Highlights

- Nanophase Technologies Corp. (OTCQB: NANX) gave a YTD return of 371.76%.

- Hudson Technologies, Inc. (NASDAQ:HDSN) has a P/E ratio of 8.4 and gave a 247.71% return YTD.

- Birks Group Inc. (AMEX: BGI) generated a 427.98% return YTD and has a market capitalization of US$83.2 million.

As the Omicron threat hit the global headlines, the enthusiasm over the much-awaited Black Friday sales last week faded into frustration and disappointment. It was the worst Black Friday in 40 years, according to some observers. But how this development might be even remotely linked to penny stocks? It does. Although the large-cap stocks might have the capacity to absorb a major calamity, the penny stocks may not. Hence, despite the price advantage on their side, this inherent weakness in penny stocks might be a dampener for investors.

However, penny stocks have tremendous growth potential, and some may even have strong fundamentals to withstand such a blow or an unexpected calamity.

Also Read: Five cybersecurity stocks to consider as ransomware threats increase

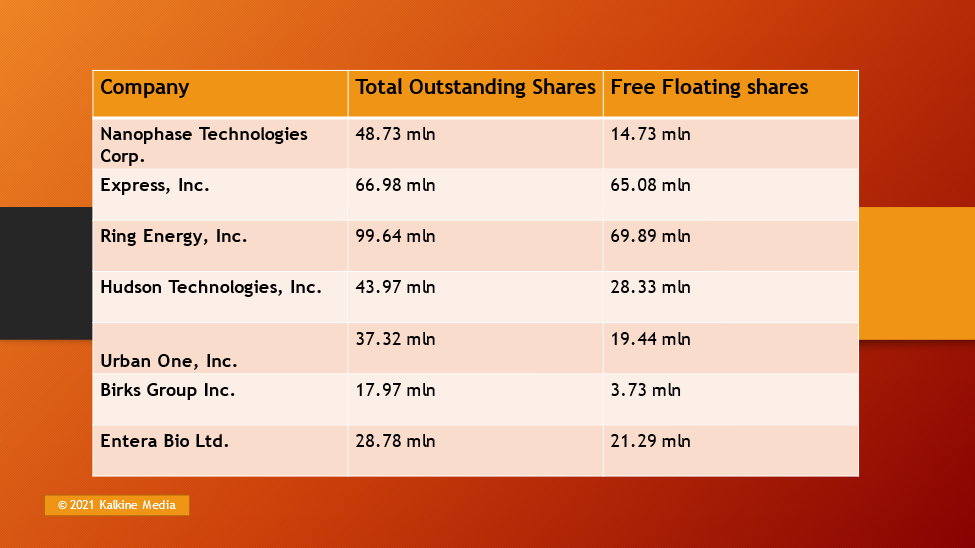

Here we discuss seven rising penny stocks in the market.

Nanophase Technologies Corp. (OTCQB: NANX)

YTD return – 371.76%

The Romeoville, Illinois-based company produces engineered nanomaterial solutions and sub-micron materials like architectural coatings, industrial coating, personal care sunscreens, abrasion-resistant, plastics additives, etc.

For the September quarter of 2021, its revenue was US$7.9 million compared to US$3.89 million in the same quarter of 2020. Its operative income grew to US$1.4 million in the September quarter of 2021, against US$0.552 million for the same period in 2020. The EPS was US$0.03 against US$0.01 in the September quarter of the previous year. It has a market capitalization of US$193.8 million. The stock closed at US$3.985 on November 30, 2021.

Also Read: 7 rising tech stocks under US$49 – should you consider them?

Also Read: Five metaverse cryptos that are making news

Express, Inc. (NYSE:EXPR)

YTD return – 297.80%

The Columbus, Ohio-based company is a specialty apparel retailer. Its portfolio includes apparel and accessories. It sells through its website and mobile app platform.

