The markets have seen more fluctuations in the first three months of 2020 that they might witness in an entire year. Looking at the current scenario, it seems extremely difficult for investors to decide where to invest to generate a decent amount of wealth. However, there is a range of investment tools such as bonds, debenture, mutual funds, and shares that investors look at and assess.

When it comes to shares, penny stocks could be a useful tool for long-term growth as these stocks provide an opportunity to grow wealth as well as to collect a decent quantity as these are very low-priced. In the following article, we will look at five penny stocks amid coronavirus crisis.

Good Read: How To Identify Trending Penny Stocks?

SRG Global Limited (ASX:SRG)

SRG Global Limited provides construction, maintenance mining services throughout the entire asset lifecycle. Recently, the Company’s Non-Executive Director Mr John Derwin stepped down from his role, which became effective on 03 April 2020.

Future growth Supported by New Contract: SRG notified the market that it had secured a five-year contract worth around $70 million from Saracen Mineral Holdings Limited. Under the terms of the agreement, SRG would provide specialist explosives management grade control drilling and drill and blast services. The Company would provide these specialist services at Thunderbox and Carosue Dam operations of Saracen. This contract diversifies customer base of SRG and adds significantly to its long-term work in hand.

Apart from this, the Company has also been presented $72 million integrated construction package from Multiplex Constructions Pty Ltd. Under this package, SRG would complete concrete structure and the design, supply and installation of engineered curtain wall facade for the 54,000sqm project.

On the outlook front, the Company has withdrawn its guidance for FY20 and deferred its dividend payment until 29 October 2020 due to the COVID-19 pandemic. However, SRG holds a robust financial position with substantial liquidity and margin in its bank covenants.

The stock of SRG closed the day’s trading session at $0.260 per share on 14 April 2020, indicating a fall of 1.887% against its previous closing price. The market capitalisation of SRG stood at $118.14 million. During the last three months and six months, the stock generated returns of -31.17% and -27.40%, respectively.

LiveTiles Limited (ASX:LVT)

LiveTiles Limited is involved in the production and marketing of business software in the Australian continent as well as overseas.

Impressive Performance in Q3 FY20:

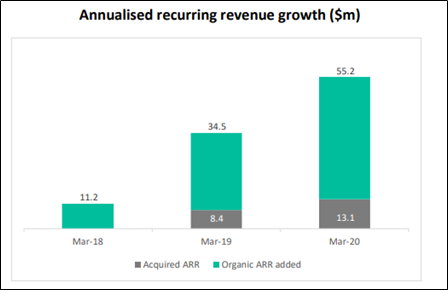

On 14 April 2020, the Company announced the results of the third quarter of FY20 with substantial growth in annualised recurring revenue (ARR) and outlined the below:

- ARR for the quarter stood at $55.2 million, higher than $52.7 million as at 31 December 2019. This reflects a growth of 60% in the last 12 months and is up to 4.9x in the past two years.

- As of 31 March 2020, the Company had a cash balance of over $30.0 million. The change in cash balance in the last three months reflected operating cash burn, Wizdom payment worth $4 million, payment for net working capital adjustment for CYCL, and FX movements, among others. The Company is in a strong position and can pursue growth across multiple channels.

- The number of customers grew from 1,031 in the last quarter, to 1,068. Average ARR/customer stood at $51,500, an increase of 31% compared to the prior corresponding period.

- The Company reiterated that it doesn’t need to raise additional capital to fund its operations.

ARR Growth (Source: Company Announcement)

The stock of LVT closed the day’s trading session at $0.240 per share on 14 April 2020, indicating an increase of 17.073% against its previous closing price. The market capitalisation of LVT stood at $184.96 million. During the last three months and six months, the stock generated returns of -25.45% and -41.43%, respectively.

Also Read: Pros and Cons of Investing in Penny Stocks

Bigtincan Holdings Limited (ASX:BTH)

Bigtincan Holdings Limited mainly provides enterprise mobility software. BTH recently announced that Regal Funds Management Pty Ltd had made a change to their substantial holdings in the Company on 07 April 2020 and the current voting power remains at 15.88% as compared to the previous voting power of 17.05%.

As of now, the Company is not able to evaluate the full impact of COVID-19 on the economy and business. However, its business is well placed to meet operational challenges, which is supported by its diverse enterprise customer base, distributed business operations, cloud-based technology and flexible cost structure.

As on 31 December 2019, the Company had a robust balance sheet with no debt and a closing cash balance of $27.1 million. Moreover, BTH reiterated FY20 guidance of 30-40% organic revenue growth along with stable retention.

The stock of BTH closed the day’s trading session at $0.640 per share on 14 April 2020, indicating an increase of 4.918% against its previous closing price. The market capitalisation of BTH stood at $188.55 million. During the last three months and six months, the stock generated returns of -18.67% and 15.09%, respectively.

Primero Group Limited (ASX:PGX)

Primero Group Limited is a provider of engineering and construction services to the energy, minerals, as well as infrastructure sectors. The Company has been granted variations on its existing contracts at Mesa K and Koodaideri for a collective value of around $20 million.

PGX has and continues to execute numerous health and safety measures, considering a high level of uncertainty surrounding the spread, duration and impact of COVID-19. The Company possesses and retains strong liquidity as well as a very low level of gearing. Its cash balance stood at $14 million as on 27 March 2020.

The stock of PGX closed the day’s trading session at $0.195 per share on 14 April 2020, in line with its previous closing price. The market capitalisation of PGX stood at $33.58 million. During the last three months and six months, the stock generated returns of -45.83% and -47.30%, respectively.

Mainstream Group Holdings Limited (ASX:MAI)

Mainstream Group Holdings Limited is engaged in providing fund and superannuation administration services. John Plummer has made a change to substantial holdings in the Company on 09 April 2020, and the current voting power remains at 9.9% against the previous voting power of 8.8%.

On the outlook front, the Company has suspended its guidance for FY20 as a result of uncertainty and unknown duration of current conditions caused by COVID-19. MAI is currently is reviewing several initiatives for decreasing its costs, which include a temporary reduction in Board fees as well as executive salaries.

The stock of MAI closed the day’s trading session at $0.365 per share on 14 April 2020, a decline of 1.351% compared to the previous close. The market capitalisation of MAI stood at $48.78 million. During the last three months and six months, the stock generated returns of -32.73% and -22.11%, respectively.