S&P/ASX 200 index moved slightly up by 0.68% during today’s trading session. Notably, all the major four banks of Australia were in the green zone today. We have made a list of 7 ASX-listed companies which moved up during the session. Most notable among them is Webjet Limited, which witnessed an increase of over 9% in its share price. Let us now look at all the seven stocks.

Webjet Limited (ASX: WEB)

Digital travel business, Webjet Limited (ASX: WEB) is currently under investors’ radar due to the media speculation in relation to expressions of interest in the company. The company today has clarified that although from time to time, it consider acquisition interest in the business, currently there is no such proposal.

The company’s stock price witnessed 9.605% growth during today’s trading session.

During the last financial year, the company reported 5.5 million travel bookings and generated around $4 billion in total transaction value (TTV). The company’s webBeds business, which was launched 6 years ago, has become the company’s largest business as it accounted for approximately 56% of Group TTV, 50% of Group revenue and 48% of Group EBITDA.

At market close on 11 December 2019, WEB stock was trading at a price of $12.780 with a Price to Earnings (PE) multiple of 24.810x.

CSL Limited (ASX: CSL)

Leading healthcare stock, CSL Limited (ASX: CSL) was up slightly by 1.369% during today’s day trade. Due to the company’s impressive product lines, one of the leading brokering firms recently increased the target price for CSL.

Last financial year was an important year for the company, as it reported strong financial as well operational performance over the period.

CSL FY19 Highlights

- Revenue was up 11% at constant currency;

- Net Profit after Tax was up 17% at constant currency, slightly ahead of its guidance;

- FY19 total dividend was up 18% in A$ terms;

- The company’s largest franchise, immunoglobulins, performed exceptionally well with Privigen up 23% and Hizentra up 22%, which is outstanding growth;

- Demand for the company’s specialty products remains robust with sales of Haegarda up 61% and Kcentra up 14%;

- Successful evolution of the company’s Haemophilia portfolio has continued with Idelvion sales up 40%

- Seqirus, influenza vaccines business, has achieved strong sales and profit growth and is well positioned to deliver on its strategy;

- Hizentra and Privigen were approved for CIDP in Japan as well as Hizentra for CIDP in Australia. Notably, in the last six months, the company’s stock witnessed an increase of 30.98% on ASX. At market close on 11 December 2019, CSL stock was trading at a price of $282.150 with a market cap of $126.33 billion.

Woolworths Limited (ASX: WOW)

One of Australia’s leading retailer Woolworths Limited (ASX: WOW) has provided impressive 33.09% return to its shareholders in the last one year. The retail giant recently released the numbers for the 14-week period to 6 October 2019, wherein, it reported group sales from continuing operations of $15.9 billion, up by 7.1% as compared to the corresponding period of 2018.

Key sales highlights include:

- Australian Food sales growth of 7.8% (comparable: 6.6%) driven by successful Lion King Ooshies and Woolworths Discovery Garden campaigns and Online

- New Zealand Food sales growth of 4.6% (comparable: 4.8%) with customer metrics continuing to improve

- Endeavour Drinks sales growth of 4.9% (comparable: 3.2%) with both BWS and Dan Murphy’s reporting solid growth

- BIG W sales momentum continues with sales up 2.6% (comparable: 4.4%) with Apparel growth the highlight

- Group Online sales growth of 37.4% driven by WooliesX and CountdownX

- Hotels sales growth of 5.5% (comparable: 3.6%) driven by strong performance in Food and Bar

At market close on 11 December 2019, WOW stock was trading at a price of $38.430, up by 0.471% intraday, with a market cap of around $48.24 billion.

All top four banks of Australia (in terms of market cap) ended today’s trading session in the green zone.

Commonwealth Bank of Australia (ASX: CBA)

The strong capital position and balance sheet settings of Commonwealth Bank of Australia (ASX: CBA) has placed it well in a challenging operating environment. In its first quarter of FY2020 (September quarter), the bank reported a statutory net profit of ~$3.8 billion and cash net profit from continuing operations of ~$2.3bn. Over the period, the bank was able to maintain strong CET1 ratio of 10.6% after 2019 final dividend payments (-90bpts) and organic generation of 35bpts ex one-offs.

The bank today has witnessed an increase of $1.080 or 1.363% in its share price and ended the session at $80.310. Most recently, the bank has paid a dividend of 231 cents per share (100% franked), taking the full-year dividend to $4.31 per share fully franked, flat on last year. CBA currently has an annual dividend yield of 5.44%.

National Australia Bank Limited (ASX: NAB)

With a market cap of approximately $72.16 billion, National Australia Bank Limited (ASX: NAB) is currently one of the leading bank of Australia with more than 30,000 people serving around 9 million customers.

