The health care industry in Australia is complicated and receptive to the new product as well as technology. In the health care sector, there is a consistent requirement of medical devices in particular for those devices that are intended to treat and manage age related disorders. There is a growing demand for devices that are available for the management of disability and chronic pain which helps to improve the recovery time among patients. The devices that already have CE markings are easily accessible to the Australian market from a regulatory point of view.

In this article, we are discussing the ASX listed medical device stocks and their plans for 2020- PNV, COH, NAN, FPH, EMV

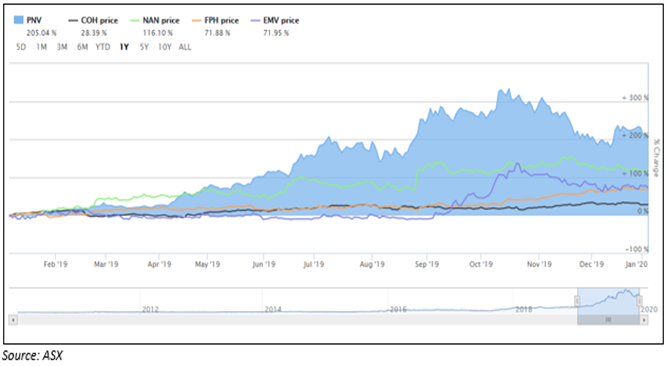

Financial year 2019 performance- When we look for the financial year performance of the above mentioned five medical device stocks, it has been observed that all the stocks have delivered a positive return in the previous financial year.

From the below-represented graph is the evidence that in 2019 all the stocks have delivered positive return, PNV stock has delivered the highest return of 205.4%, followed by NAN (116.10%), EMV (71.95%), FPH (71.88%) and COH (28.39%).

PolyNovo Limited (ASX:PNV)

An Australian headquartered medical device company PolyNovo Limited (ASX:PNV) is engaged in developing NovoSorb BTM, a dermal regeneration solution. PNV manufactures this solution by using its patented technology which is based on polymer and known as NovoSorb biodegradable polymer technology. The developmental program of PolyNovo provides solutions for Breast Sling, Hernia, and orthopaedic applications. NovoSorb BTM is registered for use in the United States, Australia, Malaysia, Saudi Arabia, South Africa, New Zealand, India and Israel.

Financial performance 2019- (year ended on 30 June 2019)

- PolyNovo reported revenue for FY2019 of $13.683 million up by 128% as compared to the previous corresponding period (pcp).

- Revenue from Sales of NovoSorb BTM is approximately $9.3 million.

- The cash on hand of the company on 30 June 2019 was nearly $13.9 million.

Outlook-

PolyNovo predicts that manufacturing process for hernia would bring some efficiency advantages to NovoSorb BTM making an encouraging impact towards its gross margins.

Moreover, the company also mentioned that the new manufacturing machines have been ordered and would be delivered circa February 2020. The company anticipate filing for US FDA 510(k) towards the end of the fiscal year 2020.

The CE Burns trial has been completed and PolyNovo plans to conclude the final publication of results by the end of Feb/March 2020.

On 8 January 2020, PNV’s stock last traded at $1.865, down by 8.128% compared to its last closing price, with a market cap of approximately $1.34 billion.

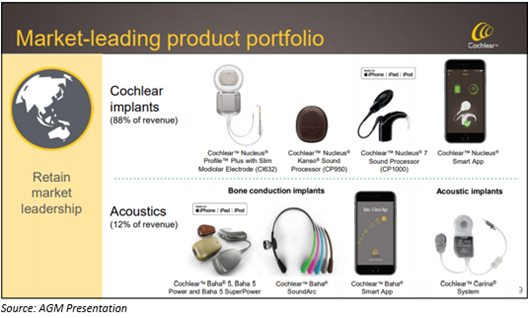

Sydney headquartered ASX listed medical device company Cochlear Limited (ASX:COH) is into development and supply of implantable hearing solutions for delivering a lifetime of hearing outcomes.

Cochlear’s implantable hearing solutions has two main parts; first is the external sound processor and the second part is the implant surgeons, which is put under the skin and is attached to an electrode array they place in the inner ear. The company provides Cochlear implants as well as acoustics and 12% of the total revenue come from acoustics that includes bone conduction implants and acoustic implants.

FY20 financial outlook

In the FY 19 results for the period close 30 June 2019, COH mentioned the outlook for FY 20 period as mentioned below:

- For the fiscal year 2020, Cochlear expects to deliver reported net profit of $290-300 million, up by 9-13% on underlying net profit for FY19.

- In the fiscal year 2020, the company anticipates strong growth in cochlear implant units, driven by several new products launched late in the financial year 2019.

