Small cap stocks are highly risky assets, which are generally for those investors, who have high risk appetite. The company whose market capitalisation is below $ 2 billion comes under the small cap zone.

Classic Minerals Ltd

Classic Minerals Ltd (ASX: CLZ) is an Australia registered company, which is involved in the exploration of base materials, with major focus on nickel, copper and gold. The company got listed on the ASX in the year 2013. On 31 July 2019, the company updated the market with its quarterly activity report for the period ended June 2019, under which it reported successfully wrap up of drill campaign at the Forrestania Gold project in Western Australia. CLZ received high-grade results from the project. Additionally, the company updated about its another drilling program at Kat Gap.

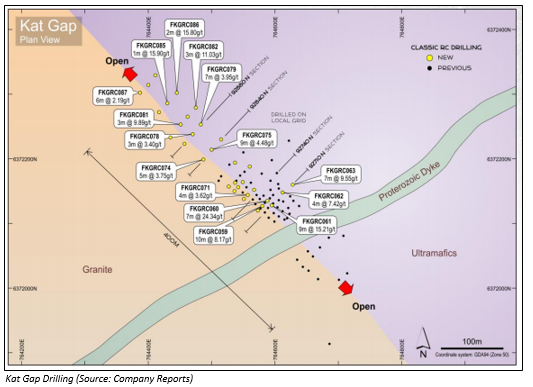

An Overview of Kat Gap Drilling Program

As part of the drilling program at Kat Gap, CLZ drilled a total of 32 holes for 2040 metres. Most of the holes hit gold mineralisation in a northwest-southeast direction. With mineralisation open in all directions, the company extended the strike coverage under the drilling program to 400 metres.

The reverse circulation drilling was largely focused on testing the main granite-greenstone contact gold zone a further 200 metre north of the companyâs prior drilling down to a vertical depth of only 50 metres below surface. The company reported following major results from RC drilling:

- A drill hole, FKGRC074, intersected 5 metre at the rate of 3.75 gram per tonne gold from 17 metre, which included 1 metre at the rate of 11.20 gram per tonne gold from 19 metre.

- Another drill hole FKGRC075 intersected 9 metre at the rate of 4.48 gram per tonne gold from 42 metre, which included 1 metre at the rate of 24.20 gram per tonne gold from 49 metre.

- The FKGRC078 drill hole intersected 3 metre at the rate of 3.40 gram per tonne gold from 37 metre

- The drill hole identified as FKGRC079 intersected 7 metre at the rate of 3.95 gram per tonne gold from 54 metre, which included 1 metre at the rate of 13.50 gram per tonne gold from 55 metre.

- The drill hole identified as FKGRC085 intersected 1 metre at the rate of 15.90 gram per tonne gold from 33 metre.

- The drill hole identified as FKGRC086 intersected 2 metre at the rate of 15.80 gram per tonne gold from 58 metre.

Outlook

Classic Minerals intends to move ahead with the Forrestania Gold Projects covering development works during the first quarter of financial year 2019 ending September 2019. Moreover, it would focus on targeted Kat Gap drilling. The company further unveiled that the reverse circulation drilling at Kat Gap is seeking cross-cutting high-grade quartz reefs at right angles to existing North West â South East orientated gold lodes. Additionally, during the first quarter of FY2020, CLZ aims to continue capital raising and debt & liability payments in order to improve its financial position.

Stock Information

On 2 August 2019, the stock of Classic Minerals Ltd last traded at a price of $ 0.002 per share. It has a market capitalisation of $ 7.64 million and approximately 3.82 billion outstanding shares.

WestStar Industrial Limited

WestStar Industrial Limited (ASX: WSI) is involved in the manufacturing and production of concrete elements and structures. The company was officially listed on the Australian Stock Exchange in 2006. On 2 August 2019, the company made an announcement regarding the release of 615,754,616 fully paid ordinary shares from escrow.

The company made an announcement on ASX on 31 July 2019, under which it highlighted that its subsidiary company SIMPEC added extensions of around $ 5 million to its existing contracts throughout all E&I and SMP disciplines. It further added that the contract extension is being built on original awards from the companyâs existing clients. It was mentioned in the release that contract extensions boosted the value of work awarded to the company during July 2019 to around $ 10 million.

