Australian health care sector is booming with strong growth prospects amid global trade worries and market volatility. Being dynamic and lucrative sector, it catches investorsâ attention often.

When the share price of a company is multiplied by the number of outstanding shares, it determines the market capitalisation of that company. Investors and market enthusiasts not only get an idea about the relative size of the company, its assets as well as the scope of the company in future by looking at the market cap, but also get a clue about the overvalued or undervalued stocks and stocks with better returns.

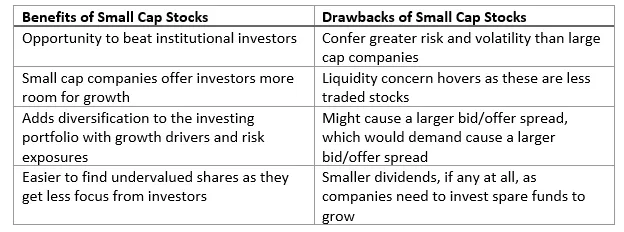

Companies with lower market capitalisation are considered small-cap stocks, ideally, a company with a market capitalisation of less than US$2 billion is viewed as a small-cap company. As a coin has two sides, small-cap stocks also come with a set of advantages that build investorsâ sentiments but also carry certain disadvantages. Let us see the benefits and drawbacks of small-cap stocks.

In this article, we would be looking at three small-cap health care stocks that are discussed below.

Monash IVF Group Limited (ASX: MVF)

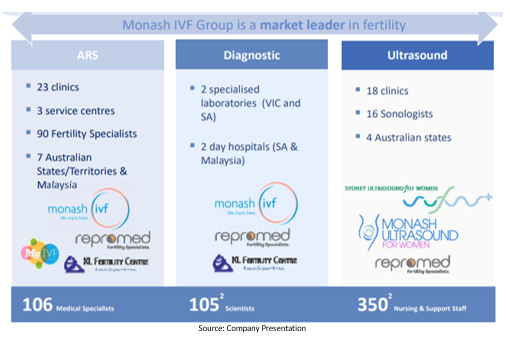

Monash IVF Group Limited (ASX: MVF) is engaged in the development of assisted reproductive technologies (particularly IVF) in Australia together with tertiary level prenatal diagnostic services.

Monash IVF Group Australia and Monash IVF Group International are the two segments of the company focused on blastocyst technique aiming for better pregnancy rates through improved growth and survival for embryos in the lab.

2019 AGM Presentation Highlights-Key Achievements in FY19

- MVF developed vision 2022 strategic roadmap, re-validating its best-in-class full-service positioning.

- Reported 3.7% growth in MVF Australian Full-Service Stimulated Cycles that excluded impact from departed specialist.

- MVF also reported continued international growth as Stimulated Cycles noted growth of 21.8% on previous corresponding period (pcp).

- Return to earnings growth in the second half of fiscal year 2019 (2H19) with NPAT increased by 9.5% on pcp, before one-off non-recurring items.

- Reported strong pre-tax EBITDA conversion to operating cash flows of 107.1%.

- The companyâs key focus remains on engagement with its Employees and Doctors.

- MVF achieved world-first scientific breakthrough in commercialisation of NIPGT.

FY19 Financials

- Revenue of $152.0 million for FY19 as compared to $150.6 million for FY18, reflecting an increase of 0.9%. Revenue for 2H19 was reported at $74.8 million, up 1.5%.

- Underlying EBITDA of $37.8 million for FY19 as compared to $38.1 million for FY18, reflecting a decline of 0.8%. Underlying EBITDA for 2H19 was reported at $18.5 million, up 6.7%.

- EBITDA margin was noted at 24.9% for FY19 in comparison to 25.3% for FY18, declined 0.4%. For 2H19, EBITA margin noted a 1.2% increase at 24.7%.

- Underlying NPAT of $20.9 million for FY19 as compared to $21.4 million for FY18, reflecting a fall of 2.3%. Underlying NPAT for 2H19 noted at $10.2 million, grew by 9.5%.

- Cash conversion of 107.1% for FY19 as compared to 93.3% for FY18, reflecting an increase of 13.8%. Cash conversions for 2H19 noted at 113.9%, which represents an increase of 10.7%.

- Free cash flow noted at $26.6 million for FY19 compared to $19.4 million, up 37.2%. For 2H19, free cash flow noted at $12.6 million, reflecting an increase of 28.0%.

Update on FY20 Trading

- In the first quarter of fiscal year 2020 (Q1FY20), stimulated cycle market growth in the key markets escalated by 2.4%.

- MVF Australian Stimulated Cycles were in line with pcp in Q1FY20, nonetheless because of doctorsâ departures and general trading conditions a downward pressure was placed on the companyâs Q2 volumes.

- A continued investment intended in its Vision 2022 Strategic Plan.

Outlook

- MVF expects NPAT for the year ending 30 June 2020 would be in the range of $18.0 million to $19.0 million;

- For six months period ending 31 December 2019, the company expects NPAT in the range of $8.5 million to $9.0 million.

