Highlights

- Qualcomm’s revenue increased by 30% in the first quarter of fiscal 2022.

- Its GAAP net income grew by 38% YoY to US$3.4 billion.

- Its GAAP diluted earnings per share rose 41% YoY to US$2.98.

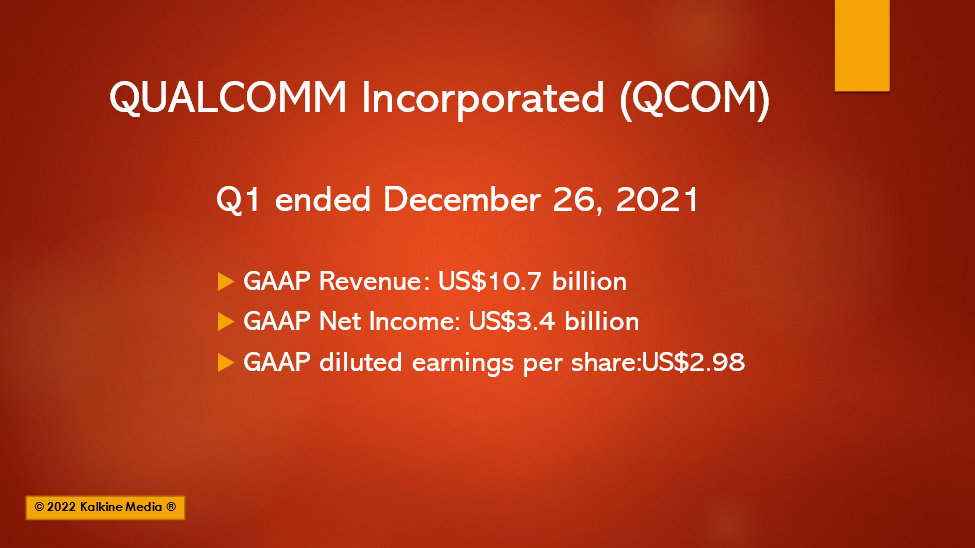

Semiconductor maker Qualcomm Incorporated (NASDAQ:QCOM) on Wednesday reported first-quarter GAAP revenue of US$10.7 billion, lifted by higher volumes of equipment sales.

The California-based company raised the revenue guidance after the results.

The semiconductor industry saw brisk business over the past year. Chip companies were overwhelmed by orders as they returned to work after the lockdowns.

However, the markets reeled under the pestering demand and supply disparity throughout 2021. The lockdown effect is expected to linger in the industry until 2023.

The Qualcomm stock jumped 6.25% to US$188.20 after the robust quarterly results.

First Quarter Performance

Qualcomm’s first-quarter revenue increased by 30%. The GAAP revenue rose to US$10.7 billion from US$8.23 billion in the corresponding period of 2020.

The equipment and the services segment contributed US$2.2 billion, while the licensing division provided US$158 million, lifting the overall Qualcomm revenue. In addition, Qualcomm’s GAAP net income grew by 38% YoY to US$3.4 billion in the first quarter.

The GAAP diluted earnings per share rose 41% YoY to US$2.98 for Q1, FY2022. The non-GAAP EPS diluted grew 49% to US$3.23.

Also Read: Moderna (MRNA) gets full approval for Spikevax, stock jumps 4.5%

Qualcomm repurchased eight million shares worth US$1.2 billion in the quarter and paid a cash dividend of US$0.68 per share. It goes on to show its enormous growth in the period.

The cash and cash equivalents were US$6.61 billion at the end of the quarter from US$7.12 billion on September 26, 2021. The drop was to share repurchase and dividend payment.

Also Read: Top 50 NYSE stocks in 2022 (Part 1)

Also Read: Top 50 NYSE stocks in 2022 (Part 2)

Segment-wise Performance

The QCT segment, Qualcomm’s chip business, generated US$8.85 billion in revenue, up 35% YoY. The headsets and IoT division grew 42% and 41% YoY, respectively. The automotive revenue grew by 21%, while the RF Front-end saw 7% YoY revenue growth.

The QTL licensing division revenue rose 11% to US$1.82 billion.

Also Read: Now Sony to acquire gaming company Bungie for US$3.6 billion

Guidance for Q2, FY2022

The company expects the revenue to grow between US$10.2 billion and US$11.0 billion in the second quarter, the GAAP earnings per share diluted to be between US$2.39 and US$2.59, and non-GAAP EPS diluted to be between US$2.80 and US$3.00.

It expects chip revenue to be in the range of US$8.7 billion to US$9.3B.

Qualcomm’s current market capitalization is around US$211.7 billion. Its dividend yield is 1.55%, and the annualized dividend is US$2.72.

Also Read: Five bank stocks to explore as rate hike prospects grow

Bottomline

The NASDAQ 100 Technology Sector Index grew 10.38% in one year, whereas Qualcomm stock gained around 16%. The wireless technology company has benefitted from the increasing digitization in the market.