Its net sales for the quarter ended July 31, 2021, were US$457 million compared to US$245.7 million in the comparable period of the previous year. The net income was US$10.6 million or US$0.16 per share diluted against a net loss of US$107.7 million or US$(1.67) per share diluted in the previous year’s July quarter. The company has a market capitalization of US$247.5 million, and its stock closed at US$3.64 on November 30, 2021.

Also Read: Seven hot dividend stocks to watch in 2022

Ring Energy, Inc. (AMEX: REI)

YTD return – 257.27%

The Woodlands, Texas-headquartered company is engaged in oil and gas exploration and production. It acquires, explores, develops oil and natural gas fields. The production is generally done through vertical drilling of the wells.

For the September quarter of 2021, its revenue and net incomes were US$49.38 million and US$14.16 million, respectively. In the same period of 2020, its revenue was US$31.47 million, and net loss was US$1.96 million, or US$(0.03) per share diluted. It has a market capitalization of US$244 million. The stock closed at US$2.31 on November 30, 2021.

Also Read: Five high-growth tech stocks to watch in 2022

Hudson Technologies, Inc. (NASDAQ:HDSN)

YTD return – 247.71%

The New York-based Hudson Technologies is a basic industry product manufacturer. Its products are used in commercial air conditioning and refrigeration systems.

For the September quarter of 2021, the company earned revenue of US$60.6 million compared to US$41.5 million in the previous year. The net income was US$15.8 million or US$0.34 per share diluted compared to a meagre US$39,000 in the September quarter of 2020. Its market cap is US$166.3 million, and its P/E ratio is 8.4. HDSN stock closed at US$3.77 on November 30, 2021.

Also Read: Niantic IPO: Is the gaming company gearing up for public offer?

Urban One, Inc. (NASDAQ:UONEK)

YTD return – 194.87%

The Silver Spring, Maryland-based Urban One is a multi-media company. It offers a radio business franchise and targets urban listeners and African Americans.

The company earned revenue of US$111.5 million and a net income of US$13.87 million or US$0.25 per share diluted in the September quarter of 2021. The revenue was US$91.9 million, and the net loss was US$12.8 million or US$(0.29) for the same period in 2020. Its current market cap is US$177.6 million, and its P/E ratio is 3.06.

The UONEK stock closed at US$3.36 on November 30, 2021.

Also Read: Nuvectis Pharma (NVCT) IPO: How to buy the stock?

Birks Group Inc. (AMEX: BGI)

YTD return – 427.98%

The company is based in Quebec, Canada. BGI is engaged in designing, developing, and producing jewelry, gifts, and timepieces.

For the fiscal year ended July 31, 2021, the company earned revenue of US$143 million compared to US$169 million for FY 2019. The net loss incurred in FY 2021 was US$5.8 million compared to a net loss of US$12.8 million in FY 2019. It has a market capitalization of US$83.2 million. The BGI stock closed at US$4.15 on November 30, 2021.

Also Read: How to spot NFT trends?

Also Read: Top metal and mining stocks to explore in 2022

Entera Bio Ltd. (NASDAQ:ENTX)

YTD return – 206.48%

The Wellesley, Massachusetts-based Entera Bio is a clinical-stage biopharmaceutical company. It develops and commercializes orally delivered large molecule therapeutics.

Its cash and cash equivalents were US$27.4 million as of September 30, 2021. The revenue for the nine months ended September 30, 2021, was US$406,000 compared to US$144,000 in the corresponding quarter in 2020.

The net comprehensive loss was US$17.1 million or US$0.68 per share diluted against a net comprehensive loss of US$7.7 million or US$0.42 per share diluted for the nine months ended September 31, 2020. The company has a current market capitalization of US$60.9 million. The ENTX stock closed at US$3.34 on November 30, 2021.

Also Read: Age Of Tanks – What is it?

Bottomline

Many penny stocks have shown resilience during the pandemic and registered notable growth. However, investors must analyze all factors before investing in the stock market.