With growing focus of governments across the globe on legalising recreational and medicinal cannabis, the cannabis industry is booming at a rapid pace and is expected to offer opportunities for investors.

In 2016, Australia became the fourth nation in the globe to legalise the medical use of cannabis. Since then, several companies have emerged in the Australian market with focus on the research and development of medicinal cannabis. According to market experts, sturdy quality control, safety management systems for crops, in addition to expertise of Australia in best agricultural practices would result in huge opportunities in the cannabis space. Let us now look at seven stocks in the related space.

Bod Australia Limited

Bod Australia Limited (ASX:BDA) operates as a vertically integrated developer, producer, distributor and marketer of natural health supplements and beauty solutions, derived from plants. With a market cap of AUD 39.5 million and ~ 88.75 million outstanding shares, the stock of BDA settled at AUD 0.455 on 02 Sep 2019, up AUD 0.010 from its previous closing price. The YTD return of the stock stands at 14.10%.

On 30 August 2019, the cannabis focused healthcare company updated the market with its full-year statutory accounts for the year ended 30 June 2019, reporting an increase of 14.9% year-on-year in revenues from ordinary activities to AUD 1.34 million and a loss of AUD 7.62 million. Cash and cash equivalents as at 30 June 2019 stood at AUD 2.84 million, down from AUD 3.12 million in the same period a year ago.

Source: Companyâs Report

MMJ Group Holdings Limited

Holding a total portfolio worth AUD 83 million, MMJ Group Holdings Limited (ASX: MMJ) is a global cannabis investment company, which was listed on ASX in 2015. The stock of MMJ closed the dayâs trading at a price of AUD 0.240 on 02 Sep 2019, up 2.128%, with a market cap of AUD 53.28 million, ~ 226.72 million outstanding shares and a PE multiple of 1.86x. Over the last one month, the MMJ stock has provided a negative return of 18.97%.

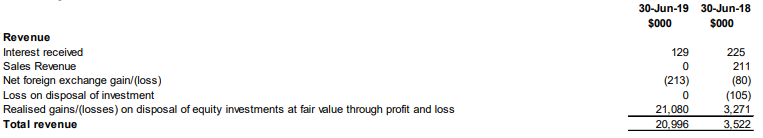

Recently on 28 August 2019, the company released its preliminary final report, registering revenues from ordinary activities of AUD 33.64 million in FY19 ended 30 June 2019, representing an increase of 73% when compared with the same period a year ago. It reported a stunning rise of 320% year-on-year in profit to AUD 21.62 million for the reported period. Additionally, the companyâs net tangible asset backing per share grew to 37.18 cents as at 30 June 2019 from 28.6 cents as at 30 June 2018. Below figure depicts the total revenue posted by the company for FY19 vs FY18.

Source: Companyâs Report

Cann Group Limited

Cann Group Limited (ASX:CAN) is one of the most experienced cultivators in Australia, accounting for more than 40 harvests since 2017. The company has a proven capability for manufacturing medicinal grade cannabis. Its stock closed trading at a price of AUD 1.840 on 02 Sep 2019, down 1.604% from previous close. The stock, which has delivered a 0.54% return in the last six months, has a market cap of AUD 265.17 million and approx. 141.8 million outstanding shares.

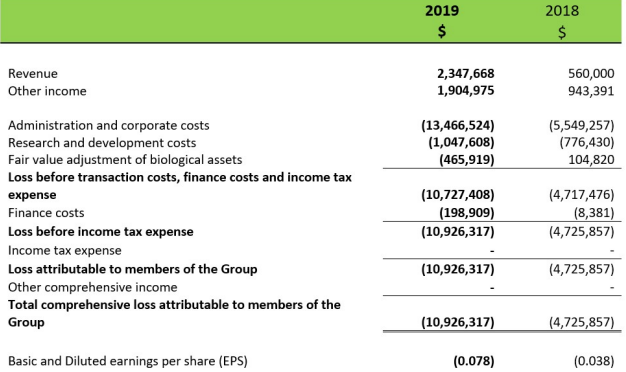

Recently, the company announced its decision of boosting annual targeted dry flower production capacity of the Mildura facility to 70,000kg, which would result in annual revenues of nearly AUD 220-280 million. Moreover, it reported to have generated AUD 4.25 million in revenue in FY19, up 182.72% on pcp. The companyâs loss from ordinary activities after tax attributable for the financial year 2019 to members stood at AUD 10. 93 million.

