What is an IPO?

A process wherein any private corporation coming forward to offer its shares to the public through first sale or issue of its shares is characterised as an Initial Public Offering. A primary benefit of raising funds through an IPO lies in getting access to capital from a large number of investors and usage of the capital to further expand the business.

Opticomm Limited

Opticomm Limited (proposed ASX code: OPC) is a licensed carrier and wholesale network infrastructure operator that designs, builds, operated and maintains telecommunication networks. Currently, the company has its operations across Victoria, South Australia, Queensland, Western Australia, New South Wales and the Australian Capital Territory.

The company intends to raise a total capital of $42,351,834 through issue of fully paid ordinary shares at an issue price of $2.00 per share. The offer is expected to close on 12 August 2019. The company has appointed Morgans Corporate Limited as an underwriter to the issue.

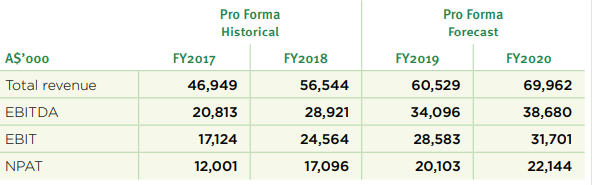

Financial Highlights: In FY2018, the company reported pro forma total revenue amounting to $56.54 million, as compared to $46.95 million in FY2017. Pro forma EBITDA for FY2018 amounted to $28.92 million against FY2017 EBITDA of $20.81 million. FY2018 pro forma net profit after tax amounted to $17.10 million, as compared to $12.00 million in FY2017. Over the past 3 years, the company witnessed strong growth in organic revenue, earnings and cash flow driven by active services on the companyâs network.

Financial Summary (Source: Company Prospectus)

Growth Strategy: The company is primarily focused on execution of its contracted pipeline of development projects. Other growth plans involve targeting new developers by leveraging the companyâs expertise and scale, delivery of smart city solutions to generate additional revenue, and increasing focus on markets other than the traditional markets. The company is also in the process of expanding the number of retail service providers and investigation of acquisition-related and other strategic opportunities. The company seeks to grow its earnings and cashflow through the above strategies and in turn increase the enterprise value of the business. This will help drive recurring revenues, increasing the ability to pay dividends to investors.

Dividend Policy & Targeted Dividend: The directors of the company are targeting a dividend payout ratio of up to 60% of the annual free cash flow of the company, franked to the maximum extent possible. For FY2020, the directors intend to target an indicative annualised dividend yield of 3.6%. Post FY2020, dividend payout ratio is targeted to be approximately 60% of the free cash flows. For FY 2020, the Board expects to pay the first dividend in October 2019 followed by final dividend in April 2020.

Tartana Resources Limited

Tartana Resources Limited (proposed ASX code: TNA) is engaged in mining and exploration activities. The company aims to become a significant copper and zinc company through development of its projects. The company has a total of four projects namely Tartana Copper and Zinc Project in north Queensland, Zeehan Zinc Slag Project in western Tasmania, Mount Hess Copper-Gold Project in Central Queensland and Amber Creek Molybdenum-Tin-Tungsten Project in north Queensland.

The company recently conducted an initial public offer through issue of ordinary fully paid shares at an issue price of $0.20 per share to raise a total capital of $6,000,000. The company had appointed Taylor Collison as the sponsoring broker for the offer. The offer closed on 26 July 2019.

Projects: The company has a number of projects with different exploration and maturity levels. There are a total of four projects including Tartana Copper and Zinc Project in north Queensland, Zeehan Zinc Slag Project in western Tasmania, Mount Hess Copper-Gold Project in Central Queensland and Amber Creek Molybdenum-Tin-Tungsten Project in north Queensland. As a part of its business plan, the company will conduct further explorations at each of the above projects to quantify copper and zinc resources.

Usage of Funds: The funds raised through the IPO will be utilised to undertake drilling as part of the projects. In addition, funds will be utlized for project generation, commencement of initial exploration at Mt Hess, further advancement of the Zeehan Zinc Slag Project and Amber Creek Projects.

Future Capital Needs: The company is expected to witness a shortage of cash reserves due to exploration and development costs associated with each of its projects. The future capital requirements will depend on the pipeline of development activities to be undertaken, involving development of existing projects or acquisition of new projects.

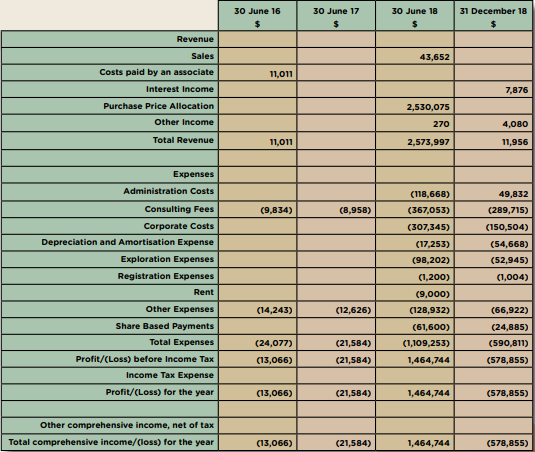

Financial Highlights: The company reported loss for the financial year 2018 amounting to $578,855. The company has not generated any operating revenue so far and is unlikely to generate any operating revenue before successful development of its projects and commencement of production.