Stock Information

MVF shares were trading at $1.052, up 0.67% on 05 December 2019 (AEST 12:56 PM). The market capitalisation of the company is $246.4 million with 235.79 million outstanding shares. The company generated a year-to-date investment return of 6.09%.

Volpara Health Technologies Limited (ASX: VHT)

Volpara Health Technologies Limited is a MedTech SaaS company focused on developing AI algorithms to assist in breast imaging analytics and analysis products. VHTâs clinical applications for clinic screening give opinion on breast compression, breast density, dose as well as quality. Its enterprise-wide practice software management tool aids with productivity, compliance, reimbursement, & patient tracking.

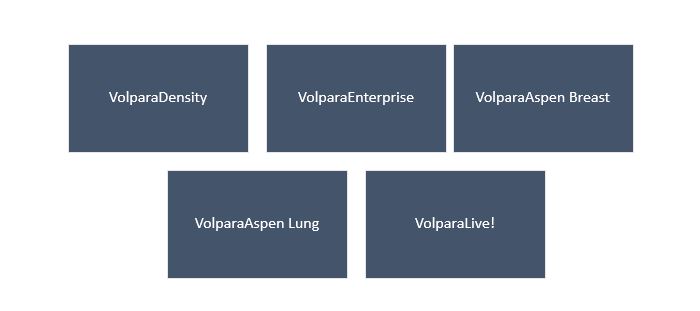

Volparaâs Product Portfolio Comprises

DENSE Trial Results Published in New England Journal of Medicine

In a recent announcement dated 28 November 2019, the company updated the market that the results of its DENSE breast screening trial were published in the New England Journal of Medicine on November 28 in the U.S. in the print edition.

DENSE Breast Screening Trial

This trail is the 1st randomised controlled study conducted on the clinical utility of breast MRI supplemental screening for women with extremely dense breasts, at the University Medical Center Utrecht, under the supervision of well-known epidemiologist Professor Carla van Gils. In this trial, automatic and objective measurement of breast density was done using VolparaDensity software.

For breast MRI screening, women with extremely dense breasts were selected with 8,061 women assigned to the MRI group, and 32,312 (of total 40,000 women enrolled) were assigned to the mammography-only control group.

- Among the women asked to undergo MRI, the interval-cancer rate; meaning the number of cancers not detected at screening but found between screenings, was found to be 2.5 /1,000 as compared to 5.0 per 1,000 in the control group (P<0.001).

- It is worth noting that 80% of the interval cancers in the MRI group were recorded from women who did not opt to undergo MRI in spite of being invited.

- The positive predictive value was noted 17.4% for recall for additional testing while the value for biospsy noted 26.3%. Per thousand screening false positive rate was 79.8.

Stock Information

VHT shares were trading at $1.870, up 5.352% on 05 December 2019 (AEST 12:57 PM). The market capitalisation of the company is $387.06 million with 218.06 million outstanding shares. The company generated a year-to-date investment return of 62.47%.

Neuren Pharmaceuticals Limited (ASX: NEU)

Neuren Pharmaceuticals Limited (ASX: NEU) is focused on developing novel therapies for neurodevelopmental disorders (with a significant unmet medical need).

Neurenâs drug portfolio includes lead product - trofinetide or NNZ-2566, developed for treatment of Fragile X syndrome and Rett syndrome, which is licenced to ACADIA Pharmaceuticals Inc. for its development and commercialisation in North America.

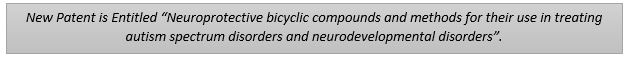

NNZ-2591 Patent Granted in Europe to 2034 for Neurodevelopmental Disorders

In a recent announcement dated 03 December 2019, it was reported that a new patent covering NNZ-2591 to treat neurodevelopmental disorders has been granted by a notice of allowance by the European Patent Office. The patent is scheduled to expire in July 2034 after issue. NNZ-2591 is being developed by Neuren to treat 3 devastating childhood disorders for which currently there exists no approved drug therapies.

- Patents arising from the same international application were previously granted in the U.S. and in Japan.

- The company is now moving ahead with the development of its 2nd drug candidate NNZ-2591 to treat Phelan-McDermid syndrome, Angelman syndrome and Pitt Hopkins syndrome, each of which has received Orphan Drug designation from the US Food and Drug Administration (FDA) following positive results in mouse models.

- At present, there are no approved drug therapies for these three devastating neurodevelopmental syndromes.

- Neuren intends to submit an Investigational New Drug (IND) Application to the FDA and initiate clinical trials in 2020, for which presently, it is undertaking the required manufacturing development & non-clinical studies.

Stock Information

NEU shares were trading at $2.410, up 0.417% on 05 December 2019 (AEST 12:58 PM). The market capitalisation of the company stood at $246.4 million with 102.67 million outstanding shares. The company generated investment returns of 93.55% and 56.86% on a 6-months and year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_07_02_2025_00_23_12_199043.jpg)