Definition

Related Definitions

Stock Markets

While thinking of stock markets, you will imagine prices going up and down every second. Stock markets are, in some ways, perceived as a money-making place like Casino, and many people also prefer punting in stock markets.

But stock markets are also filled with intellectual investors seeking to build wealth. Word of mouth can be a source of positive or negative news. People especially small investors or short-term investors, looking to invest might have got scared by losses exhibited by sensible investors. Even the most successful investor can indeed incur losses.

There have been many successful investors who have navigated market cycles, economic cycles, booms and burst in markets. One thing that remains consistent is the discipline such investor possesses.

Stock markets or equity markets are a part of a broader capital markets system. Stocks means shares, so only shares are traded in stock markets. A stock market is a crucial element of a country’s financial ecosystem.

In order to grow and expand, businesses require capital. One way of raising this capital requirement is through getting the shares traded on one or various stock markets and allowing the general public to invest. Stock Market is a medium which connects investors and capital seekers/companies, who are willing to sell a part of their ownership for a sum of money, which is the stock price.

What is a share/stock?

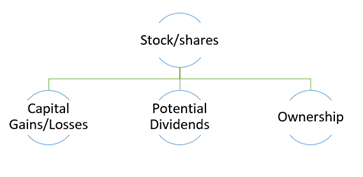

Also known as equity, it represents the ownership of an entity along with its profits, voting power, losses, and assets. Equity is a long-term source of financing the business and is non-redeemable by nature.

Voting rights are available to equity investors, giving them the authority to control the business and management. It enables the equity investors to choose the people who will run the business, and power to decide on the transactions to carried out by the firm that could impact shareholders, like a stock-merger.

Given that these shares are traded in stock markets, the ownership of business continues to change hands, as trades get settled every day. Hence, if an investor wants to become one of the holders in a particular company or wants to withdraw its ownership, it can simply be done by buying or selling of shares of that company in stock markets.

Equity shares have been responsible for creating the wealth of many investors. Shares prices movement also depends on the value of assets, cash flows and profits of a company. Price increases/decreases over time, providing investors with a capital gain/or loss on their investments. Meanwhile, equity shares could pay dividends to the shareholder, depending on the level of the residual cash left with the business.

Share price movement is backed by numerous factors, including rising competition, disruption in the industry, management decisions, losses, and windfall gains. In some cases, the companies shut down, leaving equity investors in the process of liquidation.

Equity is also seen as a hedge to inflation due to its unrestricted price appreciation potential since share price can go down to zero, but there is no upper limit defined. The rate of price appreciation could be higher than the rate of erosion in purchasing power, leaving the real value of invested assets positive.

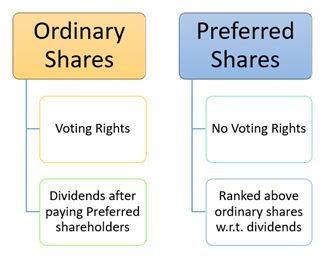

Ordinary Shares: It is the most common equity instrument that is traded in stock markets. Also known as common stocks/shares, the holders of these instruments are the owners of the entity with voting rights over the decisions of the company. Companies pay dividends to ordinary shareholders after all other commitments are duly taken care of.

Preferred Shares: Shareholders of preferred share are ranked above ordinary shareholder in the event of a dividend payment. They have a right to receive dividends prior to the ordinary shareholder that is why the term ‘preferred’ is used. However, there are no voting rights available to the preferred shareholders.

Why owners of the company sell their shares?

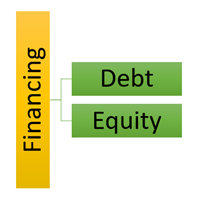

A business seeking funding has two options: debt or equity.

In debt funding, the business is granted a loan by the lender or investors. A loan can be received in the form of bank facilities, working capital facilities, bonds etc. Debt funding remains a popular choice for business as it helps to retain the voting and other rights of the shareholders by not diluting their stake, but the entity is obliged to repay the principal amount along with interest.

Equity funding allows the owners of the entities to sell a part of ownership to the investors at a price derived either through an Initial Public Offering (IPO) process or by the fight between demand and supply of a particular share. Equity holders are not required to be paid on a regular basis similar to debt capital providers, but ownership of the business is transferred.

Stock markets are not only like a funding bridge to the company, but they also provide a price value to the company’s shares. Stocks trade either at a discount or at a premium to their book value or earnings per share and stock markets provide multiples to those values.

Founders of the business are inclined to monetise their ownership in consideration for a sum of money, which is received by the founders in multiples of the underlying value of the business. Not limiting this to the founders, equity shareholders also benefit from the expansion of these multiples in the event of a favourable business environment.

What is a securities exchange?

A securities exchange is a market where buyers and sellers transact across various asset classes, including equity shares. It is an important part of the financial ecosystem of a country, provides a large marketplace for asset classes, including bonds, derivatives, commodities.

Shares of companies are listed on the stock exchange after a successful Initial Public Offering, and market participants can transact the shares of the company after the listing. Moreover, a stock exchange provides a secondary market for stocks.

At the same time, companies that are already listed on the exchange can continue issuing additional shares to raise further capital from the markets. A listing on a stock exchange requires necessary compliances to be adhered by the company, including continuous disclosure of material updates, disclosure of financials and much more.

Stock exchange charge fee from the companies that are listed on its board or are willing to list. In Australia, the Australian Securities Exchange (ASX) is a dominant exchange in the Australian capital market.

Who regulates stock markets?

In most of the jurisdictions, the capital markets are regulated by a separate body designated to supervise the activity in capital markets, but there could be more than one regulator in a country with different roles.

Since capital markets are primarily financial in nature, there remains a need for financial regulators or more than one regulator. In Australia, the primary regulatory body concerned with investments and companies is the Australian Securities and Investment Commission (ASIC), and others include Foreign Investment Review Board (FIRB), Australian Takeovers Panel, Australian Transaction Reports and Analysis Centre (AUSTRAC).

Regulators not only ensure that investor interests are not compromised, but they also supervise the company’s transactions, including mergers and acquisitions, foreign investment in a business, and anti-money laundering.

A fairly regulated capital market is better for all the stakeholders, and financial regulators remain the backbone for ethical practices in capital markets.