Financial Highlights (Source: Company Prospectus)

Dividend Policy: In the near future, the company will focus primarily on the exploration of existing projects and further acquisition of new projects. Hence, it does not expect to pay dividends as of now.

Osteopore Limited

Osteopore Limited (proposed ASX code: OSX) engaged in production of 3D printed bioresorbable implants that assist with natural stages of bone development when used in conjunction with surgical procedures. The company has commercialised a number of products including Ostreostrip, Osteomesh and Osteoplug. In addition, some of its products have received FDA and CE mark approval which are being supplied to hospitals for revenue generation. Currently, the companyâs products are available in India, US, Malaysia, Vietnam, Western Europe markets, Singapore and South Korea.

The company has planned to raise a total capital of $5,250,000 through an issue of ordinary fully paid shares for a consideration of $0.20 per shares. The company will close the offer on 23 August 2019.

The company has commercialised a number of products including Ostreostrip, Osteomesh and Osteoplug. In addition, some of its products have received FDA and CE mark approval which are being supplied to hospitals for revenue generation. Currently, the companyâs products are available in India, US, Malaysia, Vietnam, Western Europe markets, Singapore and South Korea

Growth Strategy: The company aims at enhanced market penetration of the Osteomesh, Osteostrip and Osteoplug products. It plans to invest in sales and marketing infrastructure across Asia, EU, USA and Australia. In order to enhance the revenue, the company aims to undertake market development and business development activities. In addition, it is targeting to expand its offerings particularly into the long bone, orthopaedic and dental segments.

Usage of Funds: The funds raised through the IPO will be utilised for supporting market penetration, investments into new 3D printed microarchitecture and bioresorbable materials, provision of general working capital and payment of cost of the offer.

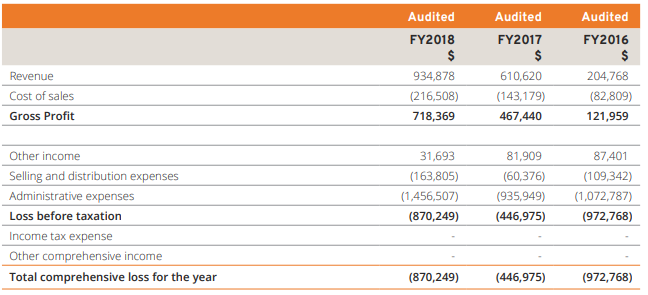

Profit & Loss Statement (Source: Company Prospectus)

Financial Highlights: During FY2018, the company generated revenue amounting to S$934,878, as compared to FY2017 revenue of S$610,620. Gross profit for the period amounted to S$718,369, as compared to gross profit of $467,440 in the corresponding prior-year period.

Dividend Policy: The company wants to be primarily focussed on growing its existing businesses and does not expect to pay any dividends in the near future. Payment of any dividend in the future will be dependent upon the companyâs distributable earnings, operating results and its financial position.

Trigg Mining Limited

Trigg Mining Limited (proposed ASX code: TMG) is engaged in identifying and evaluating mineral exploration projects. The company is exploring the essential potassium-based fertiliser, sulphate of potash or potassium sulphate that provides necessary nutrients for agricultural food production and human health.

The company intends to raise a mimimum amount of $4,500,000 through issue of fully paid ordinary shares and quoted options at an issue and exercise price of $0.20 each. The expected date of closure for the offer is 26 August 2019.

Major Assets: Laverton Links and Lake Throssell Potash Projects are the two major assets of the company. The projects cover approximately 2,640 km2 of tenure, comprising playa lakes of more than 400 km2 of and interpreted paleochannels of 300 km, considered prospective for potassium bearing brine.

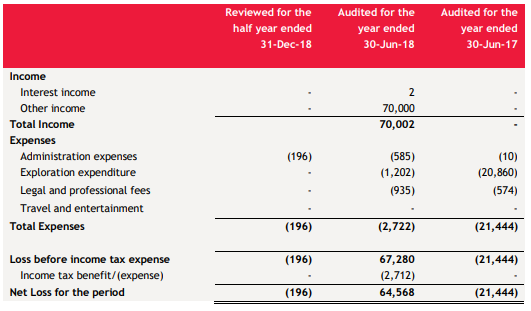

Revenue Generation: The company did not have any revenue as on the date of prospectus. It aims to develop and explore two prospective SOP projects including the Laverton Links Potash Project and the Lake Throssell Potash Project, located in the Goldfields region of Western Australia. Until the successful commercialisation of any of the above projects, the company is unlikely to report any revenue.

Statement of Profit & Loss (Source: Company Prospectus)

Strategy: The company wants to remain focused on exploration activities on the more advanced prospects at the Laverton Links Potash Project, namely Lake Rason and Lake Hope Camplbell Prospects. With this, the company aims to expand its exploration target. In case of the less advanced Prospect of East Laverton, the company plans to adopt a phased and systematic approach to add value to exploration.

Dividend: The company has notified that the payment of any dividends will be decided by the Directors upon consideration of future earnings and financial position of the company. The company is currently focused on long term growth and has not provided any information in the prospectus regarding payment of any dividends in the immediate foreseeable future.

Usage of Funds Raised from IPO: The company aims to use the funds raised to continue exploration and evaluation work at its projects.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.