In the recent past, the real estate segment experienced some growth aided by the marginal improvement in the consumer sentiment. Due to tepid GDP growth in the recent past, the overall segment might continue to witness some challenging times for the upcoming years. Higher occupancy rates suggest improved income flow for the above segment. We will be covering three investment companies which operate in managing assets within Australia. Performance of the real-estate segment is directly co-related with the operating performance of the investment companies which invest in real estate followed by certain banks which have loan exposure across real estate sector.

Let’s have a look on the recent updates and as well as the financials of these three companies.

Shopping Centres Australasia Property Group (ASX: SCP)

Shopping Centres Australasia Property Group operates in managing investments in shopping centers across Australia. On 17 January, the company reported an unfranked dividend distribution of $0.075 dividend per share. The company also informed the issue price of stapled units under SCP’s DRP at $2.71 per unit.

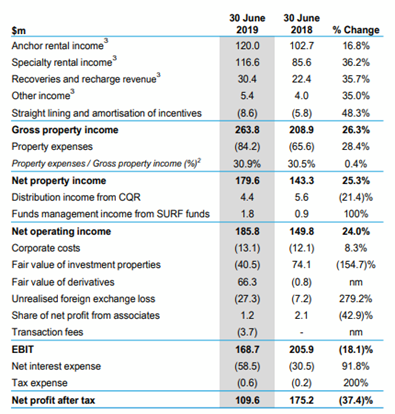

FY19 Financial Highlights for the Period ended 30 June 2019: SCP declared its full year 2019 results wherein, the company reported gross property income at $263.8 million as compared to $208.9 million in previous financial year. Net operating income came in at $185.8 million, depicting a growth of 24.0% on y-o-y basis. Property expenses in terms of gross property income came in at 30.9% as compared to 30.5% in previous financial year. Distribution income from CQR came in at $4.4, declined by 21.4% on y-o-y basis. Fair value of investment properties declined by 154.7% from FY18 at ($40.5) million. The net interest income of FY19 includes swap termination cost of $17.7 million. Average debt drawn rose by ~$230.0 million on account of the acquisitions and developments, less divestments to SURF and equity raised during the period.

FY19 Income Statement Highlights (Source: Company Reports)

Stock Update: The stock of SCP closed at $2.820 with a market capitalization of $2.64 billion on 21 January 2020. The stock has generated positive return of 3.28% and 16.46% in the last three months and six months, respectively. The stock is available at a price to earnings multiple of 22.46x on its trailing twelve months (TTM) EPS basis. The stock has generated an annualized dividend yield of 5.28%.

Charter Hall Long Wale Reit (ASX: CLW)

Charter Hall Long Wale Reit manages its funds by investing in the real estate sector in Australia. On 20 January 2019, the company reported an unfranked dividend distribution of $ 0.0700 per security held. The payment date is 14th February 2020.

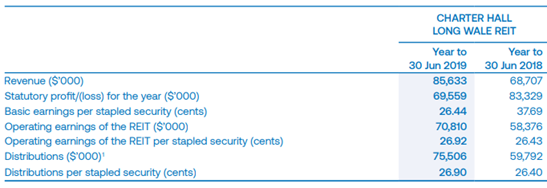

FY19 Financial Highlights for the Period ended 30 June 2019: CLW declared its full year results, wherein the company reported revenue at $85.633 million as compared to $68.707 million in FY18. Statutory profit, during the period came in at $69.559 million as compared to $83.329 million in FY18. The company reported total assets at $1,905 million while net assets per stapled security stood at $4.09. Fund management fees during the period came in at $7.569 million as compared to $6.576 million in previous corresponding period. The company reported finance costs at $19.644 million as compared to $16.218 million in FY18. Operating earnings were reported at $70.810 million as compared to $58.376 million in FY18.

FY19 Income Statement Highlights for the period ended 30 June 2019 (Source: Company Reports)

Cash Flow Highlights for FY19: The company reported net cash flows from operating activities at $63.683 million, net cash used in investing stood at $477.504 million while net cash from financing activities came in at $414.719 million during FY19.

Stock Update: The stock of CLW closed at at $5.580 along with a market capitalization of $2.7 billion on 21 January 2020. The stock has generated stellar return of 9.70 % and 28.02% in the last six months and one year, respectively. The stock is available at a price to earnings multiple of 20.99x on its trailing twelve months (TTM) EPS basis.

Growthpoint Properties Australia (ASX: GOZ)

Growthpoint Properties Australia manages commercial real estate properties and has investments in the sector.

Operating Highlights for the Period ended 30 September 2019: GOZ declared its quarterly highlights for 1QFY20, wherein the company reported total value in the investment properties at $4,023.8 million with an occupancy 98%. Average value realized at $3,805 per sqm which includes $8,934 per sqm from office segment and $1,693 per sqm from industrial, respectively. Average rent during the period stood at $255 per sqm per annum, which includes $594 per sqm from office segment and $114 per sqm from industrial segment. Number of tenants stood at 158 which includes 39 from industrial and 119 from office segment. The business reported a distribution yield of 5.5% during the quarter. NTA per stapled security is stood at $3.52 while gearing ratio stood at 32.5%. Total lettable area during the quarter came in at 1,057,558 sqm which includes 749,157sqm from industrial and 308,401 sqm from office segment. During September, the company purchased a logistics warehouse for a price consideration of $40 million. The company reported fixed debt at 68.8% during the period.

Guidance: The company expects an DPS guidance for FY20 at 23.8 cents while FFO guidance for FY20 is expected at 25.4 cps. GOZ is looking for the development of Botanicca 3 during the first quarter of FY20.

Stock Update: The stock of GOZ closed at $4.410 along with a market capitalization of $3.43 billion on 21 January 2020. The stock has generated positive return of 3.49 % and 2.30% in the last three months and six months, respectively. The stock is available at a price to earnings multiple of 8.410x on its trailing twelve months (TTM) EPS basis.