Cannabis can be understood as a nature-oriented medicine from the cannabis plants, used for medical as well as recreational purpose across the globe. Australia enjoys a long history in relation to the manufacturing of pharmaceutical grade medicines which are extracted from plants. The country produces more than 40% of the pharmaceutical opiates in the world.

Considerable changes taken by the Federal Government in last 3 years are â (a) 2016- Rescheduling of cannabis allowing doctors to prescribe, (b) 2016- Implementation of regulatory framework to enable the cultivation and manufacture of cannabis products in Australia (c) 2018- export of manufactured cannabinoid medicines from Australia was approved by the Australian Federal Government.

The Australian market for chronic neuropathic pain treatment has opportunity of 1.9 million patients or 8% of the population in the country. The Australian economy is permitted to export cannabis-based pharmaceutical products, owing to the fact that large number of countries use cannabis for medical purposes but lack production due to the absence of established legal frameworks, bringing in brighter future for the cannabis business.

In this article, we are discussing 2 small cap stocks - Cann Group Limited and AusCann Group Holdings Limited, which are engaged in cannabis business and progressing well.

Cann Group Limited

Cann Group Limited (ASX: CAN) is focused on cannabis cultivation, with the products targeted towards medicinal and research purposes. Moreover, the company is involved in the production of medicinal cannabis products. It is the first Australian company to have received the medicinal cannabis research licence in February 2017 and medicinal cannabis cultivation licence in March 2017.

CAN commenced the harvesting of medicinal cannabis in 2017 at the Southern facility in Melbourne. The production process involved a range of activities such as curing and drying the material which has been harvested, validation process of the samples, and propagation of new crops at the facility. The company is looking for opportunities and strategic agreements with parties to market the products for medicinal purposes.

Production Facility Details: The company has two cultivation and R&D facilities. CAN has purchased a site near Mildura, Victoria for a consideration of $ 10.75 million with the purpose of major Stage III expansion. Along with this, an offtake agreement has also been secured with major Canadian producer, Aurora Cannabis, which includes current and future planned production capacity. Aurora holds a 22.9% stake in CAN. Apart from this, the company enjoys important relationships with Aurora Cannabis, Agriculture Victoria, CSIRO, La Trobe University, Anandia Labs and NSW DPI & IDT Australia. These relationships add substantial value in areas including genetics, analysis & research, manufacturing capability and industry know-how.

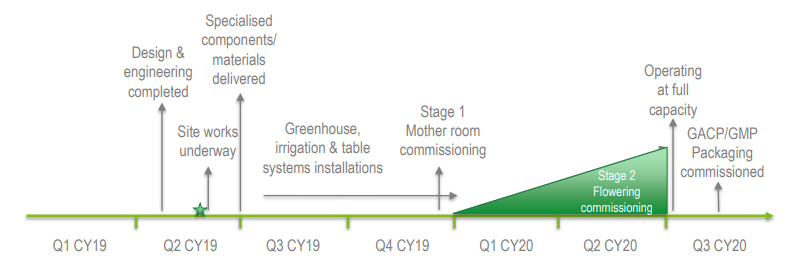

Figure below highlights how the Mildura facility is expected to provide a clear pathway to sustained profitability.

(Source: Company Reports)

(Source: Company Reports)

Recent Updates:

- The company announced on 26 July 2019 that it has received manufacturing licences from Federal Department of Healthâs Office of Drug Control (ODC), concerning its Northern and Southern medicinal cannabis facilities in Melbourne. However, the company needs to take further permits with regards to the specific activities under the licences. With this latest development, the companyâs activities related to cultivation, production and manufacturing licences fall under the Narcotics Drugs Act, whereas import and export licence comes under the purview of Customs Act. The Management considers it as a substantial milestone, which is expected to assist the fully integrated business model strategy.

- On 22 July 2019, the company notified that Tribeca Investment Partners Pty Ltd has become a substantial holder in the company with a voting right of 5.05%.

- The company exercised the underwriting options as on 27 June 2019 and as a result, issued 550,000 fully paid ordinary shares.