Financial Results (Source: Companyâs Report)

THC Global Group Ltd

THC Global Group Ltd (ASX:THC), formerly The Hydroponics Company Limited, is engaged in offering access to medicinal cannabis products of high quality to patients in Australia. The company, which also serves the global export market, operates two units in Canada, namely Crystal Mountain Products and Vertical Canna. Its market cap stands at AUD 59.75 million, while the THC stock settled at AUD 0.445 on 02 Sep 2019, up 1.136% from its previous close. The stock has delivered a negative six-month return of 14.56%.

The company announced the opening of its largest bio-pharma manufacturing facility in the Southern Hemisphere by Federal Minister for Health, The Hon. Greg Hunt MP. Meanwhile, THC reported to have registered a 67% increase in revenue to AUD 2.14 million for FY19. However, the company registered a loss of AUD 5.77 million during the reported year.

Bio-Pharm Prod R&D Facility (Source: Companyâs Report)

Creso Pharma Limited

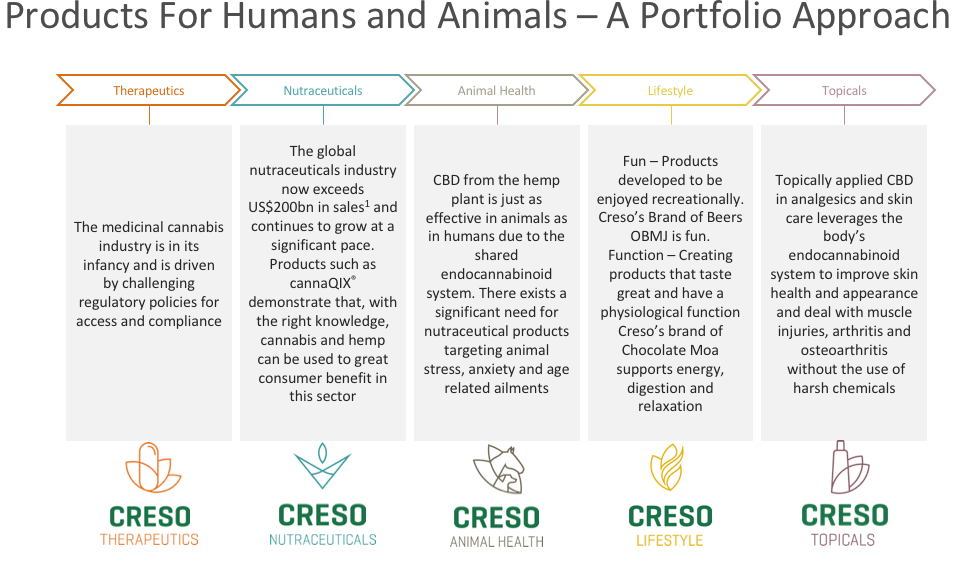

Creso Pharma Limited (ASX: CPH) is a developer of therapeutic, nutraceutical and lifestyle products, derived from cannabis and hemp. Holding global rights for several unique and proprietary innovative delivery technologies, the company has a wide patient and consumer reach for human and animal health. On 02 Sep 2019, the CPH stock traded down by 1.25% to AUD 0.395, with approx. 151.54 million outstanding shares and AUD 60.62 million in market cap. Its six-month return stands at 3.90%.

Source: Companyâs Website

At the end of August 2019, the company updated the market with its recent business activities, unveiling significant synergies demonstrated with PharmaCielo Ltd, as the former secured the first commercial cannabidiol export of high-quality CBD isolate from the latterâs Colombian operations. Moreover, CPH reported growing revenues and R&D activities in Europe, coupled with the start of revenue generation from the cannabis production facility in Canada.

