Being listed on a stock exchange has many advantages for a company especially during a growth phase. It usually represents a milestone for most privately owned companies. The benefits include the ability to raise additional funds through the sale of or issuance of stocks to raise capital. The capital thus raised could be for new projects, to undertake expansions, or to provide exit (completely/partially), to the existing shareholders with a large group of new shareholders.

Besides, having a listed stock also enables a company to enjoy additional leverage when obtaining loans from financial institutions as well as attract the attention of mutual and hedge funds, market makers and institutional traders. Thereafter, a company may also offer stock and stock options programs to potential employees, which is quite attractive to the top talent in the industry.

It also provides an avenue for indirect advertising and ensures brand equity by enhancing the credibility with the public.

Letâs take a look at the following three Australian companies preparing to debut on the Australian Securities Exchange (ASX) in the foreseeable future.

Trigg Mining Limited

Trigg Mining Limited, to be listed under the ticker ASX: TMG, is based in Perth, Western Australia (WA) and operates as a resource company engaged in the exploration, production, and development of naturally occurring sulphate of potash (SOP). Usually, SOP is found in potassium-rich hypersaline brine water, which provides two essential elements (natural fertilisers) for plant growth and human nutrition - Potassium and Sulphur.

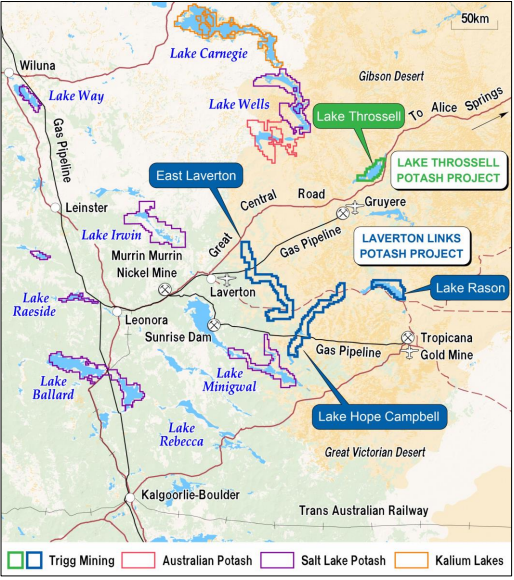

Project Portfolio- Trigg Mining has built a competitive footprint across two SOP projects (80% -owned, becoming 100% on IPO) in WA, which together cover approximately 2,640 km2 of granted tenure.

- Laverton Links Potash Project- This project includes 3 prospects (Lake Hope Campbell, Lake Rason, and East Laverton) and includes eight granted exploration licences for a total area of 2,265 km². Recently at Lake Rason, the company defined a JORC Complaint SOP exploration target and identified SOP mineralisation at Lake Hope Campbell Prospect along the length.

- Lake Throssell Project- It covers 322 km² of predominantly Salt Lake playa sediments and underlying palaeochannels and is located 200 km east of Laverton. With the Native Title Agreement for exploration in place, Trigg Mining plans to undertake a heritage survey and reconnaissance exploration in the time to come.

Source: Investor Presentation

IPO Prospectus â On 24 April 2019, Trigg Mining lodged an Initial Public Offer (IPO) prospectus with the Australian Securities and Investment Commission (ASIC), presenting an offer of 22,500,000 fully paid ordinary shares at an issue price of $ 0.20 each to raise around $ 4,500,000 before expenses, together with 11,250,000 free attaching options (on the basis of one option for every 2 Shares subscribed for) exercisable at $ 0.20 each on or before 31 October 2021 (Public Offer).

CPS Capital Group Pty Ltd is acting as the Lead Manager to the Public Offer.

As reported, the Public Offer commenced on 2 May 2019 and due to close on 23 July 2019 (may vary without notice).

