Highlights

- The Doximity (DOCS) stock has declined 12.13% since its IPO in June 2021.

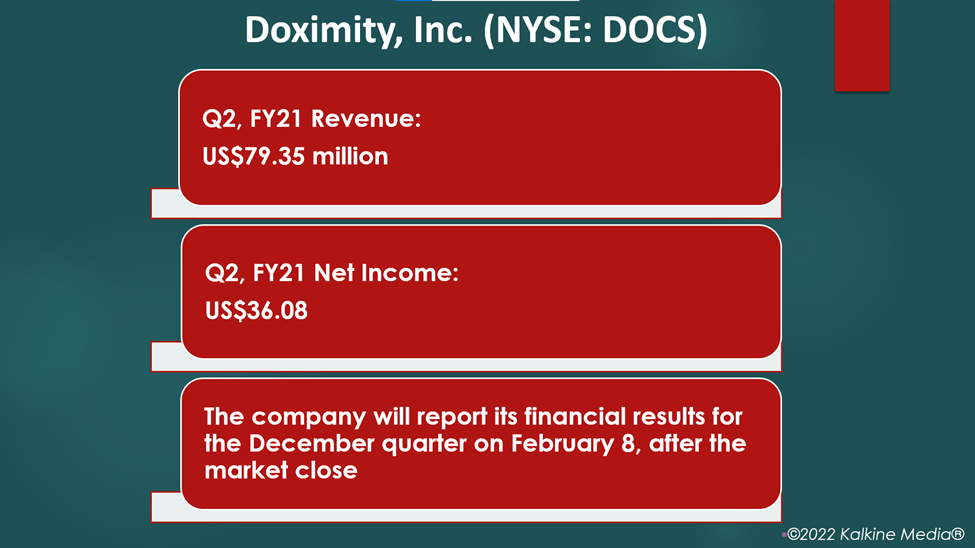

- However, Doximity’s revenue rose by over 75% in the second quarter of FY21.

- Doximity will report its Q3 financial results on February 8.

The Doximity, Inc. (NYSE:DOCS) stock has declined sharply from its 52-week high of US$107.79 in September 2021. The company debuted in the US stock market in June last year.

The San Francisco-based telehealth company offers online services like videoconferencing, sharing clinical data and ensuring patient privacy for medical professionals.

So, why is the Doximity stock seeing a sharp decline?

Also Read: Top 50 stocks on S&P 500 index (Part I)

Strong Competition

The strong competition in the market may have made up-scaling the business difficult. Though telehealth is one of its many interests, Doximity could find it hard to keep up with its main rivals like Teladoc Health.

Doximity's target customers are physicians and primary care clinics, unlike Teladoc’s focus on employers, insurers, and patients. It shows the competition between them is not direct. But Teladoc also has a telehealth unit to serve its customers. However, though Doximity’s targeted customers are different from Teladoc, some indirect overlaps cannot be denied.

Also Read: Top 50 stocks on S&P 500 Index (Part II)

For instance, if Teladoc provides faster physician or hospital appointments than Doximity, the customers are most likely to go to the former. Resultantly, physicians, who are Doximity's main clients, may also stop spending for services that their patients do not use.

Lack of interest in the stock

The lack of enthusiasm for the stock among retail investors could be another reason for the decline. The stock tumbled 12.13% since its IPO in June 2021, whereas the S&P 500 healthcare sector rose 6.48% in the same period. However, the stock’s current trend could be temporary.

Also Read: Should you follow what celebrities say about cryptocurrencies?

Also Read: Qualcomm (QCOM) raises guidance after chip revenue lifts Q1 results

What's next?

Doximity was founded in 2010. The company has handled its finances well so far, which could help expand its business and add new features to the application. It also has a low debt burden of around US$616,000 and a cash reserve of about US$742 million. Its revenue surged 75.89% YoY to US$79.35 million in Q2, FY21, while its net income rose over 259% to US$36.08 million.

Also Read: Sony Group’s (SNEJF) booming movie business lifts quarterly results

Bottomline

Doximity is expected to report its third-quarter fiscal 2021 results on February 8. If the company posts strong quarterly results for the December quarter, the stock may see some traction. However, investors should evaluate all the macroeconomics factors before investing in stocks.