What is a Penny Stock?

Though there is no specific definition to what a penny stock is, but as per its characteristics, penny stock is one which trades at a very low or discounted price, especially when compared to its face value and also have very low market capitalisation. These stocks are considered to be illiquid and have traditionally traded on smaller exchanges, as opposed to other mid-cap and large-cap stocks.

Talking about the United Kingdom markets, experts generally suggest that any stock that trades under a value of £1.00 per share or less than GBX 100 per share is considered to be a penny stock. These stocks generally trade on the Alternative Investment Market (AIM) of the London Stock exchange. Companies listed on the AIM segment of the LSE tend to be small-cap or penny stocks with being highly speculative in nature, because of the regulatory flexibility provided to them.

Penny Stocks are considered to be a double-edged sword, as they carry huge risks as opposed to other mid cap and blue-chip stocks, primarily because of their speculative nature and regulatory flexibilities, but can also turn investorsâ fortune with great returns in a very short span of time.

Risks associated with trading in Penny Stocks

There are some risks associated with investing in penny stocks. Because of the fact that these stocks are less regulated in comparison with the other equities, even when trading on stock exchanges, there are multiple risks associated with such stocks. One of the major risks is the fact that the majority of these companies are considered to be of low quality. In most cases, the financial positions of these companies are in bad shape. Other drawbacks associated with these companies are the product or service that they are bringing to market, might not be sustainable.

Another hard truth associated with penny stocks is the fact that most investors, who invest in Penny Stocks, generally lose money, primarily because there is no clear idea and research before investing into these stocks, and these investors fall victim to âgo with the marketâ or âspeculativeâ approach. Even though this is not true for all investors, there is a big chance of losing money in penny stocks.

Another problem associated with these stocks is that frauds as well as pump and dump trick, are used to trap investors, as these stocks are thinly traded in the market.

Know more about step by step process of investing in penny stocks.

Guidelines on how to make money with Penny Stocks

It is important to follow a few suggestions before investing in Penny Stocks. These include:

- Strong Financials â It is important to concentrate on companies with strong financial positions. Even though no-debt is desirable when interest rates are rising, itâs not very pragmatic too. This is especially true for Penny Stocks, because most of these companies are in the early stages of development and a lot of debt is not good for their financial positions.

- Profitability â It is important to invest in companies that have been consistently profitable, primarily because of two reasons. First is that a profitable company is also likely to pay dividends, which results in additional income, and second, that consistent profitability is a sign of the growth of the company.

- Industry Knowledge â Investing in a business and an industry, which you do not understand could be risky, and hence, it is extremely important to invest in companies, whose business models as well as products and services are easily understandable to the investor.

- Diversification â Experts suggest that when investing in penny stocks, it is important to diversify investments, as it reduces risks and at the same time, the chances for the growth of returns increase.

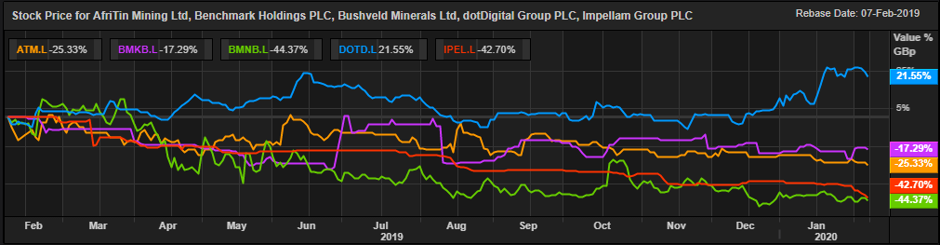

On the basis of the above-mentioned insights, the following is a list of five penny stocks on the alternative investment market of the London Stock exchange, that could be called having the potential to make you wealthy in 2020.

Afritin Mining Limited (LON:ATM) Share Price Performance

As on 10th February 2020, at 08:00 A.M (Greenwich Mean Time), by the time of writing this report, the Afritin Mining Limited share has been reported to be trading at a value of GBX 2.80 per share on the London Share Exchange market, no change in the price of the share, as opposed to the price on the previous trading day. The market capitalisation (M-Cap) of the share stood at a value of GBP 18.29 million, with respect to the current market price of the share of the company at the time of writing this report.