Last financial year was an extraordinarily challenging year for the bank, as a result of which, it witnessed a decline of 10.6% in its cash earnings. The company reported a total dividend for the full year of $1.66 per shares, down by 32 cents on last year.

In the last six months, NAB’s stock price has declined by 8.05%. At market close on 11 December NAB’s stock was trading at a price of $25.100, up by 0.28% on previous close. The stock is trading with a PE multiple of 14.590x with annual dividend yield of 6.63%.

Westpac Banking Corporation (ASX: WBC)

Westpac Banking Corporation (ASX: WBC) also witnessed a slight uplift of 0.702% in its share price during today’s trading session. Following the closing of the Share Purchase plan on 2 December 2019, the bank recently completed the SPP, raising around $770 million and around 31.9 million new shares in Westpac, to be issued today, as announced on 10 December 2019.

For WBC also, last year was a challenging period. Notably, in the last three months, WBC’s stock price has declined by 16.86%. WBC’s stock is trading a PE multiple of 12.320x with an annual dividend yield of 7.19%.

At market close on 11 December 2019, WBC stock was trading at a price of $24.380 with a market cap of 86.4 billion.

Australia And New Zealand Banking Group Limited (ASX: ANZ)

The stock of Australia And New Zealand Banking Group Limited (ASX: ANZ) was up by 0.45% during today’s session. Two days’ back ANZ had provided an update in which it announced APRA has shown green light to the sale of ANZ’s OnePath P&I business to IOOF Holdings Limited (IOOF). This transaction which is expected to be completed in March quarter of 2020 will improve the bank’s capital position as it will Increase ANZ’s APRA CET1 capital ratio by ~20 basis points.

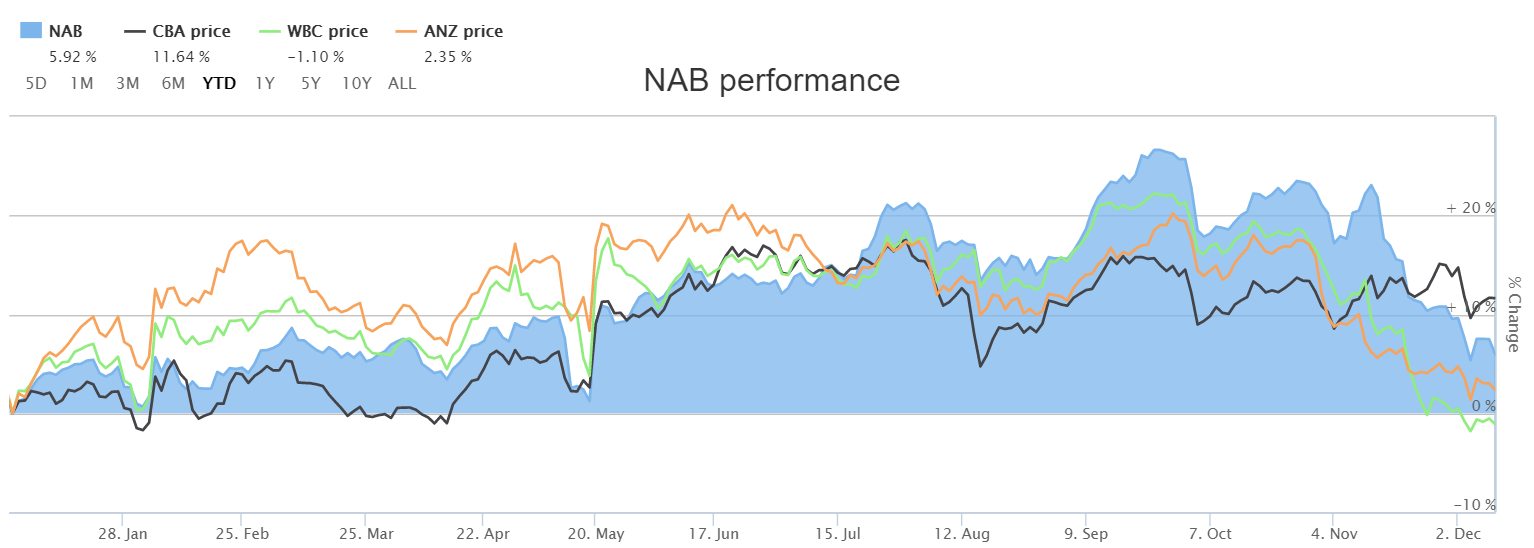

YTD Price- Comparison chart of ANZ, NAB, CBA, WBC (Source: ASX)

If we look closely at the above image, we can see that all the major four banks have been moving in the same direction.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.