Clinical-stage immuno-oncology player, Imugene Limited (ASX:IMU) recently notified that it has received firm commitments for a capital raising of up to $24.6 million that involves Placement of up to 683 million ordinary shares to sophisticated and professional investors and directors of the company.

The company mentioned that the Placement was well supported by new institutional and sophisticated investors as well as existing investors, who expressed strong interest in recently acquired CF33 oncolytic virus (OV).

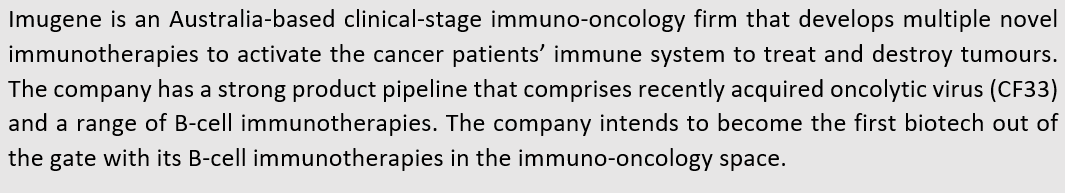

Details of Placement

Under the Placement, ~ 683 million ordinary shares will be issued with one new option (exercise price of $0.054, expiry date of 30th November 2022) for every three new shares issued. The issued shares will rank equally with IMUâs existing shares.

The Placement was priced at 3.6 cents per share, representing a 19.8 per cent discount to the weighted average closing price of shares over the previous 30 trading days to 27 November 2019 (the last trading day prior to announcement of the Offer).

The company mentioned that ~536 million shares will be issued under ASX Listing Rule 7.1 and ~374 million will be issued under ASX Listing Rule 7.1A.

The company informed that the Lead Manager for the Placement was Bell Potter Securities Limited, with Roth Capital Partners as US Placement Agent and Aurenda Partners as Co-Manager. The company has also released a prospectus incorporating Placement details on the ASX.

The funds raised under the Placement will be used to:

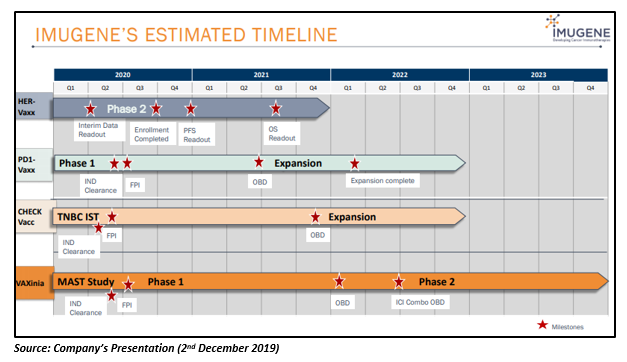

- Finance Imugeneâs existing clinical programs through to mid-2024 ($20 million), including

- The two oncolytic virus clinical candidates (CheckVacc and Vaxinia) through completion of Phase 2 study, and

- B-cell immunotherapy candidates via key value inflection points;

- Fund additional resources ($2 million); and

- Support working capital (~$2.6 million).

Vaxinia and CheckVacc constructs have recently completed clinical grade GMP (Good Manufacturing Practice) batches at the Center for Biomedicine and Genetics in City of Hope. They are the two different constructs on which the oncolytic virus CF33 has been developed.

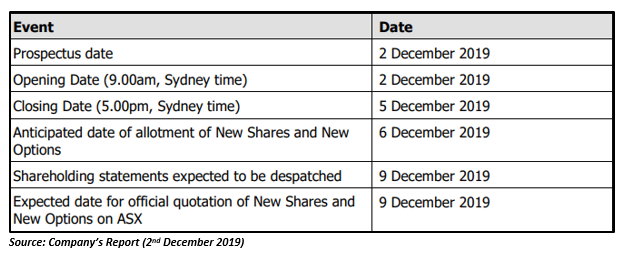

CheckVacc: CF33 +hNIS+PD-L1 (Armed Virus)

CheckVacc, the armed construct, is CF33-antiPDL1 combination oncolytic virus against TNBC (Triple Negative Breast Cancer) that has shown better cancer growth inhibition relative to Amgen or Genelux oncolytic virus in pre-clinical studies. It holds the potential to resolve the industry challenge of additive toxicity of combined checkpoint inhibitors if CF33âs safety is maintained in combination.

The company intends to conduct CheckVacc Phase 1 study in the second quarter of 2020.

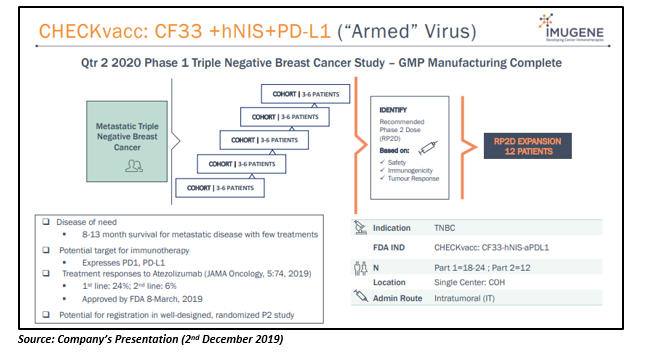

Vaxinia: CF33 + hNIS (Parental Virus)

Vaxinia, the unarmed construct, is CF33 oncolytic virus against solid tumours that has shown strong anti-tumour responses in preclinical studies. It has demonstrated inhibition of tumour growth in almost all NCI60 models in lung, pancreatic, TNBC, etc.

The company has planned to undertake Phase 1/2 Vaxinia MAST (Mixed Advanced Solid Tumours) study in 1H 2020.

Advantages of Oncolytic Virus, CF33

Imugene has recently acquired an exclusive license of CF33 from City of Hope Cancer Centre in Los Angeles. OV CF33 outperformed all parental viruses and a number of other viruses in clinical trials in pre-clinical studies.

Other major advantages of CF33 include:

- It can shrink various types of cancer at a very low dose of about 1000 PFU.

- Along with injected tumours, it shrinks non-injected distant tumours, which is termed as abscopal effect.

- It shrinks TNBC and outperforms Amgen & Genelux viruses.

- It has demonstrated single agent and tumour inhibition in several cancers.

- It can be made in high titres and can be used in multiple doses without complete neutralization by the host immune system.

- It is more potent in terms of:

- Range of cancer cell types infectible,

- Low doses necessary for cancer killing in vitro and in vivo, and

- Therapeutic window (dose for toxicity minus dose for efficacy).

Backed by its robust product pipeline and strong cash reserves of $16 million, Imugene is well positioned to deliver on all its current and planned clinical trials for 2020. The companyâs current financial position fully funds B-cell platform and programs through major milestones in 2Q 2021.

Backed by its robust product pipeline and strong cash reserves of $16 million, Imugene is well positioned to deliver on all its current and planned clinical trials for 2020. The companyâs current financial position fully funds B-cell platform and programs through major milestones in 2Q 2021.

IMU closed the trading session at $0.039 on 3nd December 2019. The stock has delivered a substantial return of 267 per cent in the last five years, with a YTD return of 122%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.