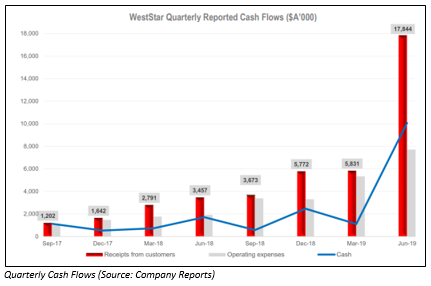

A Look at Quarterly Report

At the end of Q4 FY19, the cash balance of the company stood at $ 10.0 million. Weststar Industrial Limited reported total cash receipts amounting to around $ 17,844,000 in comparison to $ 5,830,000 in Q3 FY19, reflecting a quarter-on-quarter growth of more than 300%. It further added that the result of cash receipts has been a new historical high for quarterly cash receipts, which surpassed the total of the prior 3 quarters.

Weststarâs subsidiary company SIMPEC secured a contract amounting to $ 10 million for the construction of an 800-room camp at FMGâs Eliwana iron ore mine in Western Australia. The contract was awarded by ATCO Structures and Logistics. It further revealed that repeat contracts are continuing from Tier 1 clients, which include MSP Engineering and Rio Tinto Limited (ASX: RIO).

During the quarter, the company reported net inflow from operating activities amounting to $ 7,092,000. It also added that operating payments increased proportionately less than receipts for Q4 FY19. During the reported quarter, Weststar Industrial Limited also wrapped up a placement amounting to $ 2.4 million. The company received strong support from existing shareholders along with the entry of new high-quality international and domestic institutional and professional investors for the placement.

Its gross margin in the first half of financial year 2019 in comparison to the industry median of 41.6% stood at 18.9%. The company posted asset turnover ratio of 1.63x in 1H FY19 (industry median: 0.27x). The current ratio of the company stood at 0.64x in 1H FY19 (industry median: 1.89x).

Outlook

WestStar Industrial Limited is continuing to tender strongly for new work and anticipates the results from these tendering activities in due course. WSIâs performance for the financial year 2020 is well supported with substantial contracted future work.

Stock Information

On 2 August 2019, the stock of WestStar Industrial Limited last traded at a price of $ 0.035 per share, down 7.895% from its previous close. It has a market capitalisation of $ 23.4 million and approximately 615.75 million outstanding shares. The stock provided returns of 58.33% and 40.74% in the time span of one month and three months, respectively, while the six month period return stands at 72.73%.

Acacia Coal Limited

Acacia Coal Limited (ASX: AJC) is engaged in the development and exploration of minerals. The company was listed on the Australian Securities Exchange in 1986. The company on 1 August 2019 released its cashflow statement for the quarter ended June 2019. It reported net cash used in operating activities of $ 95,000 for the quarter after making payments for exploration and tenement administration costs and administration and corporate costs of A$0.091 million and A$0.019 million. Its cash and cash equivalents stand at $ 2.64 million at the end of the quarter.

On the same day, the company released its report for the quarter ended 30 June 2019. The company unveiled the start of maiden drilling programme at its Mt Windarra project in Western Australia. Adding to that, the companyâs soil geochemical sampling program has been wrapped up at Mt Bruce.

Mt Windarra Project

The company completed 50 drill holes for 4,103m to date inclusive of RAB, Aircore, Reverse circulation and Diamond Drilling. The following major results were reported from drilling:

- WNAC002: 13m at 0.4% Ni & 0.048% Co from 66m to EOH including 1m at 0.54% Ni & 0.233% Co from 68m

- WNAC006: 18m at 0.35% Ni & 0.05% Co from 53m including 1m at 0.37% Ni and 0.28% Co from 53m

- WNAC008: 10m at 0.37% Ni & 0.048% Co from 65m to EOH Including 1m at 0.71% Ni and 0.168% Co from 71m.

Current ratio of the company stood at 41.66x in the first half of FY19 (industry median: 1.28x). This show how the company is well positioned and is capable of meeting its obligations over the short-term when compared with the broader industry. Meanwhile, in the first half, the companyâs asset to equity ratio reached 1.02x when compared to the industry median of 1.98x. Acacia Coal Limited delivered return on equity of -22.8% in 1H FY19 as compared to the industry median of 6.6%.

Stock Information

On 2 August 2019, the stock of Acacia Coal Limited last traded at a price of $ 0.001 per share. It has a market capitalisation of $ 4.07 million and approximately 4.07 billion outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.