Zelda Therapeutics Limited

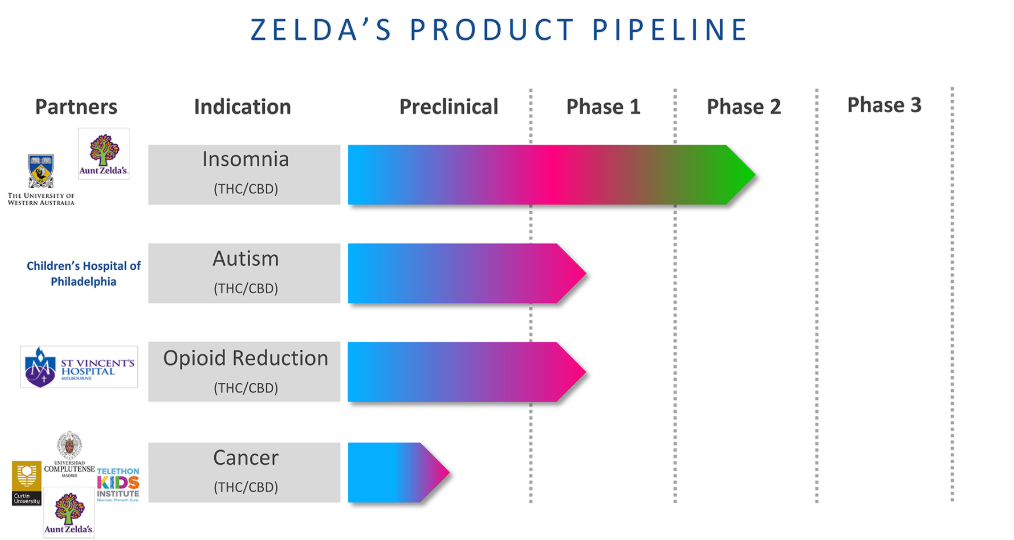

A bio-pharmaceutical company, Zelda Therapeutics Limited (ASX: ZLD) is engaged in the development of cannabinoid formulations, targeted towards the treatment of several medical conditions. ZLD is currently performing human clinical trials in Australia and the United States, focused on insomnia, autism and opioid reduction. While, its preclinical research is focused on evaluating the cannabinoid effect in cancers like breast, brain and pancreatic. With a market cap of AUD 50.74 million, the stock traded flat at a price of AUD 0.067 on 02 Sep 2019 and has delivered a six-month return of 15.52%.

Source: Companyâs Website

Consolidated groupâs revenue excluding interest received stood at AUD 769,030 and loss after tax reached AUD 3.57 million for 12 months ended 30 June 2019. Net assets of the consolidated group decreased to AUD 3.11 million at 30 June 2019 from AUD 6.21 million at 30 June 2018.

Rhinomed Limited

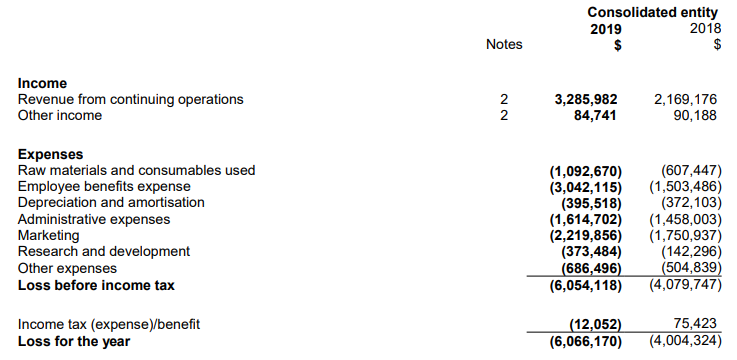

Pharmaceutical and healthcare products focused company, Rhinomed Limited (ASX:RNO) was listed on ASX in 2007. The company has licensed its technology in the United States as a rug delivery platform, aimed at catering leading medical cannabis firms with its cannabinoids. The stock of the company closed trading at a price of AUD 0.220 on 02 Sep 2019, down 6.383%. RNOâs market cap stood at AUD 33.35 million, while the stock has delivered a YTD return of 23.63%.

The company registered revenue for ordinary activities of AUD 3.29 million for FY19, up 51.5% from the previous corresponding year ended 30 June 2018. Its net loss for the period attributable to members grew 51.5% to AUD 6.07 million. For FY19, RNOâs net cash used in operating activities stood at AUD 4.71 million, compared with AUD 3.85 million in FY18. RNO held cash reserves of AUD 1.42 million at 30 June 2019.

Financial Metrics (Source: Companyâs Report)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.