It has been reported that the Afritin Mining Limited share had lost around 21.13 per cent in value, in the last twelve months, since February 11, 2019.

Benchmark Holdings Plc (LON:BMK) Share Price Performance

As on 10th February 2020, at 08:10 A.M (Greenwich Mean Time), by the time of writing this report, the Benchmark Holdings Plc share has been reported to be trading at a value of GBX 43.00 per share on the London Share Exchange market, a fall in the price of 4.44 per cent or GBX 2.00 per share, as opposed to the price on the previous trading day, which had been reported to be at GBX 45.00 per share. The market capitalisation (M-Cap) of the share stood at a value of GBP 251.54 million, with respect to the current market price of the share of the company at the time of writing this report.

It has been reported that the Benchmark Holdings Plc share had lost around 17.29 per cent in value, in the last twelve months, since February 11, 2019. Benchmark Holdings Plcâs beta was reported to be at 0.28, indicating the fact that the share price movement of the Benchmark Holdings Plc share, is less volatile, as against the movement of the comparative benchmark index.

Bushveld Minerals Limited (LON:BMN) Share Price Performance

As on 10th February 2020, at 08:15 A.M (Greenwich Mean Time), by the time of writing this report, the Bushveld Minerals Limited share has been reported to be trading at a value of GBX 19.75 per share on the London Share Exchange market, no change in the price, as opposed to the price of the previous trading day. The market capitalisation (M-Cap) of the share stood at a value of GBP 227.71 million, with respect to the current market price of the share of the company at the time of writing this report.

It has been reported that the Bushveld Minerals Limited share had lost around 42.75 per cent in value, in the last twelve months, since February 11, 2019. Bushveld Minerals Limitedâs beta was reported to be at 0.44, indicating the fact that the share price movement of the Bushveld Minerals Limited share, is less volatile, as against the movement of the comparative benchmark index.

DotDigital Group Plc (LON:DOTD) Share Price Performance

As on 10th February 2020, at 08:20 A.M (Greenwich Mean Time), by the time of writing this report, the DotDigital Group Plc share has been reported to be trading at a value of GBX 112.50 per share on the London Share Exchange market, a surge in the price of 2.27 per cent or GBX 2.50 per share, as opposed to the price on the previous trading day, which had been reported to be at GBX 110.00 per share. The market capitalisation (M-Cap) of the share stood at a value of GBP 327.68 million, with respect to the current market price of the share of the company at the time of writing this report.

It has been reported that the DotDigital Group Plc share had gained around 26.44 per cent in value, in the last twelve months, since February 11, 2019. DotDigital Group Plcâs beta was reported to be at 0.99, indicating the fact that the share price movement of the DotDigital Group Plc share, is almost as volatile as the movement of the comparative benchmark index.

Impellam Group Plc (LON:IPEL) Share Price Performance

As on 10th February 2020, at 08:30 A.M (Greenwich Mean Time), by the time of writing this report, the Impellam Group Plc share has been reported to be trading at a value of GBX 316.00 per share on the London Share Exchange market, a fall in the price of 0.63 per cent or GBX Â 2.00 per share, as opposed to the price of the share on the previous trading day, which had been reported to be at GBX 318.00 per share. The market capitalisation (M-Cap) of the share stood at a value of GBP 148.86 million, with respect to the current market price of the share of the company at the time of writing this report.

It has been reported that the Impellam Group Plc share had lost around 42.70 per cent in value, in the last twelve months, since February 11, 2019. Impellam Group Plcâs beta was reported to be at 00.10, indicating the fact that the share price movement of the Impellam Group Plc share, is inversely correlated to the movement of the comparative benchmark index.

Comparative Share Price chart of ATM, BMK, BMN, DOTD and IPEL

(Source: Thomson Reuters) Daily Chart as on 10-February-20, before the closing of the LSE Market