- Cochlear expects to release the new osseointegrated steady-state implant (OSIA) product later in the financial year 2020 to expand the Acoustics product portfolio.

On 8 January 2020, COH’s stock last traded at $223.430, slipping by 1.12% compared to its last close, with a market cap of approximately $13.07 billion.

A health care sector player Nanosonics Limited (ASX:NAN) is engaged in the development of unique automated high-level disinfection device and is an innovator in providing high-level disinfection for ultrasound probes.

Nanosonics unique, automated trophon® EPR high-level disinfection device is a comprehensive solution for decreasing the spread of health care acquired diseases by reducing the contamination among the patients.

The company is working with the goal of improving the safety of patients, clinics as well as their staff by transforming the way of infection prevention and introducing innovative technologies for providing improved standards of care.

FY20 outlook-

For the financial year 2020, the company has planned to focus majorly on the below three areas-

- Nanosonics would be establishing trophon as standard of care for the high-level disinfection of all semi-critical ultrasound probes.

- The company would invest and expand into new markets and drive awareness for the significance of high-level disinfection of ultrasound probes.

- NAN is planning to expand its product portfolio and focus on the development and commercialisation of new products focusing on unmet needs in infection prevention.

On 8 January 2020, NAN’s stock last traded at $6.360, going down by 0.469% from its last close, with a market cap of approximately $1.92 billion.

Fisher & Paykel Healthcare Corporation Limited (ASX:FPH)

A leading medical device company Fisher & Paykel Healthcare Corporation Limited (ASX:FPH) is a prominent developer and marketer of a broad range of products and systems. The products offered by the company are used for the treatment of obstructive sleep apnea (OSA) and for providing acute and respiratory care. FPH operates in two groups; Hospital product group, which comprises of humidification products used in respiratory, acute and surgical care and Homecare product group, which comprises of products used in the respiratory support and for the treatment of obstructive sleep apnea (OSA) in the home.

Half-year results for 2020-

For the six-month period ended 30 September 2019, FPH mentioned the following pointers:

- Net profit after tax for the H12020 was $121.2 million, up by 24% as compared to the previous corresponding period (pcp).

- The operating revenue was $570.9 million, up by 12% on pcp.

- The group operating revenue from hospital product increased by 19% to a record $353.6 million.

- In the homecare product group, the operating revenue soared 2% to NZ$214.7 million.

Outlook for the remainder of FY2020-

- For the second half of the financial year 2020, the company expect consistent underlying trends in its hospital product group. Moreover, for the remaining half, FPH expects constant currency hospital revenue growth like the H2 FY19.

- At current exchange rates, Fisher & Paykel continues to anticipate complete year operating revenue for the financial year 2020 to be around $1.19 billion and net profit after tax to be nearly in the range of $255-$265 million.

On 8 January 2020, FPH’s stock settled the day’s trade at $21.170, falling by 2.622% from its previous close, with a market cap of approximately $12.49 billion.

EMvision Medical Devices Limited (ASX:EMV)

An ASX listed Australia based medical device company EMvision Medical Devices Limited (ASX:EMV) is engaged in both the development, as well as commercialisation of medical imaging technology. EMvision is developing a portable, cost effective brain scanner employing electromagnetic microwave imaging to monitor and diagnose stroke.

Outlook-

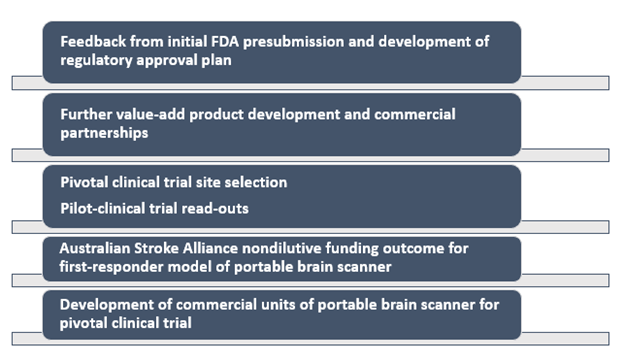

In the financial year 2020, EMvision would continue to explore the partnerships for the product development as well as for commercialistion, and the company anticipates that it will add long-term value to EMV.

In addition, the collaboration made in 2019 with Australian Stroke Alliance, Keysight Technologies and NVIDIA Corporation would drive the company to achieve excellent growth in 2020.

Target milestones for 2020-

The company has planned key milestones over the next 6-12 months-

On 8 January 2020, EMV’s stock settled the day’s trade at $0.690, down by 2.817% from its last close, with a market cap of approximately $45.2 million.

By looking at the previous financial year highlights and the future plans of the above discussed five medical device stocks, it could be concluded that the collaborations and achievements made in 2019 would definitely add great value for achieving the set goals for the forthcoming year.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.