 1:13PM), with a daily volume of ~4,518,450 and a market capitalisation of approximately $580.59 million. The stock has a 52 weeks high price of $0.927 and a 52 weeks low price of $0.350 with an average (year) volume of ~3,402,215.

Nine Entertainment Co. Holdings Limited (ASX: NEC)

Being a leading Australian multi-platform media network, Nine Entertainment Co. Holdings Limited (ASX: NEC), is focused on engaging audiences in multiple media segments spanning over news, business and finance, lifestyle, entertainment and sports.

NEC lays emphasis on creating the best content across television and radio, convenient for its consumers to access when and how they want while giving shared experiences to audiences.

NEC Acquires 98.64% of MRN Shares

NEC recently announced the closure of the offer period and compulsory acquisition of shares in Macquarie Media Limited (MRN). The offer was made by NECâs subsidiary, Fairfax Media Limited (Nine Bidder), in respect of all the fully paid ordinary shares in MRN.

Proceeding further towards the closure (at 7.00 PM, Sydney time, on 14 October 2019) of the offer, Nine Bidder gained a relevant interest in 98.64% of MRN shares. With a relevant interest in more than 90 percent of the MRN shares, Nine Bidder shall compulsorily acquire the outstanding stakes in MRN on the same terms of the offer.

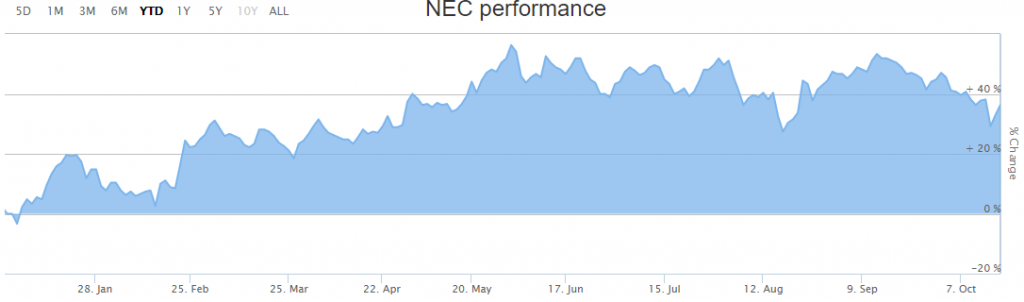

Figure 2 NEC Stock Performance (Source: ASX)

On 21 October 2019, the NEC stock was trading at a price of $ 1.817, with a daily volume of ~915,922 and a market capitalisation of approximately $3.1 billion. The stock has a 52 weeks high price of $ 2.130 and a 52 weeks low price of $1.305 with an average volume of ~6,252,758. On a year to date basis, the companyâs stock has provided 34.44% return.

Southern Cross Austereo (ASX: SXL)

As a subsidiary of Southern Cross Austereo Services Pty. Ltd (SCA), Southern Cross Media Group Limited (ASX: SXL) is among Australiaâs leading media companies. The company owns several assets including radio, television and digital assets, which facilitate the penetration into more than 95% of the Australian population.

Above 8.9% ROI from Redwave Media Acquisition for SXL

Recently, SXL put forward a proposal to acquire Seven West Media Group Limitedâs Redwave Media, subject to regulatory approvals from the Australian Communications and Media Authority (ACMA) and the Australian Competition and Consumer Commission (ACCC) with regards to the proposed acquisition of the Spirit 621 licence in Southwest/Bunbury.

Upon completion of the transaction to acquire Redwave Media (comprising of Red FM and Spirit AM with licences in various Australian regions), $28 million shall be payable in cash signifying an FY19 EBITDA multiple of eight times.

In addition to this, it is expected that the acquisition shall be generating a return on invested capital above Southern Crossâs hurdle rate of 8.9%.

On 21 October 2019, the SXL stock was trading at a price of $0.857, down by 3.164% (at AEST 1:26 PM), with a daily volume of ~1,417,886 and a market capitalisation of approximately $680.58 million. The stock has a 52 weeks high price of $1.430 and a 52 weeks low price of $0.845 with an average (year) volume of ~2,003,210.

oOh!media Limited (ASX: OML)

As a leading operator in Australia and New Zealandâs forward moving, Out of Home advertising industry, oOh!Media Ltd (ASX: OML) strives to endure the implementation of its end to end digital strategy. The digital strategy of OML comprises of the sustained roll-out of its data analytics platform anticipated to deliver long term significant revenue and earnings growth to maximise shareholder value creation.

Recently, the company notified the market on the hiring of Ms P. Kelly as OMLâs Director (Non-Executive).

OMLâs Chairman, Tony Faure, stated that the hiring of Ms P. Kelly established part of the OML Boardâs procedure to hire further NEDs that was pointed out at its AGM held in May this year.

OML Registers Revenue Growth of 5% for 1H19

OMLâs financial results for the half-year ended 30 June 2019 (1H19) reflect revenue growth of 5% to $304.9 million. Other highlights of OMLâs performance during the 1H19 are:

- Commute business delivered a 13% revenue growth (half-on-half);

- Underlying EBITDA down by 4% to $56 million;

- Underlying Net Profit After Tax (NPAT) down by 24% to $9.0 million;

- Underlying NPATA up by 3% to $18.2 million;

- Annualised run rate synergies of $10 million achieved to date;

- Fully franked interim dividend of 3.5 cents per share.

On 21 October 2019, OML stock was trading at a price of $2.695, moving up by 2.471 percent (at AEST 1:34 PM) with a daily volume of ~1,239,565 and a market capitalisation of approximately $637.48 million. The stock has a 52 weeks high price of $5.230 and a 52 weeks low price of $2.290 with an average (year) volume of ~2,187,253.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.