LBT Innovations Limited

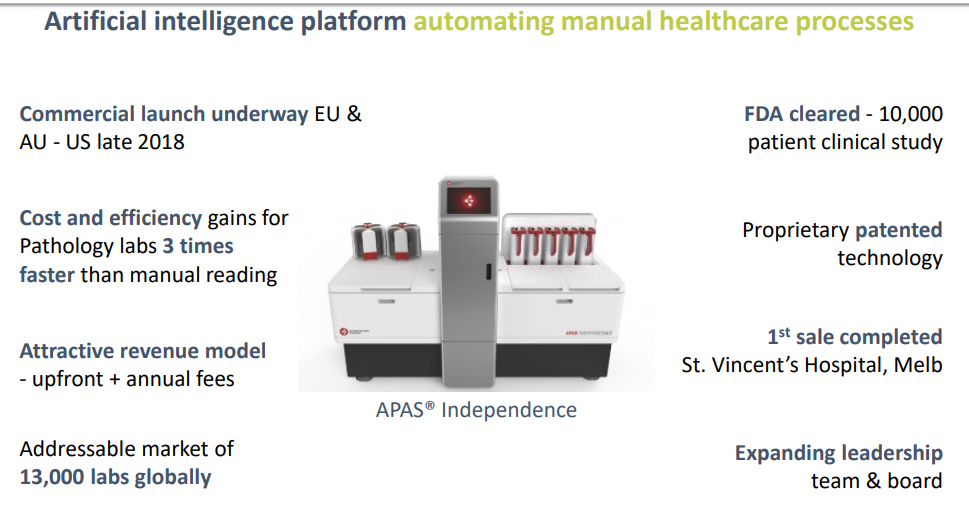

LBT Innovations Limited (ASX: LBT), established in 2004 and based in Adelaide, Australia, is engaged in the research and development of technologies for the healthcare and laboratory supply markets in Australia, Switzerland, and the United States. It offers MicroStreak®, an automated culture-plate streaking and inoculation system; and the Automated Plate Assessment System (APAS®), for automated imaging, analysis and interpretation of culture plates following incubation.

With around 200.93 million outstanding shares and a market capitalisation of ~ AUD 28.13 million, the LBT stock price closed the market trading on 23rd May 2019, at the price of AUD 0.160, up by 14.286% by AUD 0.020. In addition, the LBT stock has generated a positive YTD return of 60.92% so far.

On 20th May 2019, LBT Innovations informed the market that its joint venture company, Clever Culture Systems (50% owned) had received 510(k) clearance from the United States Food and Drug Administration (FDA) for its APAS® product offering. This marked the final regulatory milestone that would allow the commencement of commercialisation and sales activities for APAS® in the United States.

Source: Business Update Presentation

Source: Business Update Presentation

The US, with more than 5,000 clinical laboratories and the single largest pathology market in the world, presents a lucrative market opportunity for LBT.

Also, in the same month, the company announced the drawdown of the first installment of $ 1.0 million of the total $ 4 million loan facility provided by the South Australian Government.

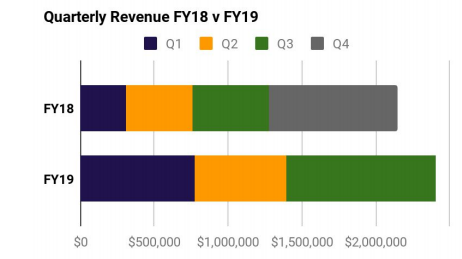

With the end of the March 2019 quarter, the cash balance stood at $ 4.2 million.

Rhinomed Limited

Rhinomed Limited (ASX: RNO), based in Melbourne, operates as a medical technology company and serves clients in Australia and the United States. It is focussed on developing respiratory management technologies and working to monetise on its portfolio in the sleep, sport, wellbeing and drug delivery markets across the world.

With a market capitalisation of around AUD 34.06 million and 141.93 million outstanding shares, the RNO stock settled the dayâs trading on 23rd May 2019 at the last price of AUD 0.250, edging up 4.167% by AUD 0.25 on the previous dayâs close of AUD 0.240. In addition, the RNO stock has generated a positive YTD return of 26.32% so far.

Recently, W. Whitney George increased his shareholding in the company to 23.92% from 22.92% upon purchase of additional ordinary shares.

Also, on 17th May 2019, the airway technology leader confirmed that itâs revolutionary new Pronto⢠rechargeable, dual action, vapour release technology has been registered with both the US FDA and the Australian TGA as a class 1 medical device.

In the USA, Rhinomed completed registration of Pronto including both variants - Pronto Clear and Pronto Sleep under device classification Name: Dilator, Nasal. Also, in Australia, the classification of Pronto was confirmed for the Australian Register of Therapeutic Goods (ARTG) under companyâs existing TGA listing under the same product category as its Mute and Turbine products.

For the quarter ended 31st March 2019, the company reported a strong growth of 64% in the revenue to $ 1.012 million and closed the period with cash in hand of AUD2.47 million.

Source: Companyâs Quarterly activities report

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.