In a significant development, the Tanzanian Government and Barrick Gold Limited have signed a landmark settlement agreement, providing a breakthrough to unlock the financing and development of the EcoGraf Limited’s (ASX:EGR) 100 per cent owned Epanko Graphite Project.

Barrick Gold and Tanzanian Government Signed Historic Landmark Agreement

The landmark settlement agreement signed by the Tanzanian Government and Barrick Gold has been described as “a historic day for Africa” by the Barrick President, Mr Mark Bristow.

Dr John Pombe Magufuli, the United Republic of Tanzania’s President, guaranteed complete government support to Barrick at the signing ceremony, ordering the respective authorities to liberate the concentrate containers that have been seized at the port of Dar es Salaam since March 2017.

Subsequent to the signing, Barrick announced an exploration budget of USD 50 million during 2020 as a sign of its confidence in Tanzania, seeking out opportunities to expand and sustain its operations within the country.

The settlement has paved the way for financing and development of the Epanko Graphite Project, that faced a delay in development for about two and a half years, during the deadlock between Barrick and the Government.

During the period of deadlock, EcoGraf worked with KfW IPEX-Bank consistently and involved the Government on resolution of the legislative issues affecting global financing of Tanzania’s mineral projects.

Agreement to Unlock Epanko’s Debt Financing Hurdles

The dispute resolution between the two parties is anticipated to unlock debt financing hurdles for the Epanko Graphite Project.

It is imperative to note that despite the delays resulting from uncertainty regarding the Barrick settlement and legislative changes, the Company has achieved positive progress in recent weeks to revise the proposed financing structure with an objective of fast-tracking and simplifying the entire debt financing.

To continue the senior debt financing of the new Epanko mine, the Company has been working with KfW IPEX-Bank and a second financial institution.

The Company notified that a senior debt funding proposal valuing USD 60 million is currently being formulated under the revised structure, and contingent on securing the agreement of all parties, finalisation of necessary loan agreements and approvals is anticipated to speed up by the recent landmark settlement agreement.

The on-going support received by the Company from offtake customers and KfW IPEX-Bank in Asia and Germany remains crucial to this process.

Development of Epanko Graphite Project Remains Well on Track

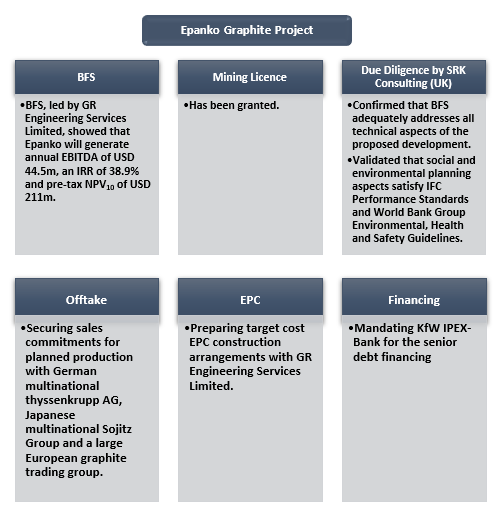

Epanko is a long-life, highly attractive natural flake graphite project in Tanzania, which has achieved the required milestones to facilitate rapid development, including Bankable Feasibility Study (BFS), mining licence, due diligence, debt financing.

It is worth noting that the Epanko project is exceptional in its Equator Principles development model as it has been created to meet the rigorous standards for social and environmental sustainability and to remain in full conformity with the Equator Principles and IFC Performance Standards.

The project’s stringent standards of sustainability offer assurance to customers and financiers that Epanko products will be responsibly made in the interest of all stakeholders.

Moreover, the strong economics of project will enable an inter-generational, long-term contribution to industrial, economic and social development within Tanzania.

The project is likely to operate for more than 40 years, during which it is projected to contribute more than USD 2 billion to Tanzania directly via procurement, local employment, taxes, royalties and dividends. It is also expected to create significant employment opportunities in Tanzania as more than 95 per cent of the 300 permanent staff will be Tanzanian people, with about 4,500 indirect jobs to be reinforced by the operation.

EcoGraf Maintains an Active Approach to Community Engagement

EcoGraf has maintained an active approach to community engagement at Epanko during the deadlock period between the Government and Barrick, undertaking a number of social projects within the Epanko and Mahenge communities over the last 12 months, which are as follows:

- Two new demonstration houses were constructed and provided.

- Additional buildings were constructed for the Epanko Primary School.

- 52 students were sponsored to attend educational programs at Mikumi Vocational Training centre.

- To prepare for national examinations, materials were donated to Ulanga secondary schools.

- Roofing materials were supplied at the Nawenge Secondary School for a new classroom.

In a nutshell, the historic landmark agreement signed between Barrick Gold and the Tanzanian Government is expected to speed up the development of the Epanko project. EcoGraf is well positioned to establish the project as a new supplier of high-quality, responsibly produced natural flake graphite commodities.

As on 31 January 2020, EGR is trading at $0.089 on the ASX.