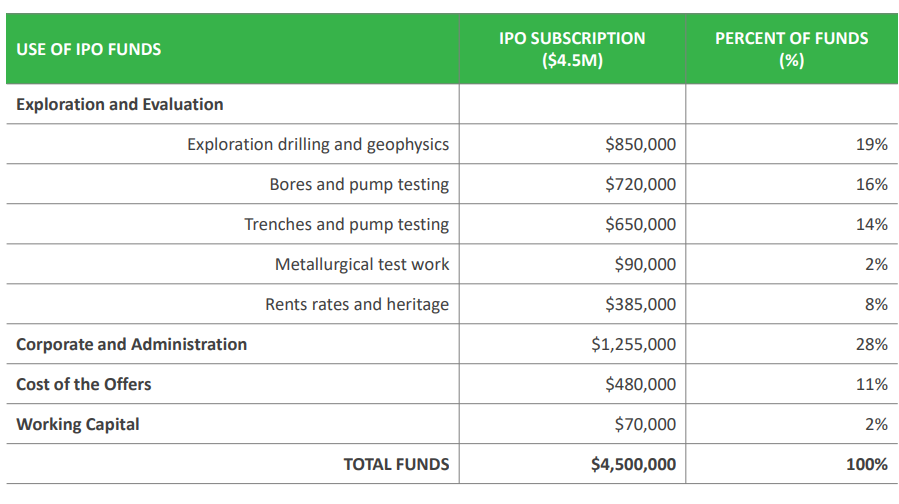

The $ 4.5 million IPO and the subsequent listing on the ASX is expected to facilitate the next stage of development of the tenements with expenditure planned to expand the Exploration Target and to progress towards the approximation of a Mineral Resource and possible flowsheet selections for the processing of brine.

As indicated in the Investor Presentation, the funds generated would be directed towards the following.

Source: Investor Presentation

Source: Investor Presentation

SOP Outlook- SOP is an essential fertiliser for global food security, particularly for high-value chlorine sensitive crops such as avocados, coffee beans, grapes, tree nuts, fruit and vegetables, and arid and acidic soils. At present there is no domestic production in Australia.

Thus, Trigg Mining is well positioned to serve and capitalise on the growing need for fertilisers in the Asia Pacific Region with close proximity to infrastructure like two gas pipelines, two airstrips at the Tropicana and Gruyere gold mines and a commercial airport at Laverton, multiple roads, rail and a deep water port for distribution to domestic and international markets.

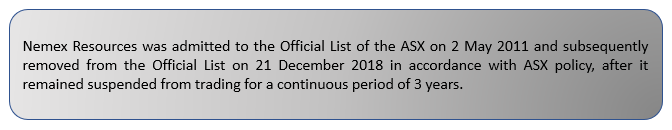

Nemex Resources Limited

Nemex Resources Limited, to be listed under the ticker ASX: NXR, is based in Mount Hawthorn, Western Australia, and focussed on securing interest in and exploration and development of, various mineral exploration projects prospective for gold and base metals in Western Australia (WA).

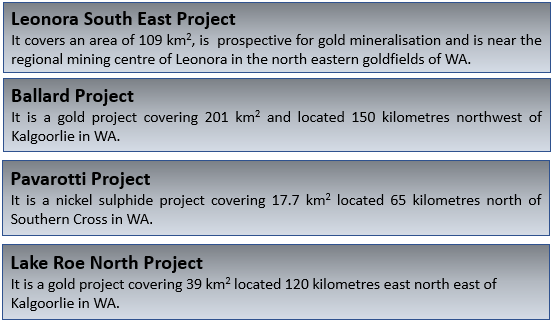

Project Portfolio- In April 2019, the company announced to have entered into two conditional agreementsâ

- Legendre Acquisition Agreement- An acquisition agreement under which it has a conditional right to acquire an 80% interest in the Leonora South East Project, the Ballard Project and the Pavarotti Project; and

- an acquisition agreement under which it has a conditional right to acquire 100% of the Lake Roe North Project (Lake Roe North Acquisition Agreement).

Following the completion of the acquisitions, the company would hold interest in the projects given below.

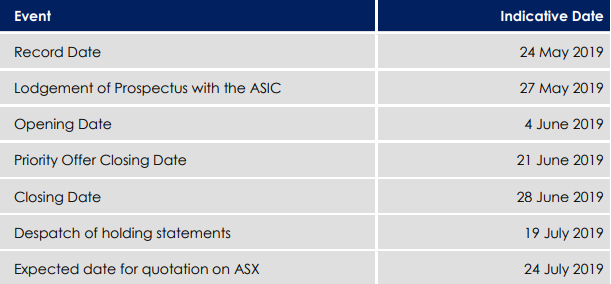

IPO Prospectus - Nemex Resources lodged its IPO Prospectus with the ASIC on 27 May 2019, presenting its offer for the issue of 25,000,000 Shares to retail and sophisticated investors at an issue price of $ 0.20 each to raise up to $ 5,000,000. The minimum subscription is $ 4,500,000 through the issue of 22,500,000 Shares. DJ Carmichae is acting as the lead manager to the Offer.

Reportedly, the company has so far received firm commitments for Shares for a total of $ 4.5 million from Cornerstone Investors including â Hong Kong -based Natural Space Investment and Holding Group Limited - $ 1,950,000; Ms Ying Luo - $ 1,350,000; and Elephant Group Holding Ltd (a company controlled by Mr Victor Liu, a Director of the Company) - $ 1,200,000. They have been guaranteed the allocations as mentioned.

The indicative timetable for the offer is-

Source: Companyâs Prospectus

The Offer also includes a priority offer to existing Shareholders who are Australian residents. The priority offer gives existing Shareholders a chance to increase their shareholding by subscribing for Shares under this Prospectus.

