The Australian Economy has been suffering from the housing slump since more than two years. Silver linings have appeared and disappeared in the property scenario and till now, there is no sign of stability, which has further extended the grim phase.

In the article on the rise of Property Sales in Australia, we had stated that the Australian housing market was signalling a steady recovery graph with the improve in auction demand. However, the bleak side of the Australian property market has cropped up again, after the Australian Bureau of Statistics (ABS) concluded that the new building approvals in the country had hit a record-level slump of six years. This means that the rate of construction is continuing to be in a state of free fall in the Australian economy.

What do the statistics say?

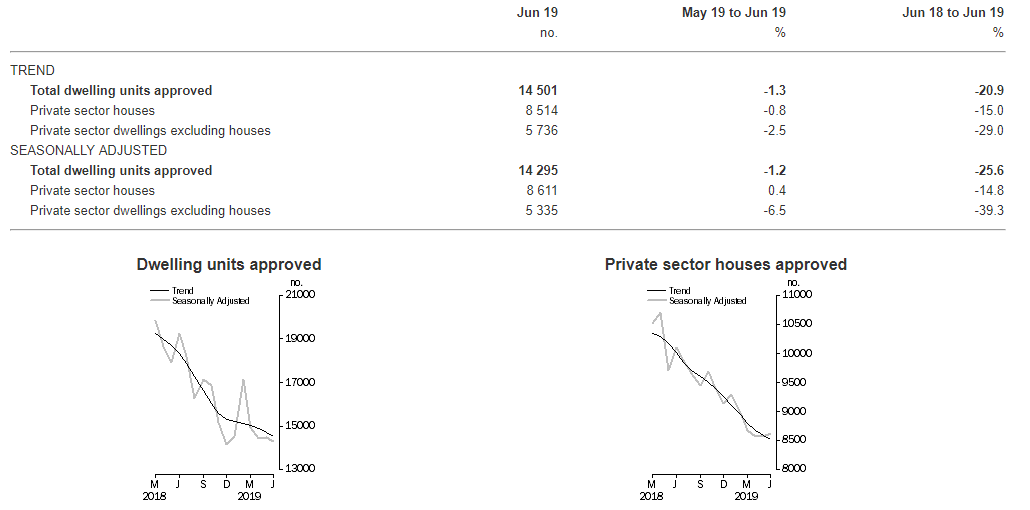

According to the much-awaited figures after a possible post-federal election phase released by the ABS, there were a total of 14,501 new approvals in June 2019, falling by over 20 per cent from their level last year, and 1.3 per cent from the last month. The heightened construction activity was driven by the House prices of the two major cities, Melbourne and Sydney, who were charging higher amount than before. The annual approvals have plummeted by a figure lower than the forecast - approximately negative 25 per cent.

On the Private Sector Houses front, the trend estimates for the approved houses fell by 0.8 per cent in June 2019, even though the seasonally adjusted estimates rose by 0.4 per cent. Excluding the houses, the trend estimates for private sector dwellings dipped by 2.5 per cent and the seasonally adjusted estimate (excluding houses) was down by 6.5 per cent.

June Key Figures of Building Approvals (Source: ABS)

June Key Figures of Building Approvals (Source: ABS)

Has history repeated itself?

The Building approvals in Australia had dropped by approximately 10 per cent and stood at a five-year low in November 2018 as well. This was a peak time wherein investors and developers had taken their foot behind, succumbing to the wider housing marketâs anxiety and tighter lending situations. ABS had released a report stating that the overall building approval status was down by more than 30 per cent in 2018.

What do the experts say?

News like this is a disappointment for an economy which has over a million jobs in the construction space and indicates a period of slump. The collapse of the construction economy would have a direct impact on another triggering dagger over the Aussie economy- soared unemployment rates and its continuance, hitting the overall economic growth hard.

Another drawback of the situation is the difficulty that new project developments would undergo, while hunting for investments.

Market experts believe that this downward trend would continue to maintain its pattern in the remainder of 2019, as the sales are weak and reaching the approval stage is becoming a task amid the property volatility. Apart from Sydney and Melbourne, South and Western parts of Australia, along with the New South Wales has been witnessing building approval declines.

What are the anticipations?

With the constant approval decline, a ray of hope lies with the decision of the consecutive interest rate cuts declared by the Reserve Bank of Australia (RBA). Once the cost of borrowing would decline, the demand would increase and gradually improve the property market. Besides this, the silver lining depicted by the improved auction rates in Sydney and Melbourne would also contribute to a positive return of the property market.

A significant mention of the Royal Commission is necessary here. It is a boon for the Australian economy to have adapted itself to the Royal Commission era, as there are a lot of hopes on corrective measures and reforms to rephrase the situation of doldrum in the economy. The watch-dog motive of the Commission is most likely to reap benefits and ease the property tensions, with time.

Is there a Global Impact of the Building Approval Crash?

Besides the pressure on the Australian Dollar after ABSâ report of the fall in buildings approval, the Pound Sterling Australian Dollar remained subdued.

How are the ASX listed Property Stocks Performing?

On 1 August 2019, the S&P/ASX 200 Real Estate (Sector) trading under the code XRE was at 3,795.4 points, (at AEST 12:30 PM) up by 13.3 points or 0.35 per cent, on the Australian Securities Exchange.

Let us now look at the performances of a few property stocks, listed and trading on ASX on 1 August 2019 (at AEST 12:33 PM):

| Company Name | Stock Value (A$) | Trade Status (%) | YTD Return (%) |

| Goodman Group (ASX: GMG) | 14.855 | Up by 0.304 | 38.67 |

| Charter Hall Group (ASX: CHC) | 11.430 | Up by 0.972 | 54.01 |

| Aveo Group (ASX: AOG) | 2.040 | Down by 0.488 | 34.87 |

| Lendlease Group (ASX: LLC) | 14.710 | Up by 1.1 | 30.96 |

| Cromwell Property Group (ASX: CMW) | 1.180 | Flat | 19.80 |

| Cardinale Property Trust (ASX: CDP) | 6.900 | XD | -3.50 |

| Domain Holdings Australia Limited (ASX: DHG) | 3.020 | Up by 0.332 | 35.59 |

The above table depicts the mixed performance given by the respective stocks, relative to their trading status on 1 August 2019 (at AEST 12:33 PM).

It would be interesting to witness the future plans and deals that these companies have in store, as the share market participants gear up for the earnings, yearly and half-yearly reports of the ASX-listed companies, in this reporting season. With the property market being a crucial element of the otherwise booming technology, it is important to assess the contribution that it can make in the Australian market, which is welcoming a hoard of foreign investors on board.

Further, the market enthusiasts and investors are constantly monitoring the status of the Property scenario and the related stocks, to invest and mint good money, as and when they can. ABS would further release an additional June issue on 6 August 2019, followed by the July Building Approvals on 30 August 2019, as the Australian economy await a positive outcome to quench its thirst for a hail and healthy property surrounding, along with the hope of an upliftment of the prosperity of the nationâs overall economy.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.