The critical ratio to determine whether the stock is overvalued or undervalued is Price to Earnings ratio, which can help an investor to determine the market value of a share compared to the companyâs earnings.

In brief, the PE ratio demonstrates amount the market would pay on a particular day for a stock based on its future or past earnings. A high P/E generally means that a stockâs price is high relative to earnings and generally overvalued. While a price to earnings ratio could possibly signify that the current stock price is low comparative to earnings, generally undervalued.

The following are two most popular ways to calculate the price to earnings ratio:

- Most of the time, the P/E is calculated using EPS from the last four quarters. This is known as the trailing P/E, but this method gives a less accurate reflection of the companyâs growth potential;

- The P/E is also calculated using EPS for the next four quarters and is known as the forward/leading P/E. This method leaves room for a lot of errors because of its dependency on the expected earnings.

The trailing P/E method is more accurate as it is based on actual earnings. However, earnings remains fixed while stock prices always move as a result of which forward P/E becomes more relevant to investors while evaluating a company.

There are many stocks listed on ASX with an extraordinary price to earnings multiple and one of them is Phoslock Environmental Technologies Limited. Letâs have a look at the stock.

Phoslock Environmental Technologies Limited (ASX: PET)

About the Company

Phoslock Environmental Technologies Limited is engaged in the business of providing engineering, design, and project application solutions for water associated projects and water-treatment products to clean up rivers, canals, lakes, and drinking water reservoirs.

- Phoslock operates a large multi-purpose manufacturing facility at Changxing, Central China and devotes significant resources on the evaluation and development of new water treatment products and technologies through in-house development, licensing arrangement or acquisition;

- PET is headquartered in Sydney, Australia and has sales and marketing offices in Australia, China, Germany, UK and licensees and sales agents in 10 countries.

The company has three business divisions- International Materials (excluding China), China Materials and China Contracting. All the divisions are performing well and have a growing pipeline for future transactions, some of which are very large.

PET confirmed the Revenue Guidance of $27-30 million for FY19

Phoslock maintained its previous guidance of revenue standing at $27-$30 million for FY19 and it currently has 3,000 tons of Phoslock® in inventory in China and at international warehouses whose sales value is $9 million. The expected sales for October to December 2019 period are in the range of 4,000 tons to 5,000 tons.

Key Updates:

- Changxing Factory has now production capacity of 20,000 tonnes per annum;

- The second production line is expected to be completed by May 2020;

- Currently, PET has zero debt on its balance sheet with a cash balance of $14.6 million;

- Global project pipeline is now greater than $330 million.

Updates on the Changxing Factory

- The changes at the Changxing Factory have been successfully concluded on time and within budget with daily production up by more than 50 tons per day;

- The annual production capacity is now at 20,000 tonnes for the first production line;

- The plans for a second production line at the Changxing Factory of similar size are being finalised, which is expected to be completed by May 2020;

- This expansion is expected to cost $4-6m and can be funded out of existing resources.

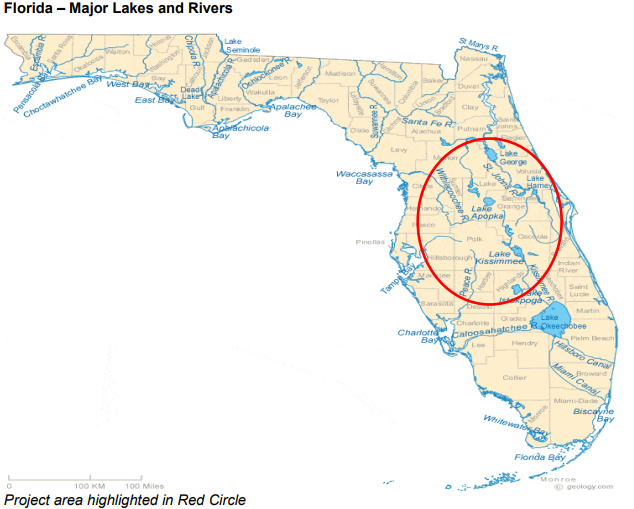

Secured an Order of $1.3 million for Florida Wetland and Lake Remediation Projects

- Initial $1.3m order from the companyâs US Licensee to begin active remediation as part of the Florida State Four Year plan;

- Successful trials with Phoslock® have demonstrated its ability to mitigate the effects of Phosphorus in local water bodies;

- Phosphorus is an increasing threat to sensitive Eco-systems in Southern Florida with large budgets now allocated to their remediation;

- This order is the first part of a process to use Phoslock® as part of a Florida Wetland solution.

Source: Companyâs Report

PET Signs a Contract for a New Project in Wuhan City

PET has signed a contract to commence work applying Phoslock® to the East Lake, which is Chinaâs second-biggest downtown lake located in Wuhan City. The Wuhan Cityâs lakes area is vast, with 68 lakes being larger than 100 hectares, most of which are grade 5 (very poor) or worse in water quality. Due to this reason, this new project will be an important application and will open a new field of ecological restoration of the eco-environmental protection in the Yangtze River Economic Belt in China.

There are many other opportunities for treating other lakes in the region. This project involves a large lake where a portion of this lake will be barriered off, and Phoslock® will be applied to this area. The company is also progressing other new projects detailed in the 23rd August 2019 business update. More information would be advised when contracts are formally signed.

Source: Companyâs Report

Chinese Directors of PET conducted a Strategic Share Sale

The companyâs Chinese directors agreed to sell some of their holdings in two crossings as a well-respected Australian institutional investor was looking to purchase a meaningful stake in PET. This sale was coordinated to minimise market disruptions and the PET management and board still has ownership in more than 25% of the fully issued capital of PET.

Stock Performance

The stock of PET closed the dayâs trading at $0.930 per share on 22nd October 2019, up by 5.682% from its previous closing price, with a market capitalisation of $495.04 million. The total outstanding shares of the company stood at 562.54 million, and its 52-week low and high is $0.313 and $1.592, respectively.

The company has given a total return of -38.5% and +132.74% in the time period of 3 months and 6 months, respectively. The stock last trading at a high price to earnings multiple of 1,100.000x as per ASX, and the company has an EPS of $0.001 per share.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.