The primary purpose of the Offer is to generate funds to meet the expenditure commitments in relation to the proposed acquisition and undertaking systematic exploration programs on each of the companyâs Projects, aimed at the discovery of an economic mineral deposit.

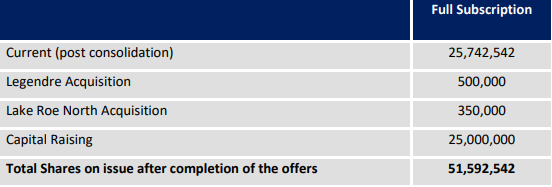

The proposed Capital Structure of the company following completion of the Proposed Acquisition and the Capital Raising is set out below-

Source: Companyâs announcement dated 15 April 2019

Composition of the Board of Directors â Following the settlement of the proposed acquisitions and listing on the ASX, the Board of the Company will consist of-

- Patrick Flint (B.Com, CA, MAICD) as the Non-Executive Chairman

- Paul Jurman (B.Com, CPA) â Non-Executive Director and Company Secretary

- Victor Liu â Non-Executive Director

Also, Hui Zhang and Tao Ding, existing Directors of the Company, will resign upon completion of the Acquisitions.

Every Board member holds an extensive and significant corporate, management and business development experience in general and across the global and domestic resources industry.

Other Key Management Personnel will include Mr Lijun Yang (MMLM, AIG and SEG) as the Exploration Manager for the Company, and he brings technical expertise to the management team. Mr Yang is also the vendor under the Lake Roe North Acquisition Agreement.

Tartana Resources Limited

Tartana Resources Limited, to be listed under the ticker ASX: TNA, based in Sydney, Australia, is engaged in the acquisition, development, exploration, and mining of copper and zinc projects.

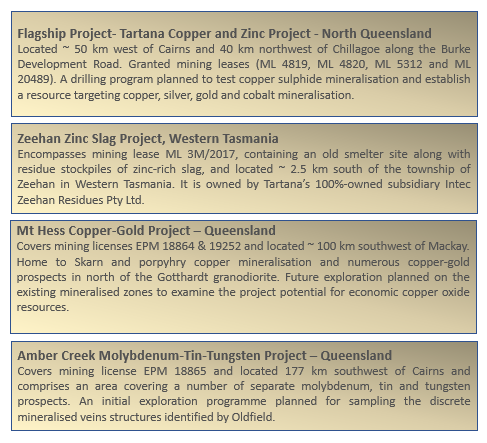

Project Portfolio- The companyâs current project portfolio comprises â

Under the Tartana Copper and Zinc Project, the company has further defined three separate projects and one prospect within the four mining leases. These include the Queen Grade Zinc Project, Copper Oxide Project, Copper Sulphide Project and the Valentino Copper-Gold-Silver-Cobalt Prospect.

Recently on 29 May 2019, Tartana Resources announced that it had commissioned the services SRK Consulting (Australasia) Pty Limited to provide JORC 2012 compliant Open Pit Exploration Targets for the Queen Grade Zinc Project, the Copper Sulphide Project below the existing open pit and the Valentino Copper Project.

In addition, Tartana has also commissioned Bluespoint Mining Services Pty Ltd to estimate an Indicated Resource Statement which is JORC 2012 compliant for the Zeehan Zinc Slag Project in consultation with SRK.

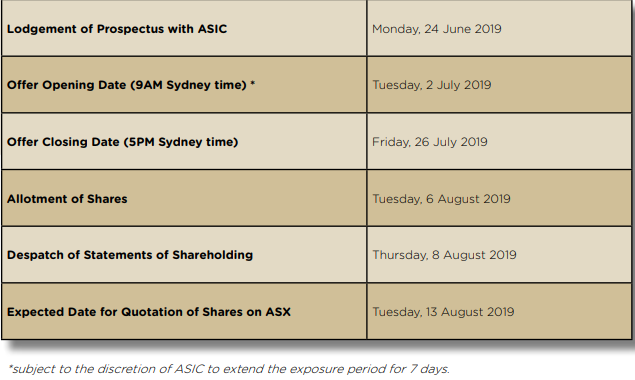

IPO Prospectus â On 24 June 2019, the company lodged an IPO Prospectus with ASIC presenting an offer of a minimum of 20,000,000 ordinary shares and a maximum of 30,000,000 ordinary shares at an issue price of $ 0.20 each to raise a minimum of $ 4,000,000 and a maximum of $ 6,000,000. The indicative calendar for the offer is as below-

Source: Company Prospectus

The company aims to fund its business development activities, exploration program and other objectives in the short term using the proceeds generated from the offer.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.