Media industry includes various segments such as television, cinema, music, print media and digital media. The trends and drivers for each segment is different across sub-segments, geographies and customer segments. This makes the industry unique, as these verticals compete, compliment and combine to meet the growing demand for media and entertainment across the globe. The industry also depends on various factors such as cloud network, internet access speed, mobile and social media, among others.

Consumer demand and preferences change with time and technological developments. Shifting customersâ needs in terms of how and when to access content have changed the way the entertainment industry connects with consumers. Additionally, over 85 per cent of Australians own smartphones and the number of people using smart devices to access entertainment has been increased drastically over the last five years.

Trends in Australian Media & Entertainment Industry

- Growing Rate

The media & entertainment industry in Australia is growing at a phenomenal rate and is expected to maintain an average growth rate of 2.1 per cent in the future, surpassing $40 billion by 2025, according to a 2017 report by PwC. Moreover, growth is anticipated to be distributed unevenly across various sub-segments.

- Major Drivers for Growth

Growth in the media & entertainment industry is majorly driven by the online video segment. Key players in the online video segment include subscription, video-on request services like Amazon Prime and Netflix, which are likely to register growth at a CAGR of more than 16 per cent by 2021.

Below discussed are two players from the communication services space that were trading in the red zone on 22 October 2019 (AEST 12:35 PM). Let us have a look at their recent developments and performance on the ASX.

Nine Entertainment Co. Holdings Limited (ASX: NEC)

New South Wales headquartered NEC is a media and entertainment company, which primarily operates into two segments â Television and Digital.

Recently on 17 October 2019, the company announced that National Australia Bank Limited and its associated entities listed in Annexure A ceased to be a substantial holder in NEC.

Compulsory Acquisition of Shares in MRN

On 15 October 2019, NEC made an announcement regarding the off-market takeover bid by Fairfax Media Limited of all the fully paid ordinary shares in Macquarie Media Limited (ASX:MRN). The company stated that post-closure of the offer period on 14 October 2019, Fairfax Media has a relevant interest in 98.64 per cent of share in Macquarie Media Limited.

The company also advised that conditions concerning the offer were satisfied at the end of the offer period. Owing to which contracts resulting from acceptances are now unconditional. Thus, the shareholders will receive payment for their shares in Macquarie Media Limited within 21 days, which is in accordance with the offer terms.

Moreover, the company informed that its subsidiary Fairfax Media will now compulsory acquire the outstanding shares in MRN, as it has a relevant interest in more than 90 per cent of the MRN shares. Additionally, to those MRN shareholders, who did not accept the offer, the notice about compulsory acquisition will be despatched by the subsidiary.

FY2019 Group Revenue Soared 40 Per Cent

On 22 August 2019, the company announced financial results for FY2019 ended 30 June 2019.

- Group revenue increased by 40 per cent to $1.8 billion compared to the previous corresponding period

- Group EBITDA went up by 36 per cent to $349.9 million

- Group Net Profit After Tax grew by 19 per cent to $187.1 million

- Earnings per share decreased by 28 per cent to 13.1 cents per share

- The company unveiled a fully franked dividend of 10 cents per share for the year

- NEC merged with Fairfax in December 2018.

Outlook

For FY20, the company is expecting to report pro-forma group EBIDTA growth of approximately 10 per cent, pre the impact of the AASB16 and purchase price accounting adjustments. Interest expense to fall in the range of $15 million to $20 million, pre MRN. The dividend is expected to be similar in cents per share to FY19 and fully franked, with capital expenditure likely to come at $110 million - $120 million.

Stock Performance

The stock of NEC was trading at $1.775 on ASX on 22 October 2019 (AEST 12:38 PM), down by 1.389 per cent from its previous closing price. The company has a market cap of $3.07 billion and approx. 1.71 billion outstanding shares. The 52-week high and low value of the stock is at $2.130 and $1.305, respectively. The stock has generated a positive return of 3.15 per cent in the last six months and a positive return of 33.33 per cent on a year-to-date basis.

Southern Cross Austereo (ASX:SXL)

Australia-based entertainment company Southern Cross Austereo provides services to more than 95 per cent of the population in Australia. The company, operating various media channels, is headquartered in South Melbourne, Australia.

SXL to Acquire Regional Radio Business of SWM

On 18 October 2019, the company announced to have proposed to acquire Redwave Media, which is the regional radio business of Seven West Media Group Limited (ASX: SWM) in Western Australia, in a cash deal worth $28 million.

The transaction is subject to approvals from the Australian Communications and Media Authority and the Australian Competition and Consumer Commission, concerning the proposed acquisition of the Spirit 621 licence in Southwest/Bunbury. The company already operates Hit and Triple M radio licences in Southwest/Bunbury.

Trading Update and Earnings Guidance

In another release on 15 October 2019, the company announced trading update and guidance for six months ending 31 December 2019. The company, which believes to have achieved consolidated advertising share gains in the previous equivalent period, is currently trading in accordance with media markets.

First quarter operating costs were $1 million less than the prior equivalent period. The company expects EBITDA for the first half to fall in the bracket of $60 million to $68 million. Cost discipline remains a core focus for the company, which will continue to focus on expanding its market share while focusing on controlling costs across all the divisions.

New Substantial Holder/Change in Directorâs Interest

On 7 October 2019, the company announced that Vanguard Group became a substantial holder with 38,455,084 ordinary shares, translating into a 5.001 per cent voting power. In another announcement, SXL unveiled a change in the interest of director (Grant Blackey) with the acquisition of 324,830 fully paid ordinary shares. The number of securities held by Mr Blackey post the new share acquisition stood at 547,329 fully paid ordinary shares.

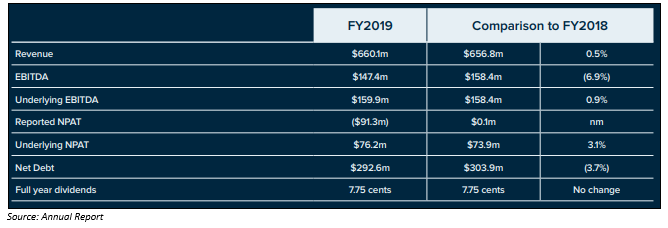

FY2019 Underlying NPAT Up 3.1 Per Cent

On 22 August 2019, SXL released financial results for FY2019 ended 30 June 2019, unveiling strong result in a challenging media environment.

- The companyâs revenue increased by 0.5 per cent to $660.1 million compared to the previous corresponding period

- EBITDA of the company decreased by 6.9 per cent to $147.4 million

- Underlying net profit after-tax of the company improved by 3.1 per cent to $76.2 million

Stock Performance

The stock of SXL was trading at $0.852 on ASX on 22 October 2019 (AEST 12:40 PM), down by 0.351 per cent from its previous closing price. The company has a market cap of $657.51 million and approx. 769.01 million outstanding shares. The 52-week high and low value of the stock is at $1.430 and $0.845, respectively. The stock has generated a negative return of 30.49 per cent in the last six months and a negative return of 13.20 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.