Summary

- The major market index, S&P 500, ended higher by 8.11 basis points while the DJIA Index rose by 115.8 basis points on Friday.

- Vistra Corp., one of US’ largest power producers, reported a net income of US$476 million in Q2 2023.

- United Rentals Inc., a construction equipment supplier, reported a total revenue of US$3.554 billion in Q2 2023.

The latest jobs data released on Friday helped raise the benchmark index in the market. The S&P 500 ended higher by 8.11 basis points on September 1, 2023. The Dow Jones Industrial Average Index (DJIA) also ended higher by 115.8 basis points on Friday.

The Bureau of Labor Statistics data revealed that the US economy saw an addition of 187,000 jobs in August. The upbeat release helped raise the market to some extent on Friday.

ALSO READ: Tech stocks to examine as the S&P 500 IT index rises

The following large cap stocks also moved higher with the market on September 1, 2023.:

Vistra Corp. (NYSE:VST)

Vistra is a large power producer in the US that also focuses on providing retail energy in the country. The company serves around a third of the electricity demand in Texas. VST has a market cap of over US$11 billion.

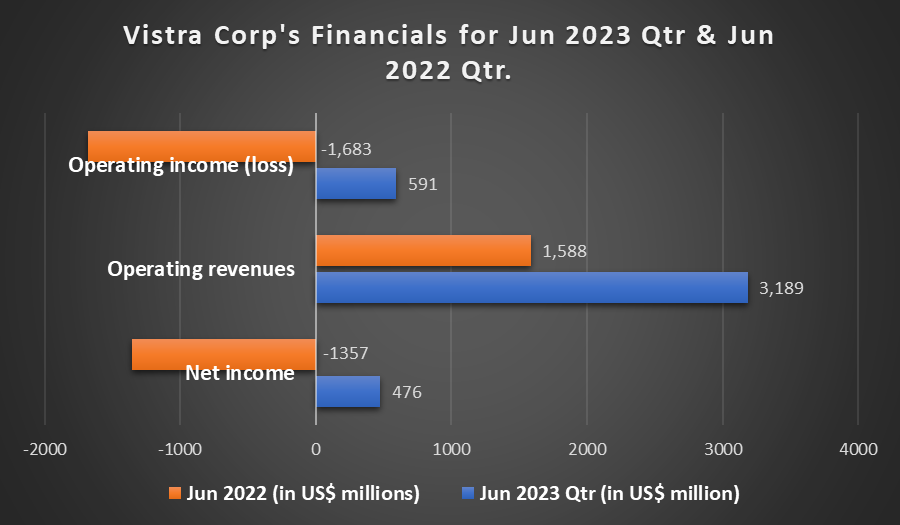

Vistra’s net income in Q2 2023 was US$476 million and the operating income was US$591 million for the quarter. As of August 4, 2023, Vistra executed its share repurchase program of around 2.9 billion since November 2021.

Image source: ©2023 Krish Capital Pty Ltd.; Data source: Company Reports

Meanwhile, Vistra’s operating revenue was US$3.189 million for Q2 2023, as compared to US$1.588 million in Q2 2022.

Based on Friday’s closing price of US$31.79, VST has a P/E ratio of 8.59x and a dividend yield of 2.59%. VST stock price saw a YTD gain of 36.79% as at the close of trade on September 1, 2023.

Vistra’s next dividend of US$ 0.206 per share is around 12% higher than the previous quarter dividend and will be paid on September 29, 2023.

ALSO READ: Should you watch these energy stocks as the market finishes in red?

United Rentals Inc. (NYSE:URI)

United Rentals provides equipment on rent to these end markets: residential and commercial construction as well as the industrial market. URI has a market cap of over US$33 billion.

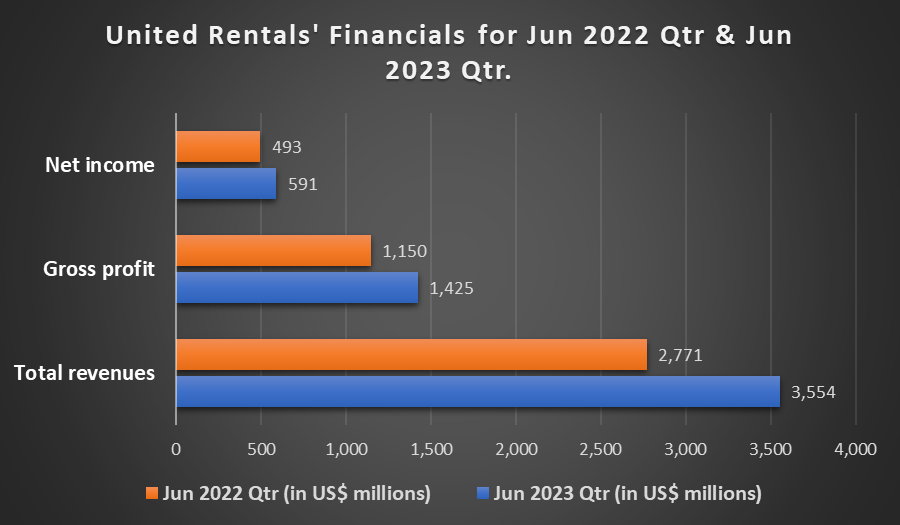

United Rentals reported a total revenue of US$3.554 billion in Q2 2023, which included a rental revenue of US$2.981 billion. URI’s net income in Q2 2023 was US$591 million, with a margin of 16.6%. The net income during Q2 2023 was 19.9% higher than that in the previous corresponding period.

Image source: ©2023 Krish Capital Pty Ltd.; Data source: Company Reports

The company’s adjusted EBITDA was US$1.695 billion and the total liquidity as on June 30, 2023, was US$2.706 billion.

Based on Friday’s closing price of US$491.17, URI has a P/E ratio of 14.5x and a dividend yield of 1.21%. Meanwhile, URI’s stock price grew by 37.31% on a YTD basis as at the close of trade on September 1, 2023. The stock’s intraday price gains were 3.07% on September 1, 2023.

_01_09_2025_07_01_12_631371.jpg)