Highlights

- Spotify Technology (NYSE:SPOT) revenue rose 24% YoY in Q4, FY21.

- It expects 418 million users and 183 million paid subscribers at the end of Q1, FY22.

- For the first time, the company reported a positive operating income in Q4, FY21.

The Spotify Technology SA (NYSE: SPOT) stock declined sharply after Thursday's fourth-quarter earnings. Its expected growth in the user base to 418 million total users and 183 million paid subscribers in the first quarter of 2022 failed to meet Wall Street expectations.

The Spotify stock dropped as much as 23% in extended-hours trading on Thursday, wiping out most of its gains made in the last two years. However, it partly recovered the drop on Friday.

The SPOT stock was up 10.53% to US$176.58 at 3:12 pm ET on February 4.

Also Read: Meta (FB) stock rout sends shockwaves across tech sector

In the December quarter, Spotify added 25 million users and eight million paid subscribers, the biggest addition ever in a quarter. The Stockholm-based company added 130 million users since 2019, of which around half are now paid members.

Also Read: Amazon (AMZN) rides Rivian stake to US$14.3-bn profit, raises membership fees

However, the pandemic effect has made it hard for companies to forecast growth. For instance, Netflix also expects slow growth in user numbers.

In addition, several artists have boycotted the Spotify platform in protest against its podcaster Joe Rogan, accusing him of peddling misinformation about Covid-19 vaccines. Spotify CEO Daniel Ek said the company is still reviewing the impact of the recent boycott by artists.

The company has promised to issue advisories on podcasts. In addition, some social media users have also supported the boycott and threatened to delete the application.

Also Read: Merck & Company (MRK) bets big on ‘molnupiravir’, raises guidance

Also Read: Top 10 Nasdaq semiconductor stocks to explore

Fourth-quarter earnings

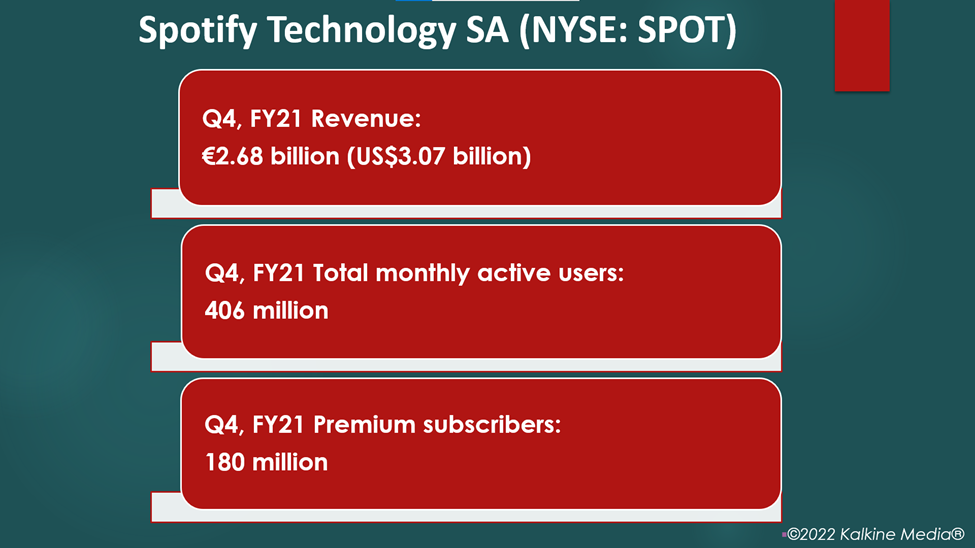

Spotify Technology reported fourth-quarter revenue of €2.68 billion (US$3.07 billion), up 24% YoY, beating forecast. Its total monthly active users rose 18% YoY to 406 million.

The company also reported its first positive operating income in 2021, crediting users from India, Indonesia, Latin America for the high number of downloads. It had 180 million premium subscribers from whom it collects most of its revenue.

Also Read: Honeywell (HON) sales hit by supply chain issues, stock plunges 5%

Bottomline

CEO Daniel Ek said the company wants to be a dominant player. He added that Spotify aims to provide services to 50 million audio makers and add one billion users.