Definition

Related Definitions

Quantitative Analysis

What is quantitative analysis?

Quantitative analysis is a method through which investors analyse the risk versus reward structure of different investments. The quantitative analysis approach emphasizes on determining the present or future value of an asset by employing mathematical models or statistical analysis. In the stock market, assets stand for the derivatives, and stocks or physical assets like gold, silver to name a few.

Quantitative trading analysts utilise a combination of historical and current market data for constructing computer models and trading algorithms. Quantitative trading analysts are also known as quants.

The developed models allow investors to generate information from computers that helps investors to advance their trading strategy by identifying investment opportunities. The information generated mainly comprises of risk of trading, expected return, entry and exit points.

Financial quantitative analysis is adopted with the aim to make a profitable investment decision by exploiting quantifiable metrics and statistical tools.

Summary

- Quantitative analysis involves the study of historical and current market data to determine the present or future value of an asset.

- The quantitative analysis approach involves employing mathematical models or statistical analysis to construct computer models and trading algorithms.

- Quantitative trading analysts are also known as quants.

- Financial quantitative analysis is adopted with the aim to make a profitable investment decision by exploiting quantifiable metrics and statistical tools.

Frequently Asked Questions (FAQs)

What is the history of quantitative analysis?

Harry Markowitz, a Nobel prize holder, marked the beginning of quantitative analysis in the stock market by publishing a “Portfolio Selection” research paper in 1952. Modern Portfolio theory was introduced by Markowitz which projected the idea of constructing a diversified portfolio that would allow investors to maximise the returns at different levels of risk. Mathematics is used for diversifying the asset portfolio, and it was the first mathematical model that can be adopted by investors while making an investment decision.

Another breakthrough was brought in the field of quantitative analysis by Robert Merton who introduced the mathematical model for calculating the prices of derivatives. Merton is seen as the pioneer of modern financial theory.

Merton and Markowitz laid the foundation for quantitative analysis research in the stock market.

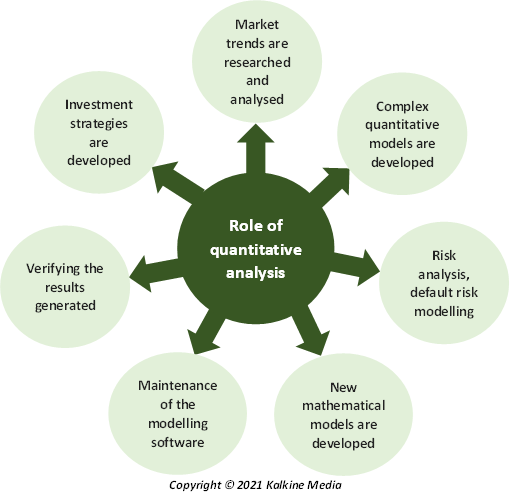

What is the role of a quantitative analyst?

Quantitative analysts are demanded in the stock market as they help in generating information regarding alpha and risk management. Quants are useful in financial banking and in insurance companies also because of their risk management skills.

The duties of quants differ based on the area of work, for example, hedge funds, investment banking, commodities or securities. However, the majority of the quants performs the following functions –

- Market trends are researched and analysed for making investment or risk management decisions.

- In consideration of the market trend, complex quantitative models and software are developed and implemented by quants.

- Statistical analysis is undertaken on daily basis for the purpose of risks analysis, default risk modelling and loan pricing.

- New mathematical models are developed and tested.

- Maintenance of the modelling software is ensured.

- Results generated from the models are verified.

- Investment strategies are developed via collaborating with computer engineers, physicists and mathematicians.

- Data is collected as per the client’s requirements and data is interpreted for clients or senior management.

Few quants are specialised in a specific field, such as derivatives pricing, statistical arbitrage, algorithm trading or quantitative investment management. In the current market, quants have gained significant attention because of their role in high-frequency trading.

How has the computer era changed quantitative analysis?

The disruption created by the internet around the world allowed investors to gain access to the large volume of data in real-time. It resulted in the creation of complex trading strategies. As a large volume of quantitative data empowers the quants to identify patterns, they use those patterns for constructing models and predicting the security’s price movements.

The software constructed identifies the market trend and triggers the buy or sell order on securities or commodities. However, in the majority of the cases, stop-loss is implemented.

A combination of trading algorithms, historical data and current market trends are used for mitigating the risk component by ascertaining the securitise which will extend the highest return at minimum risk.

Moreover, quantitative analysis assists in comparing the risks, such as beta, alpha, r-squared, Sharpe ratio and standard deviation among different securities. Through these algorithms, an investor takes the risks into consideration with the individual’s expected return while other aspects remain out of focus. For instance, if two securities are assessed and both provide the same return, but the risk is different, then the less risky security would be recommended by the Quant to their client.

What are the benefits of quantitative analysis?

The investment decision is based on quantitative data only, therefore, it is not affected by the investor’s biases or emotions.

Quantitative analysis is a cost-saving strategy as majority of the work is done by the information technology and additional human resource is not required to undertake those tasks. Moreover, the data collection process is also automatic, saving time and cost.

What are the limitations of quantitative analysis?

The choice of the right data and pattern generated by the software does not guarantee the success of the trading strategy. It is a challenging task to validate the information generated.

It is not a suitable approach to be completely dependent upon the quantitative analysis as it does not incorporate qualitative information such as scandals, management update or new policies introduced by the government or companies seen by a human. The strategy further becomes ineffective as a similar strategy is deployed by investors around the globe.

What is the difference between fundamental, technical, and quantitative analysis?

- Fundamental analysis – It aims to ascertain the fair value of a company by analysing the industrial, market, domestic and global aspects.

- Technical analysis – It aims at estimating the price movement of securities or derivatives or indexes by evaluating the historical data and price movement. The data is evaluated by utilising charts or graphs.

- Quantitative analysis – It aims at determining the value to a broad market or a specific company by deploying simple financial ratios or quantitative data or data patterns.

Generally, an investor or quants operates by combining technical, quantitative and fundamental analysis while determining or estimating the company’s future price movement or profitability.