We will be discussing three diversified stocks with different business models. Letâs discuss about the recent stock price movements along with the latest updates from these companies. WOR and RFF have upcoming acquisitions on the basis of which the companies have guided on upcoming capital expenditure.

WorleyParsons Limited (ASX: WOR)

WorleyParsons Limited offers specialized services across construction, engineering and procurement services. It also provides a wide range of advisory and consulting services. On 25 October 2019, WOR concluded its full acquisition of 3sun Group Ltd, for an enterprise value of £20 million.

As reported by the Management, the key objectives of the acquisition were:

- Entry into the growing offshore wind energy Operations and Maintenance (O&M) business.

- The company will look to accelerate its offshore wind energy strategy.

- Leveraging 3sunâs capabilities with Worleyâs global presence, the company is targeting expansion in North America and Asia Pacific.

- As per the Management Guidance, WORâs management capability and data analytics is expected to provide extra benefits to the customers of 3sun.

FY19 Financial Highlights for the year ending 30 June 2019: WOR declared its FY19 full-year financial reports wherein, the company reported aggregated revenue at $6,439.1 million, increase 36% on y-o-y basis while underlying NPATA came in at $259.8 million, witnessing a growth of 43% on y-o-y basis. During FY19, the year was marked by increased backlog across all sector aided by increasing contributions from Americas largely due to ECR acquisition. The operating cash flow of the business came in at $236.3 million. During the financial year, the company reported complete acquisition of ECR and integration activities were on track with expenses, while margin and revenue synergies are being realized on an ongoing basis. During FY19, WOR reported industry leading safety performance followed by a diversification of earnings through increased opex revenue and chemicals revenue. The company successfully completed transition cost synergies along with flowing-in of revenue synergies. The Management highlighted that deliberate strategy over last three years has increased earnings diversity and resilience with growth in opex based contracts. The business witnessed growth across diversifying sectors with stable growth across chemicals.

Outlook: As per the guidance, the company is not looking at lump sum turnkey (LSTK) contracts. Further, the business will focus on oil & gas production, processing, storage, floating storage & regasification & greenfield LNG.

Stock Update: The stock of WOR closed at $13.740, down 0.363% as on 30 October 2019. The stock is available at a price to earnings ratio (P/E) multiples of 37.88x and has a market capitalization of $7.18 billion. The annualized dividend yield of the stock stood at 1.99%. The stock has given has generated negative returns of -14.88% and -4.57% during the last three-months and six-months, respectively.

Rural Funds Group (ASX: RFF)

Rural Funds Group is a REIT and is engaged in operating a diversified portfolio across Australian agricultural assets. The company derives its income by leasing its agricultural assets to experienced operators. The assets are spread across poultry, vineyards, almond orchards, etc.

On 28 October 2019, RFF has entered into agreements with ProTen Investment Management Pty Ltd for the sale of its 17 broiler chicken farms at a price consideration of $72.0 million. The reasons behind the disinvestment are listed as below:

- As per the management commentary, the business has eleven poultry farms with old infrastructure while the grower agreement and leases are likely to expire in FY24. Thus, upgradation of these contracts would require investment in construction infrastructure.

- Investment opportunities are more compelling in assets concentrated on natural resources.

- The management clarified that businesses with greater economies of scale with ongoing investment would suit the poultry sector and the company has informed that it was best to bring forward an investment decision regarding the redevelopment or sale of the poultry assets.

- The business started the development application process for redevelopment of the older farms during 2019.

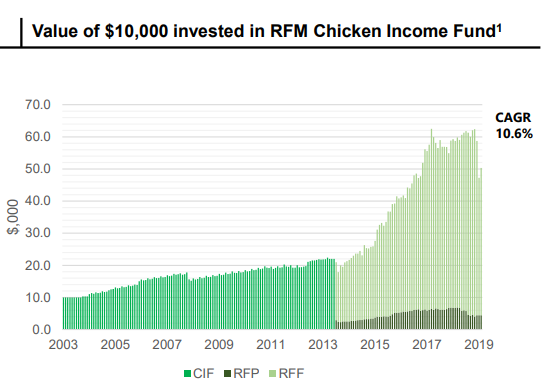

RFF was managing its poultry assets since 2003 while the unitholders have received a compound annual total return CAGR of 10.6% during the timeframe.

Snapshot of Poultry investor returns (Source: Companyâs Reports)

Acquisitions:

RFF has reported three-acquisitions namely Petro, High Hill and Willara located in Western Australia for price consideration of $22.6 million which includes estimated transaction costs). As per the update, the properties will be leased to Stone Axe Pastoral Company Pty Ltd.

The company will do the additional investment on these properties to aid operational requirements and improve productivity through grazing area development and added irrigation.

Guidance: As per the FY20 guidance, the business expects distributions of 10.85 cpu which translates to a forecast payout ratio of 81%. The business expects ~45% revenue from almonds, ~30% from cattle, and ~6% and ~5% from vineyards and poultry segments. RFF will look into additional opportunities available from acquisitions.

Stock Update: The stock of RFF closed at $1.795, down 0.554% as on 30 October 2019. The market capitalization of the stock stood at $604.54 million while the stock has generated a dividend yield of 5.83%. The stock of RFF is available at PE of 17.64x. The stock has delivered returns of -21.18% and -20.83% during the last three and six-months, respectively.

Phoslock Environmental Technologies Limited (ASX: PET)

Phoslock Environmental Technologies Limited operates in water treatment and engineering solutions to revamp rivers, canals, drinking water reservoirs and polluted lakes.

On 28 October 2019, the Management of the company has announced that the Chinese subsidiary of the company granted High-Tech & reduced tax rate status. In order to gain this status, the company must upgrade into new technology and continue development of independent intellectual property rights. The corporate tax has been reduced to 15% from its existing 25% for an initial 3-year period. The revised tax rate was applicable from FY19 onwards, with the excess tax being reversed and refunded in FY20 and thereafter.

Earlier, the company announced its cash flow details for the quarter ended September 2019, wherein the company reported cash out flow from operating activities at 3.48 million, net cash used in investing activities at $0.477 million. The company reported net cash inflow from financing activities at $0.829 million. The company reported cash balance of $14.587 million as on 30 September 2019.

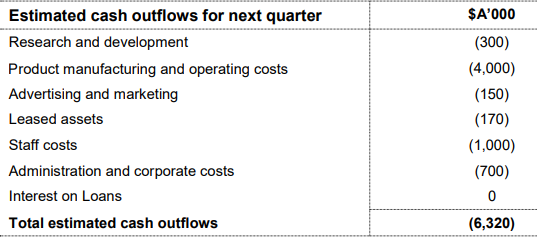

As per the cash flow guidance for Q4 FY19, the company has guided for a net outflow of $6.320 million including product manufacturing and operating costs at $4 million, staff costs at $1 million and administration and corporate expenses at $0.7 million.

Q4FY19 Cash Flow estimates (Source: Companyâs Report)

Stock Update: The stock of PET closed at $0.950, flat with respect to the previous close, as on 30 October 2019. The market capitalization of the stock stood at $534.41million. The stock has delivered returns of -34.61% and 141.71% during the last three and six-months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.