Definition

Related Definitions

Roth IRA

What is Roth IRA?

Roth IRA is an Individual Retirement Account offering tax-free growth and tax-free withdrawals during retirement. The account requires certain conditions to be fulfilled for these benefits to be attained. It is a strong and hassle-free method of saving till retirement.

The contribution to Roth IRA continues to grow tax-free even when there are no current year tax-benefits. The account holder may either continue to increase its saving or withdraw these funds after surpassing 59.5 years of age, which then becomes tax-free, provided the account has been opened for 5 years. The distributions fulfilling these two criteria are called qualified distributions.

Roth IRA is touted as one the best investment plans. In addition to its tax-free benefits, it is easy to set up and manage. Roth IRA is an investment option for the long run.

Summary

- Roth IRA is a special type of retirement account, which has tax -free withdrawals. li>

- Roth IRA withdrawals become tax-free on meeting certain conditions such as minimum 5-year lock in period and surpassing 59.5 years in age.li>

- Variety of security options are available while investing in Roth IRA such as stocks, mutual funds, bonds etc. to name few. li>

- Roth IRA comes with an upper limit of investment per year.

Frequently Asked Questions (FAQ’s)

How does a Roth IRA work?

Account holders can start adding funds to the account as soon as they open it. However, the Roth IRA account must be maintained for at least five years in addition to the age limitation set before the tax-free benefits can be availed.

Consumers can choose which specific securities they want to hold in the account like stocks, bonds, certificates of deposit, mutual funds, and exchange-traded funds. The overall performance of the account depends on how well these securities perform over time.

Additionally, withdrawals can be made any time for any amount that the customer may prefer. The tax-free withdrawals and growth are made possible as consumers pay taxes on the front end. A Roth IRA must be maintained outside of one’s employer-sponsored retirement savings plan.

Customers need not pay tax distributions that are considered “qualified”, even during retirement when the IRA is used for income. However, non-qualified distributions can be partially taxed. If these are taken before the age of 59.5 then the customer may be asked to pay 10% extra in penalties on the distribution.

How can one open a Roth IRA?

A Roth IRA can be opened at any bank or brokerage house through online methods or by physically visiting the bank. Opening Roth IRA is a simple and easy process. Customers mostly take the help of brokers who open an IRA account for them. Any institution that has been approved by the IRS to offer an IRA can issue a Roth IRA.

The customer may be asked to bring in his/her own Social Security Number as well as the Social Security Numbers and addresses of potential beneficiaries.

To fund a Roth IRA, valid sources include regular contributions, spousal IRA contributions, transfers, rollover contributions and conversions.

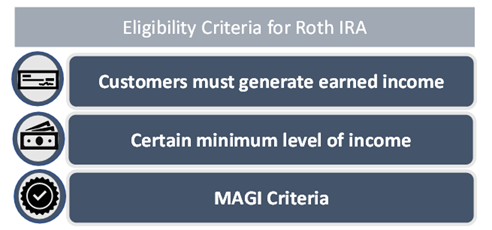

Who is eligible to open a Roth IRA?

- Customers must generate earned income: Earned income includes salary, commissions, wages, bonuses, etc. However, investment income, retirement distributions, unemployment compensation and pension are not counted as income. Alimony, child support or divorce settlement money can be contributed.

- Certain minimum level of income: The income limit is set based on one’s tax filing status and living situation. If this limit is exceeded, then the customer may be denied a contribution to a Roth IRA. In such a case, a customer with high income can contribute to the Roth IRA using a backdoor Roth IRA strategy. Under this, a traditional IRA can be converted into a Roth IRA after making certain level of contributions. This fund conversion would require the customer to pay additional tax.

- MAGI Criteria: The Modified Adjusted Gross Income is another criterion that is judged before the Roth IRA can be issued. MAGI can be calculated with the help of Adjusted Gross Income (AGI). The MAGI is typically AGI plus any tax deduction that one receives for student loan interest payments (tax-exempt interest payments) and certain deductions.

Image Source: Copyright © 2021 Kalkine Media Pty Ltd.

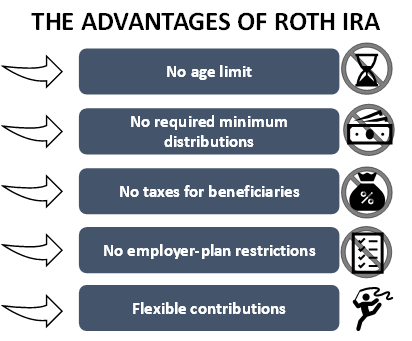

What are the advantages of Roth IRA?

- No age limit: A Roth IRA can be opened at any stage of life provided the income conditions are met. To fully avail the benefits of a Roth IRA, one must open an account as early as possible. A Roth IRA can be maintained for as many years as possible before the account holder reached the age limit.

- No RMDs: Roth IRA does not have any required minimum distributions. These are present in the case of 401k or traditional IRAs which start at age 72.

- No taxes for beneficiaries: Roth IRA can be passed onto the beneficiaries without the beneficiary having to pay any taxes. Thus, the tax-free benefits of the account are passed onto the beneficiaries too.

- No employer-plan restrictions: If a customer is covered by any employer mandated retirement plans like the 401k or 403b, the customer can still opt for a Roth IRA. The only restriction being the income condition in the case of a Roth IRA.

- Flexible contributions: Account holders may choose how much they want to contribute to the account. Distributions may be split u over different periods depending in the preference of the account holder.

Image Source: Copyright © 2021 Kalkine Media Pty Ltd.

What are the disadvantages of a Roth IRA?

- Income restrictions: Restrictions on AGI and MAGI differ based on the marital status of the account holder.

- Contribution cap: The maximum annual contribution that can be made to a Roth IRA in 2021 is USD 6,000. However, those above the age of 50 can contribute up to USD 7,000.

- No loans offered on IRA: Unlike many 401k contributions, a loan cannot be taken from an IRA.

- Early withdrawals: Early withdrawals are charged with a 10% penalty.

How is a Roth IRA different from a traditional IRA?

One of the major things setting Roth IRA apart from a traditional IRA is the timeline for paying taxes on the investments. In traditional IRAs, taxes can be delayed until retirement. However, under Roth IRA, tax is paid at the stage when contributions are made.

Traditional IRAs may allow the customer to deduct a part of their contributions from the income tax bracket, however, it requires one to pay income tax on money withdrawn on retirement. Another difference is that Roth IRA is more flexible than traditional IRA. Unlike Roth IRA, traditional IRA does not allow penalty-free withdrawals in case they are earlier.

Additionally, traditional IRA requires first withdrawal to be made after reaching the age of 70.5 years. These are the required minimum distributions. After the age pf 70.5 years, no contributions can not be made to the traditional IRA, however the same is not the case for Roth IRA.

One similarity between traditional and Roth IRA is that both have tax-free growth of contributions.