The commodity coal, used for power and steel production, has not seen a lot of action in terms of growth capital being deployed in the past few years across the globe. Primarily because of environmental reasons. However, over the past year and a half the tide has turned and the demand for coal has surged due to geopolitical factors, thus raising coal prices. According to a report from the International Energy Agency (IEA), the consumption of coal is projected to rise and hit an all-time high in 2022.

On the back of strong tailwinds and rising coal prices, an ASX-listed coal producer, TerraCom Limited (ASX:TER), has seen over a fourfold increase in its share price in the past year alone, despite the benchmark index being under pressure. TerraCom is a low-cost producer managing a high-yielding, diversified portfolio of operating assets in Australia and South Africa within the coal sector.

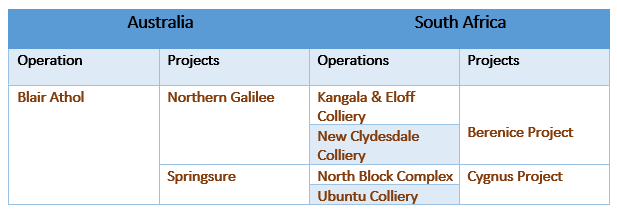

Australia – In 2017, the company acquired its flagship Blair Athol Coal mine. At present, the company exports more than 2 million tonnes per annum of high-quality thermal coal from the mine.

South Africa – TerraCom has 100% ownership of Universal Coal Plc (Universal). It holds an interest in a portfolio of production, development, and exploration assets located across major coalfields of South Africa.

In terms of its sales, domestic thermal coal contributes 55% and export thermal coal contributes 45%.

TerraCom soaring high on the ASX

On October 21, TerraCom had a market capitalisation of AU$803.52 million and a share value of AU$1.005. The share price has been trading within the 52-week range of AU$0.151–AU$1.190. The shares of the company have gained around 30% in the last three months and around 368% in the last year.

Data and image source: Refinitiv

© 2022 Kalkine Media®

On 26 August 2022, TerraCom announced the final dividend of 10 cents per share, following which the stock price of the company escalated by about 15% on that day.

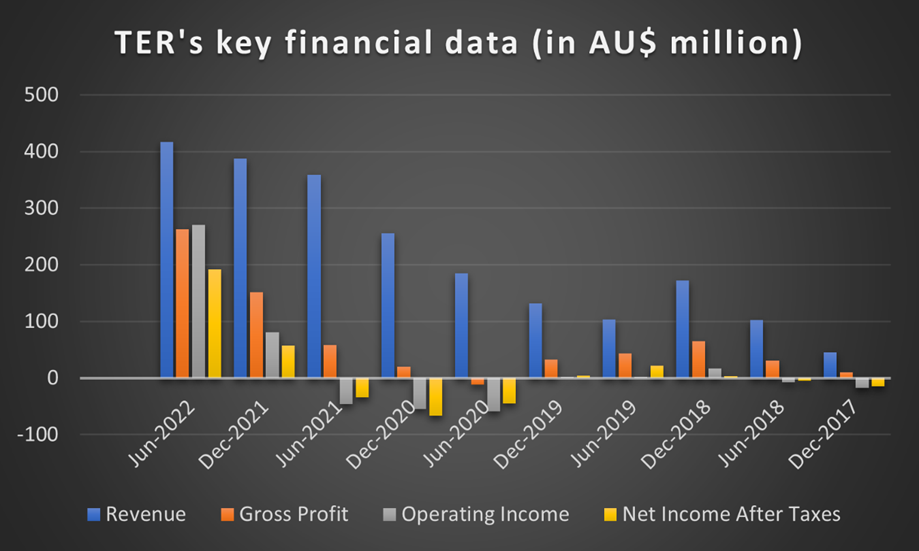

Snapshot of TER’s financial position

Data source: Refinitiv

© 2022 Kalkine Media®

The figure above depicts the year-on-year movement of key financial data of TER. Since June 2018, the revenue of the company has increased by nearly 309% from AU$101.9 million to AU$417.2 million and gross profit has surged by about 756% from AU$30.7 million to AU$262.7 million.

Latest updates on TerraCom’s operations

As announced in the company’s FY22 annual report, TerraCom’s revenue has increased from about AU$549 million to AU$804 million (46.44%) compared to previous year. Other highlights of the reporting period are as follows:

- Total ROM production of 12.6 Mt.

- Dividend declaration and payment of 10 c (unfranked).

- Record average coal price of AU$403 per sold tonne achieved at Blair Athol for the June quarter and AU$245 per sold tonne achieved for FY22.

- Total coal sales of 8.96 Mt.

The global energy market has been in focus for some time now, and the prices of key commodities such as coal have seen a lot of action. However, prudent investing decision-making calls for keeping a close eye on how the energy market unfolds. Is the disruption in the energy market in general and the coal sector in specific a structural one? Will the prices hold or go back to their historical levels? These are some questions that need to be answered by investors in their quest to find investment options in the energy space.