- The company also notified in the month of May that the Victorian Government has accepted the delivery of the first Australian sourced and commercially grown cannabis resin, which will be used for the treatment of Australian patients. The new large-scale cultivation facility near Mildura is scheduled for commissioning in 2020, with an annual production capacity of up to 50,000 Kg of dry flower.

- The company entered into a 5-yr agreement with Aurora Cannabis. The agreement covers the delivery of GMP processed dry flower, in addition to extracted resin and manufactured medicinal cannabis products.

CAN stock was trading at $ 2.170 on 29 July 2019 (AEST 01:48 PM), up 0.463% from its previous closing price. The company has a market cap of $ 306.3 million and 141.8 million outstanding shares. The stock gave a return of 2.37% in the past six months.

AusCann Group Holdings Limited

AusCann Group Holdings Limited (ASX: AC8) is in the business of medicinal cannabis product cultivation, manufacturing and delivery. The company is also involved in distribution activities across Australia through established pharmaceutical distribution channels as well as unregistered product pathways.

Recent Updates:

- The company, on 23 July 2019, issued 50,000 fully paid ordinary shares at $ 0.21 per share on exercise of 50,000 unlisted options, scheduled for expiry on 19 January 2020.

- On 01 July 2019, AC8 notified the market about signing an agreement with Tasmanian Alkaloids (TasAlk). Under the deal, AusCann will secure high-quality cannabis raw material from TasAlk. The company will use the material for cannabinoids-based pharmaceuticals development and production. The strategic alliance between the two was undertaken in 2017 to benefit from each otherâs abilities with regards to cannabis plant cultivation along with manufacturing and marketing of cannabis products.

- On 8 March 2019, S&P Dow Jones Indices announced the March 2019 quarterly rebalance of the S&P/ASX Indices. The company was added to All Ordinaries, effective at the open on 18 March 2019.

March Quarter 2019 Updates: The company appointed Mr. Ido Kanyon as new Chief Executive Officer during the period. Further, AC8 inked an agreement for purchasing cannabis resin from MediPharm Labs, which is the largest supplier of purified, pharmaceutical grade cannabis extracts in Canada.

The company bought a R&D (Research & Development) facility of 7,300 square metres to further improve its product development capabilities. The facility is based in Perth, the capital city of Western Australia. The consideration price for the facility was $ 5.25 million, which was fully funded from existing cash reserves on the balance sheet and the anticipated completion of the facility is CY 2019.

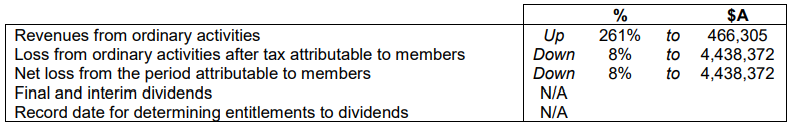

1H FY19 Results Review (ended 31 December 2018): The company, in July 2018, accomplished a share placement program and raised A$ 33.5 million. An amount of A$ 1.9 million was further raised in August 2018 through a share purchase plan. AC8 posted a loss of $ 4,438,372 in 1HFY19 as compared to $ 4,829,822 in the prior corresponding period. On balance sheet, net assets rose to $ 43,255,881 at the end of 1H FY19 from $ 14,112,032 at 30 June 2018. Total current liabilities at the end of the period stood at $ 592,819, slightly lower as compared to $ 600,139 at the end of June 2018. Accumulated losses at the end of 1H FY19 were $ 31,810,379 as compared to $ 27,372,007 at the end of 1H FY18.

1H19 Results Highlights (Source: Company Reports)

1H19 Results Highlights (Source: Company Reports)

Key Focus Areas for FY2019: The company intends to launch solid hard-shell capsules to treat chronic pain which is likely to be released for clinical trials in 2019. The company plans to continue with diversifying and boosting cannabis raw material supply base. With regards to the product development, the company is progressing towards the development of a new AusCann R&D facility in Western Australia. The facility will be engaged in cultivation, extraction and new product development activities. AC8 is likely to invest a further capital of ~$ 6 million in the upcoming time for the customisation of the site.

AC8 stock was trading at $ 0.510 on 29 July 2019 (AEST 02:41 PM), up 7.368% from its previous closing price. The company has a market cap of $ 150.57 million and 317 million outstanding shares. The stock gave a negative return of 26.36% in the past six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.