Highlights

- The company expects an 18% jump in sales in 2022.

- Covid pill molnupiravir sales are expected to be US$5 billion to US$6 billion in 2022.

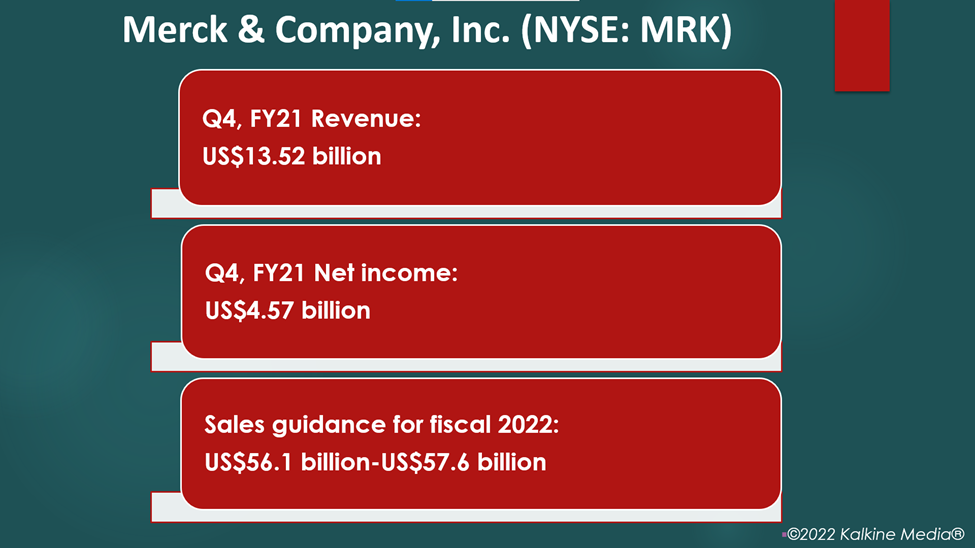

- Merck & Company's revenue surged 24% YoY to US$13.52 billion In the fourth quarter.

Merck & Company, Inc. (NYSE:MRK) expects sales from Covid pill molnupiravir to increase by 18% in 2022, a key consideration for its revenue guidance of US$56.1 billion to US$57.6 billion.

The New Jersey-based pharmaceutical firm declared bumper fourth-quarter results on Thursday. Its net income jumped 84% YoY to US$4.57 billion, or US$1.80 per share.

But the stock plunged 2.45% to US$80.004 after the results.

Merck gave strong fiscal year guidance after the success of the molnupiravir pill.

Also Read: Jeff Bezos gets Dutch bridge dismantled to make way for his yacht

Optimism over molnupiravir

The company expects the total sales to increase by 15% to 18% in 2022, driven by molnupiravir sales. Merck sold around US$952 million worth of molnupiravir pills in the last quarter of 2021.

It expects sales to be between US$5 billion and US$6 billion in 2022. Merck and Ridgeback Biotherapeutics, which jointly developed the drug, share the profit from the pill.

Also Read: Why has Doximity (DOCS) stock declined & what’s next?

Merck CFO Caroline Litchfield said the company might exceed the sales guidance because it is based on a signed supply agreement of around 10 million doses. She added that the company plans to manufacture about 30 million courses of the drug by 2022.

The pill showed 30% efficacy in reducing the hospitalizations of patients with Covid-19.

Also Read: Qualcomm (QCOM) raises guidance after chip revenue lifts Q1 results

Also Read: Sony Group’s (SNEJF) booming movie business lifts quarterly results

Fourth-quarter earnings

Merck's fourth-quarter revenue surged 24% YoY to US$13.52 billion, while its net income rose 84% YoY to US$4.57 billion, or US$1.80 per share.

Both the revenue and net income topped analysts' expectations. For fiscal 2021, its net income was US$15.28 billion, or US$6.02 per share, on revenue of US$48.70 billion.

Also Read: Meta (FB) lost US$200 billion in market value after results

The robust sales in the final quarter were driven by the sales of molnupiravir, cancer drug Keytruda, and the HPV vaccine Gardasil.

The company now expects its earnings to be in the range of US$7.12 to US$7.27 per share in 2022. Its revenue is expected to be between US$56.1 billion and US$57.6 billion.

Also Read: Is Black Rifle Coffee Company going public?

What's next?

Merck CEO Rob Davis said the company is working to fulfill its commitment of supplying 3.1 million doses of molnupiravir in the US in the coming days. In addition, the company plans to ship four million courses to 25 countries.

Litchfield said the company plans to reinvest most of the cash from molnupiravir sales back into the business to support its development.

Also Read: Investors jittery after PayPal’s (PYPL) dim forecast, eBay deals reduce

Bottomline

Most of Merck’s sales came from the US, the UK, and Japan. It supplied 1.4 million doses in the US after the Food and Drug Administration granted authorization for the drug in December.